Family walking on highway, five children. Started from Idabel, bound for Krebs. In 1936 the father farmed on thirds and fourths at Eagleton, McCurtain County. Was taken sick with pneumonia and lost farm. Was refused relief in county of 15 years' residence because of temporary residence elsewhere. Pittsburg County, Oklahoma

Ilargi: The following is a conversation between Stoneleigh and Euan Mearns of TOD Europe.

Euan Mearns: At the ASPO conference in Denver, October 2009, I had the good fortune to meet Stoneleigh, former editor of The Oil Drum Canada, who left the TOD crew with colleague Ilargi to set up The Automatic Earth where they publish stories, news and analysis of the unfolding financial crisis.

I spent a couple of days chatting with Stoneleigh where she recounted her rather gloomy prospects for the immediate future of the global economy. The following interview is a summary of her analysis of the unfolding situation. Note that in a departure from convention my questions are set in "blockquotes" to distinguish these from Stoneleigh's responses.

Euan Mearns: Stoneleigh, the world economy seems to be suffering from two great structural woes at present, namely stubbornly high energy prices that are linked to demand that is persistently ahead of the supply curve, and a level of debt that has destabilized the global finance and banking systems.

Can you explain for us the scale and structure of this debt and to what extent write-downs and quantitative easing (QE) have solved this problem?

Stoneleigh: Firstly, I would say that the energy prices that currently seem stubbornly high should fall substantially as the speculative premium evaporates and demand falls on a resumption of the credit crunch. The sucker rally that has spawned all the talk of green shoots is essentially over in my opinion.

The result should be a reversal of a number of trends that depend on the ebb and flow of liquidity - we should see stock markets and commodity prices fall, a significant resurgence in the US dollar and a large contraction of credit. The scale of the reversal should be substantial, as should its effects on energy demand. Demand is not what one wants, but what one is ready, willing and able to pay for, and in a severe credit crunch the capacity to pay for supplies of most things will be severely reduced.

As demand falls, and with it prices, investment in the energy sector is likely to dry up. Many projects will be uneconomic at much lower prices, meaning that the projects which might have cushioned the downslope of Hubbert’s curve (and the much steeper net energy curve), are unlikely to be developed. In this way a demand collapse sets the stage for a supply collapse that could place a hard ceiling on any prospect of economic recovery. That is a recipe for extremely high energy prices in the future.

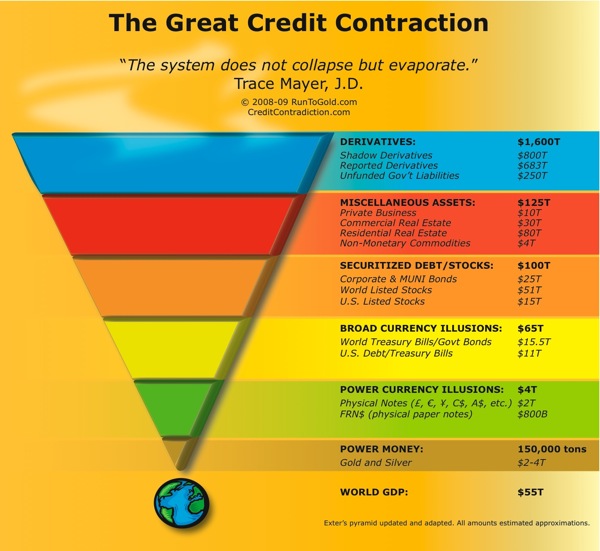

Secondly, our vulnerability to the consequences of debt is extremely high at the moment. The scale of that debt is staggeringly large. The global credit hyper-expansion has been decades in the making and is now significantly larger than notable events of the past such as the South Sea Bubble of the 1720s and the Tulip Bubble of the 1630s. It dwarfs the excesses that led to the Great Depression.

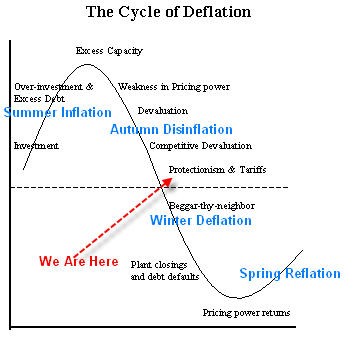

Credit bubbles are inherently self-limiting, proceeding until the debt they generate can no longer be supported. We have already passed that point and we are now two years into a contraction phase that is about to accelerate. As the aftermath of a credit bubble is typically proportional to the scale of the excesses that preceded it, we should be in for the largest economic contraction for at least several hundred years, and it will be global.

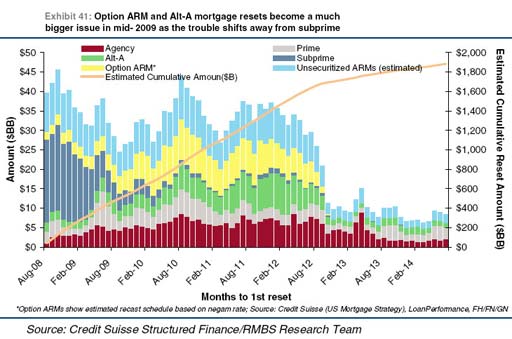

Real estate, which is a major focus of the mania, should do particularly badly in the coming years (in fact the coming decades or longer). There is still so much deleveraging ahead, and so many danger signals, such as the scale of the coming interest resets on US mortgages between now and 2012 (below). While the subprime resets are ending, Alt A and Option ARMs are just beginning.

There will be a very significant undershoot of historically average values, as there always is following a mania (much more than the Case-Shiller projection below suggests). In my opinion, housing prices are likely to fall at least 90% on average. For those who own property on margin, this will be a disaster.

For evidence that this crisis is indeed global, look, for instance, at European housing bubbles, which were worse than in the US.

Unlike inflation, which divides the underlying real wealth pie into smaller and smaller pieces, credit expansion creates multiple and mutually exclusive claims to the same pieces of pie. Once a credit expansion reaches its maximum extent, and contraction begins, these excess claims begin to be extinguished.

Unfortunately, the leverage is such that there are probably over a hundred claims to each piece of pie. While contraction begins slowly, as is the nature of positive feedback loops, it picks up momentum until a cascade point is reached, whereupon one can expect the excess claims to be extinguished in a rapid and chaotic process. This amounts to a rapid collapse in the supply of money and credit relative to available goods and services, which is the definition of deflation.

The scale of the problem has been temporarily concealed by a market rally and the shovelling of tens of trillions of dollars of taxpayer’s money into a giant black hole of credit destruction. This has done nothing to reignite lending, but the temporary (and entirely irrational) resurgence of confidence has restored a measure of liquidity. As that confidence evaporates with the end of the rally, that liquidity will also disappear

Banks hold extremely large amounts of illiquid ‘assets’ which are currently marked-to-make-believe. So long as large-scale price discovery events can be avoided, this fiction can continue. Unfortunately, a large-scale loss of confidence is exactly the kind of circumstance that is likely to result in a fire-sale of distressed assets. The structure of the credit default swap component of the derivatives market makes this very much more likely.

The CDS market allowed large bets to be placed on certain prices falling, and by entities which did not have to own those assets. This creates a perverse incentive for some parties to cause others to fail for profit (akin to me being able to take out fire insurance on your house and thereby give me an incentive to burn it down).

An added complication is the extreme degree of counterparty risk that resulted from a complete lack of capital adequacy regulation. Many parties with winning bets will not be able to collect, so they may cause financial mayhem for nothing. The CDS market is worth some $62 trillion, and a meltdown is very likely in my opinion.

A large-scale mark-to-market event of banks illiquid ‘assets’ would reprice entire asset classes across the board, probably at pennies on the dollar. This would amount to a very rapid destruction of staggering amounts of putative value. This is the essence of deflation.

Euan Mearns: I have for a long time argued and believed that there are so many interests vested in protecting our current system that national governments, the IMF and institutions working together would keep the market flooded with liquidity in order to ward off the threat of deflation.

In fact, it seems that a prolonged period of inflation is the only way to diminish our debts. I sensed at ASPO International in Denver that this was the majority view. Do you agree that inflation is the most likely near term outcome of current monetary policy?

Stoneleigh: Absolutely not. I agree that this is the consensus opinion, but I see it as fundamentally mistaken. The debt monetization that is going on has done nothing to increase the supply of money and credit relative to available goods and services, which is the definition of inflation.

Credit contraction dwarfs debt monetization, leaving us in a state of net contraction, even though we have just experienced a large rally lasting months, which should have been the most favourable condition for reigniting lending if such a thing were in fact possible. I would argue that it is simply not possible and that deflation is inevitable.

Credit bubbles always end this way, with the mass extinguishing of the excess claims debt represents. They are essentially Ponzi schemes, crucially dependent on the continued buy-in of new entrants. Globalized finance brought a flood of new entrants following the liberalization of the early 1980s, but there are now no more new sources of wealth to tap.

Deregulation allowed the reckless to gamble away virtually everything, including bank deposits and pension funds. Globalized finance has created a giant Enron, which while appearing robust is actually almost completely hollowed out. Such structures implode, often without much notice.

In my opinion, deflationary deleveraging will continue until the (small amount of) remaining debt is acceptably collateralized to the (few) remaining creditors. Until that point, there can be no lasting return of the confidence required to rebuild shattered credit markets.

Deflation is ultimately psychological. Without trust we will see hoarding of the cash which will be very scarce in the absence of the credit that currently comprises the vast majority of the effective money supply. The combination of scarce cash and a very low velocity of money will be toxic.

Money is the lubricant in the economic engine and without enough of it that engine will seize up as it did in the 1930s, when farmers dumped milk they couldn’t sell into ditches while others were starving for want of the money to buy food. There was plenty of everything except money, and without money, one cannot connect buyers and sellers.

Potential buyers will have no purchasing power as they will have lost access to credit and their ability to earn an income will be hit by spiking unemployment. Those who still have jobs will find that they have no bargaining power and there is therefore no wage support.

Sellers and producers will have no market and will themselves lose the means to purchase supplies or raw materials for the things they would like to produce.

If conditions remain frozen for any length of time, they will go out of business. The deeper the collapse, the more protracted the trough and the more difficult the eventual recovery.

I would argue that we have no need to fear inflation until we have reached a trough - until the deleveraging impulse is spent. We can expect to spend a long time in the liquidity trap, where real interest rates will be much higher than nominal rates, leaving central bankers “pushing on a string”.

Euan Mearns: Some would argue that faced with the unimaginable specter of deflation that governments will seize control of interest rates from the bond market. Why do you think this may not happen?

Stoneleigh: The bond market is far more powerful than governments at this point. While the international debt financing model remains, the bond market will retain its power to prevent money printing. Even though governments are not succeeding in increasing the effective money supply for reasons already discussed, they are nevertheless increasing systemic risk with their activities.

This is a recipe for very much higher interest rates as a risk premium. Governments do not set interest rates, they decide what rate to defend, but if that rate is substantially different from what the bond market requires, then defending it would be ruinous.

I think we are headed (not imminently but eventually) for a bond market dislocation, with nominal interest rates on government debt spiking into the double digits. This will amount to hitting the emergency stop button on the economy, especially since real interest rates will be substantially higher (the nominal rate minus negative inflation).

I am in fact expecting interest rates on private debt to rise before we see problems in the market for government debt, as the latter should benefit substantially in the shorter term from a flight to safety. The risk premium on private debt is already rising, which is a serious danger signal for such thoroughly indebted societies as we see in the developed world.

Euan Mearns: But stock markets are booming again, several OECD economies are emerging from recession, unemployment has stabilized, there are green shoots everywhere. Surely the current QE strategy is working?

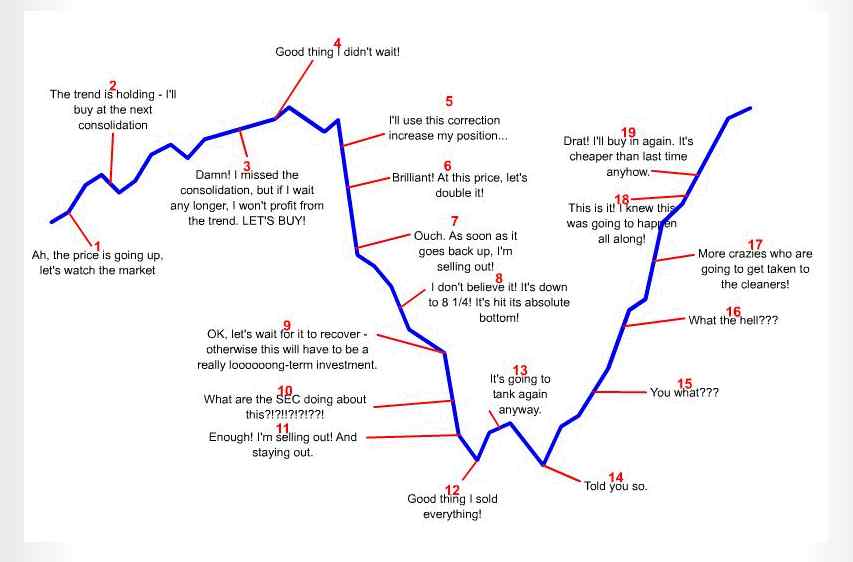

Stoneleigh: The green shoots are gangrenous. Some of the largest market rallies on record happened during the course of the Great Depression, as depressions are associated with very high volatility. Look for instance at the great sucker rally of 1930. There are always rallies of all different sizes in any bear market, just as there are pullbacks of all sizes in bull markets. No market ever moves in only one direction.

People tend to extrapolate recent trends forward, but this amounts to stepping on the gas while looking only in the rearview mirror. This is one reason why major trend changes are so rarely anticipated. Another is that the prevailing view of markets is fundamentally wrong. There is no perfect information, perfect competition, stabilizing negative feedback, rational utility maximization or efficient markets.

Markets are irrational, driven by swings of optimism and pessimism, or greed and fear, in an endless tug of war, and largely in an information vacuum. Investors chase momentum by jumping on passing bandwagons, hence demand for financial assets increases when prices are rising and falls when prices are falling, in classic positive feedback loops.

We have just lived through a period of several months when greed and complacency were in the ascendancy, but that trend is about to reverse in my opinion. Looking at markets as constructs of human herding behaviour allows them to be probabilistically predictable, permitting the forecasting of trend changes. For anyone who is interested in pursuing this idea further, I suggest looking into Bob Prechter’s socionomics - a fascinating subject which delves into the many effects of changes in collective mood.

For instance, as pessimism deepens, driving economic contraction, one would expect to see many manifestations of collective anger and mistrust. As this progresses it is likely to lead to xenophobia and a blame-game, with skillful manipulators (such as the fascist BNP leader Nick Griffin in the UK) poised to direct the anger of the herd towards their own chosen targets.

The potential for serious social fragmentation is very high when expectations have been dashed and there is not enough to go around. Having lived through a very long period of manic optimism and increasing inclusion, we in the developed world are not used to expressions of the dark side of human nature, except for entertainment purposes in popular television programmes. It will come as a considerable shock.

Euan Mearns: Would you care to give your opinion on where the Dow Jones Industrial Average is headed in the near (1 year) and medium terms (2 to 5 years)?

Stoneleigh: I think the market will fall hard (intervening short rallies notwithstanding) for perhaps 18 months. This was the length of the first leg down (October 2007-March 2009) and so represents a reasonable first guess at how long the next leg at the same degree of trend might last.

I think we will see falls of thousands of points in a series of cascades. I don’t see the markets reaching a lasting bottom until probably the middle of the next decade, and even then I don’t expect it to be a final bottom. This has been the largest credit bubble in history, and the aftermath of a major bubble always undershoots where it began before any kind of recovery begins.

The aftermath of the last major mania - the South Sea Bubble in the 1720s - lasted decades and culminated in a series of revolutions. We are still relatively near the beginning of our own crisis, but already it compares with the Great Depression.

Euan Mearns: How do you see the US$, gold and oil trading in the same time frame?

Stoneleigh: I think almost all assets will fall as price support is knocked out from underneath them, but the dollar should rise initially on a flight to safety. Scarce cash will be king for a long time, and the value of one’s currency relative to available goods and services domestically will matter much more for most people than its value relative to other currencies internationally.

In a deflationary scenario, prices fall, but purchasing power typically falls even faster, meaning that everything becomes less affordable despite the lower nominal prices. Prices in real terms, adjusted for changes in the supply of money and credit, are what matter.

In a world where almost everything is becoming rapidly less affordable, the essentials will be the least affordable of all, as a much larger percentage of a much smaller money supply will be chasing them. This will confer relative price support.

Although we could initially see a large glut in energy supply as demand falls off a cliff, this is likely to lead to supply collapse as investment dries up, hence I expect energy prices to bottom early in this depression.

Both financial and physical risks to energy exploration are likely to increase substantially in a destabilized and capital constrained world, and even maintaining existing assets could become very difficult. This is a recipe for much greater state involvement in ownership and exploitation of (probably deteriorating) energy assets, with increasing conflict over those assets as supply gets dramatically tighter with lack of investment.

As for gold, I expect it to fall initially as people sell not what they would like to, but what they can, in order to raise the cash they need for living expenses and debt servicing. Owning gold is likely to become illegal again (as it did in the Great Depression) in my opinion.

This wouldn’t necessarily stop you owning it, but would stop you trading it (at least without taking major risks) for other things you might need. Owning gold now therefore only makes sense if one is confident of being able to sit on it for a very long time, as it will hold its value over the long term as it has for thousands of years.

Euan Mearns: What will be the consequences for unemployment levels and services provided by government?

Stoneleigh: Unemployment will go through the roof as the prospects for selling most goods and services decline dramatically. In the developed world we are nations of middle men - generally service economies where we make a living figuratively taking in each other’s laundry.

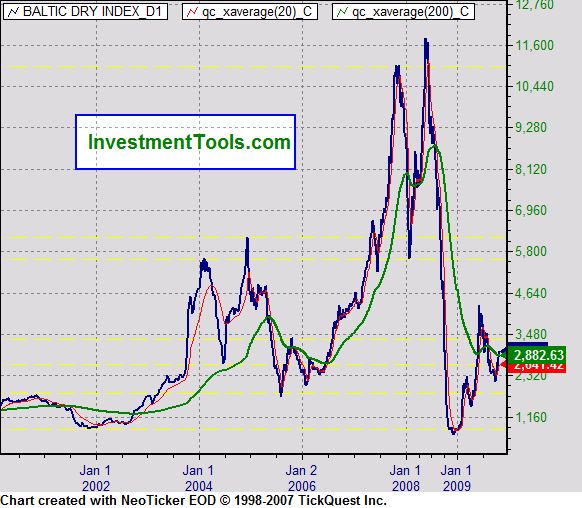

Most of us produce relatively little. Even those who do will find almost no market for their exports, and those who could find buyers may not be able to send shipments as credit contraction prevents shippers from getting the letters of credit they need to ship goods. A glance at what has happened to the Baltic Dry Index (below) indicates the difficulties already facing shipping companies.

Unfortunately middlemen are almost completely expendable, and the services of others are likely to become unaffordable for the majority very quickly. While there will be a huge surplus of labour, and the few who retain purchasing power will be able to hire anyone they want for very little, most people will have to do everything for themselves, as poor people have done throughout history and as most of the population of the world does now.

Not only will we lose access to the paid labour of others, but we will lose our virtual energy slaves as well. This will represent an enormous fall in the standard of living for the vast majority.

Whereas inflation can conceal a fall in purchasing power, so that people may not even realize it is happening, deflation brutally exposes it. Wages would have to fall just to keep purchasing power the same, but keeping it the same will not be an option for cash-strapped employers. In addition, with a large surplus of labour, workers will have no bargaining power.

This is a recipe for exploitation the like of which we have not seen for a very long time, but in the intervening adjustment period it is likely to lead first to war in the labour markets.

I would expect general strikes and a breakdown in the reliability of centralized services such as healthcare, education, power systems, water treatment, garbage (and snow) removal etc. This will be exacerbated by plunging tax revenues for all levels of government, which governments will try to compensate for by raising taxes, on anyone still capable of paying, to punitive levels. We would thus expect rapidly deteriorating services at much higher cost.

Many people are at risk of being eventually priced out of the market for goods and services, and particularly the essential ones, entirely.

In my opinion, we stand on the brink of truly tragic circumstances.

Euan Mearns: End note:

The day before the ASPO conference began in Denver, Stoneleigh, Rembrandt Koppelaar and myself took a drive into the Rocky Mountains National Park providing the opportunity to discuss and reflect upon the current global situation. As the week unfolded I realised that I was in denial about the gravity of the global financial situation. In what has become a situation of complexity that is beyond the ken of most folks, I find it simpler to break this down into smaller components that I can relate to.

In the UK, we have an escalating burden of government debt that we can unlikely ever repay. Unemployment is rising, tax receipts are plunging whilst expenditure on social security, health and the elderly go through the roof. We have been living way beyond our means, which with the peaking of UK oil and gas have suddenly become more meagre.

We have an election in May 2010. The new government will want to raise taxes and cut public spending. The current reversal in global growth is sending energy prices higher. Higher unemployment, higher taxes, higher energy prices and reduced public services are a toxic mixture for an ailing economy. If the bond market decides to price in the risk premium for escalating debt it will be game over. The questions are if and when? Figure 12 (Fed Follows the Market) is one of the more interesting for me.

That's me (Euan) on the left and Rembrandt Koppelaar on the right, contemplating our future after a most enlightening, if not very cold day in the Rocky Mountains. Photographer - Stoneleigh.

Ilargi: The Automatic Earth’s Fall Fund Drive (see the left hand column) is going well, and we owe heartfelt thanks to all of you who have donated. That said, in order to execute what we think would be the appropriate and logical next steps for us, more is needed, and quite a bit of it actually.

There are many thousands of people who read us every single day, and if everyone of them would donate just a dime for every time they read us we'd be doing just fine. But obviously, most never will.

We would love to be able to expand on what we do, to involve more people, more opinions, a more diverse view from more places in the world. And that is unfortunately not possible right now. Along the same lines, we would like for Stoneleigh to be much more involved at TAE. Not happening. On a happy note, our brand-new Twitter and Facebook presences are directed by our good friend VK, all the way from Nairobi, Kenya, the first time we’ve been able -and willing- to expand and relinquish control at least a little.

The Automatic Earth will be busier than ever as the real economy deteriorates in the months to come and things come to a head. Inevitably that will take more from us, and we hope you will do more as well.

Again for those among you who have donated to us -and many have in the past 3 weeks-, and those who will do so in the days and weeks and months to come, please know we are deeply grateful for, and humbled by, the confidence you have in us.

279 comments:

«Oldest ‹Older 201 – 279 of 279I.M.Nobody - "...some of the pre-Columbian Native American peoples."

Don't misunderstand me... Actually I think something like the Cahokia society is similar to what I have in mind. Had it not been for the devastating diseases brought by the incoming Europeans they likely would have prevailed, or at least more fully enfluenced future North American culture.

Taizui: The starving are not going to queue, except in the food lines which might spring up only long enough for fighting to start.

One of the reasons I truly believe I am a Dead Man Walking is that, to survive in the upcoming reality, you are going to need serious arms and the willingness to kill those who will kill you first.

Taizui: "I claim no progress on mental preparation. Any recommendations?"

My second son, on his own recognizance, is training in Krav Maga.

http://en.wikipedia.org/wiki/Krav_Maga

I'm impressed, and he says he's gotten much better about not holding back when he kicks someone in the crotch.

It's not an agressive philosophy, I think. Just- prepared- really really prepared.

Ahimsa,

The produce feria runs Thursday and Friday. I was only able to check it out about noon Friday. I just happened to be in the location. I was told that they have a great organic selection, but you have to get there by 8 AM Thursday as the organic goes fast. Have not seen it for myself yet. There are two buses into town from this high up on the mountain; one at 7 Am and one at 3:30 PM, so in theory I could get there about 8:30 AM.

I was told by someone very knowledgeable in Oaxaca, that all the coffee there is organic, so buying organic coffee at a premium is a gringo scam, at least in Oaxaca.

I was in town yesterday and looking at Chinese bikes. I would like to get a 125cc which are much cheaper and more fuel efficient, but at 16 stone, it might not haul my butt up the mountains without outraged Ferrari drivers trying to pass me (or just run me over), so I'll probably spring the extra bucks for a 200 cc. The duties are huge here :-(

But I have to take care of renting a house and getting started on my pesionado residency first.

I have a house lined one up much closer to town and at a lower elevation for $275 a month. Hope it's not too warm there, about 350 m lower. I am enjoying sleeping under a light blanket after 13 years of a tropical sweat lodge. Three bedrooms, somewhat primitive and poorly furnished, on 5 acres with a huge number of various fruit trees, iguanas, sloths, and a cool spring fed natural swimming pool. The gardener is part of the deal and the grounds are beautiful with huge cedar trees. I can also get decent broadband wifi, but I haven't been able to track down the company yet. The equipment would cost me $750 to buy, but I may be able to rent it. I went to the government monopoly cell phone office yesterday to get a line, but I was told that the rule changes which allows a tourist visa to get a line in December. Actually, I am doing very well on Skype and would certainly continue to use it for calls and video calls outside the country. Skype has the added advantage that nobody can bother me when I am off the computer. I am also trying to figure out how to do voice Skype on my iPod Touch. Going to give it a shot in a few minutes. One drawback to an iTouch, however, is that it has about 20% range sensitivity as a MacBook. You practically have to sit on the router.

BTW, Ilargi, if this sort of post is inappropriate, I can stop. Just say the word.

Greg,

Being that concentrated wealth such as gold is a double edged sword, what would you do with it at this point? Covert to cash?

Not necessarily. It depends on your situation. If you already have no debt, plenty of cash, some control over the essentials of your own existence, and you are fairly sure you won't need to sell your gold for a few years at least, plus you are reasonably confident of being able to access informal channels for selling when the time comes, then keeping it as an insurance policy makes sense. Also, if you plan to be mobile you will need wealth in concentrated form.

The downside risk in the short term is a fall of perhaps half, but gold will certainly hold its value for the long term after that.

A sustainable civilization cannot look like 1950s America. The 1950s America so many remember fondly was the knee in the curve. The poison, death, and destruction were there, riding that same wave, just not yet clearly visible to most.

Any sustainable civilization that we create must, by definition, look radically different than the current civilization, which has been anything but sustainable in 99.9% of its aspects.

What will that look like? Will we even manage to do it? Both are unknowns. This is why, rather than prescribing huge statist intervention, which will almost surely doom the entire species, I instead hope for collapse. Collapse of governing structures will allow thousands or tens of thousands of smaller communities to spring up and experiment. Most will, of course, fail. That's the nature of natural selection. But as a species, we only need a few to succeed to have a chance.

Greenpa said...

"My second son, on his own recognizance, is training in Krav Maga."

Well, numbering your sons shows your time spent in China. What marital art is your #1 son into :-)

"I'm impressed, and he says he's gotten much better about not holding back when he kicks someone in the crotch."

I already have enough trouble with my prostate. Would you give his GPS coordinates, so I can avoid him.

Erasmus,

Ilargi & Stoneleigh what do you think will happen to the Canadian Federation (you both live there)? Quebec, for example, exhibits a great deal of political instability.

I think Canada will break up eventually. It is too large to hold together in the absence of cheap energy and cheap credit, and there are significant cultural fault lines as well. I think Quebec will do quite well as it is relatively cohesive.

thethirdcoast,

That's quite the picture. I only regret that I guessed incorrectly when I envisioned Stoneleigh with purple hair...although I suppose blue is a component of purple when you're mixing pigments...:D

LOL - the hair in that photo was a Halloween wig. The purple was my real hair, back in my carefree youth. I don't think I have any surviving photos of that though ;)

El Gal- "

Well, numbering your sons shows your time spent in China. What marital art is your #1 son into :-)"

Tongue Fu.

@Taizui...

For mental preparation, I highly recommend the ongoing study and practice of the following:

1. Buddhist psychology

2. Mindfulness meditation

3. Nonviolent communication (a la Marshall Rosenberg)

4. Systems Theory

A good--but difficult--text that brings most of this together is "Mutual Causality in Buddhism and General Systems Theory," by Joanna Macy. She is also a deep ecologist. This text would require some prerequisite knowledge of Buddhism.

Best wishes for presence of mind!

Hello,

Has anyone else read Karl's piece dated 31 October on war?

Did I completely misunderstood his point? Is he really saying that if the U.S. are not willing to use nuclear weapons in Afghanistan, they should leave?

That Viet-Nam was not a war because the U.S. did not go all out to win it? That nuclear weapons should have been used in that country?

I hope I am wrong.

FB

FB

He left it deliberately ambiguous, because if he came out and made it explicit, even he knows that any decent person would see him for the crazed Libertarian that he is. That is not really fair, as Mish and Ron paul are Libertarians and adamantly against the Iraq and Afghan wars. So Karl is just fcuking crazy.

Just a tip for you iPhone and iTouch people if you don't know about. I have an iTouch and recently bought a tiny mic for it from a company in the UK called Truphone. It cost $7.50 plus postage, and came to a total of $15.00.

I just tried it out for the first time and called up a friend in the USA on her land line telephone (from Costa Rica) and talked to her for half an hour at a total cost of $1.15. I used the latest Skype app which is a free download from the iTunes store, and used an earbud to hear her. The program worked flawlessly and she sounded like she was in the next room. She said that I sounded fine except for a background rumble, which I suspect was the raging Rio Chirripo about 50 meters away. I was standing about 3 m from the router. If you have an iPhone, you don't need any hardware. Just download the free Skype app. If you have an iTouch, the link to buying the mic is:

http://www.truphone.com/applications/shop/

This story may signal the beginning of the fall of Golum Sacks:

http://www.mcclatchydc.com/227/story/77791.html

And another great read by Joe Bageant

The Iron Cheer of Empire:

http://www.joebageant.com/

I recommended a piece earlier today in which Mish abstracted a 54 page pdf down to 4 pages. It was about the psychological warfare waged by the oligarchs and their minions against under water "homeowners." In that piece, the question I had been asking this week was answered quite explicitly.

The question was, what is a balanced and normal ratio between the annual rental price of a residential house and its appraised value? The answer in the abstract, and presumably original article, is one to 15-16. The author stated that at the height of the bubble it had climbed to one to 30 or so. What I am finding in this valley is that it is about one to 85, adding strong backing to my idea that the real estate here is in a prolonged WEC moment. The prolongation is undoubtedly caused by the fact that the owners, for the most part, own it free and clear, and are not under pressure to sell. On the other hand, they are realistic about market rents, and not seeing the relationship between rental and sale prices, rent it to market so it doesn't lay fallow.

El G and other "investors"

I'm 1.5% underwater on my SH shares (break even price = $58). If the market decline continues into the early part of the coming week so that I'm finally above water for the first time since September, would you cash-out with a small profit in anticipation of a modest market bounce (lasting 2-4 days), or would you let it ride in anticipation of further declines?

I ask this question because it seems as though for the past 4 months or so, the market has repeated the same pattern of 3-5% decline followed by bounce followed by 3-5% decline followed by bounce etc. Each bounce led to new highs so the net effect was the market pushed higher. I don't expect a bounce to reach new highs (since Stoneleigh thinks we're done with that). Nevertheless, a bounce might take the market back to S&P 1000 again before resuming the decline.

Any thoughts?

Any winnings will be shared with our hosts.

Correction to my previous post:

A bounce might take the market back to S&P 1100 (not 1000) before resuming its decline.

Ed_Gorey

I don't day trade any more. Every time I try, I lose money. Every time I stick with long term predictions, I make money. Shorting the market now will be like cigarettes were for me - once I sell, I don't ever intend to touch them again. I will ride the market down and will probably sell off parts once I am strongly in the green to minimize the risk from government intervention or the collapse of my broker, which I consider the greater risks. I go into the green around 1000. Once I sell, I will put the money into treasurydirect.gov ASAP. Your milage may vary.

FB - On Karl D., he wrote the following, which convinced me he is often completely irrational and about as obnoxious as a be-medaled tinhorn despot!

--------

"There is only one way to fight a war. You commit your nation's resources - material and the most precious of all, human - to the complete obliteration of your enemy.

You mass those resources against each objective in turn, without reservation, without holding back, without care for collateral damage or world opinion."

---------

In other words, turn off your brain and destroy, murder, and maim with impunity!

One moment he is a rather astute and forthight investigative financial reporter, the next moment he is a raving maniac. Quite the Jekyl and Hyde character.

Starcade - How, or why, did you remove, or gravitate from Leviathan to Siren?

Wyote - Just read the Joe Bageant piece.

He has a way with words, a gift, or a craft well honed. It makes him a good read whether one agrees with him or not. For the most part I agree with his sentiments regarding some of the cultural nuances which ail us. Like working for career advantages rather than as an art or craft which we hold dear, or at least feel is constructive and additive to the social fabric.

I worked for 30 years in much the manner he seems to be describing, but bailed out at the earliest moment that would not leave me in dire straights financially. Typically western, I suppose.

Wyote

No amount of good investigative reporting will bring down Gollum Sucks. Everyone already knows that they are the scourge of humanity; a bald and pudgy Genghis Khan collective. The only thing that will bring it down is a truckload of nanothermite, and then a wooden stake through its heart the size of a California redwood. Maybe Dick Cheney will get confused in his paranoid labyrinth-like ideation and orchestrate another controlled demolition, this time at 85 Broad Street, first flying a flock of inebriated, Arabian pigeons into the upper windows as a diversion.

Nikkei drops 2¾ percent in opening minutes ... looking more and more like we are on (el g., I'll try to remember that styptic pencil, hehe)

@ Coy Ote

Joe Bageant is writing about the Monetization of life and this is the model that the rest of the world wants to adopt. People the world over want to live the 'American lifestyle'.

Now no doubt some people really live the American life of money, power, sex and fast lives and that's what the media hypes around the world, we on the outside rarely get to witness the real America. Yes American's are far wealthier then the rest of the world but many poorer countries are equally as happy, if not happier.

Just an example from a recent survey done here, which I certainly found surprising given the poverty levels here. Community counts for happiness, the monetization of life has led to increasing isolation and a sense of emptiness.

http://www.nation.co.ke/News/-/1056/663566/-/uneg1q/-/index.html

An overwhelming 86 per cent of Kenyans rate themselves as happy, with 55 per cent being very happy and 31 per cent moderately happy.

I am back from going back in time and visiting past civilizations.

=====

UP DATE S&P

What would the market look like if this slide continued for 12 weeks, until 25 Dec 09?

S&P 500

- 2% per week

02 Oct 09 1024 - 20.48 = ACTUAL +4.51% = 1071 =

09 Oct 1003.52 - 20.07 =

16 Oct 983.45 - 19.67 =

23 Oct 963.78 - 19.27 =

30 Oct 944.50 - 18.89 = ACTUAL = 1033

06 Nov 925.61 - 18.51 =

13 Nov 907.09 - 18.14 =

20 Nov 888.95 - 17.78 =

27 Nov 871.17 - 17.42 =

04 Dec 853.75 - 17.07 =

11 Dec 836.67 - 16.73 =

18 Dec 819.94 - 16.40 =

25 Dec 803.54

-----

With all the ups and down the S&P finished the month of October with an increase.

Timmy is still in control.

-----

I've read the comments and the postings ... still no Black Swan in sight.

-----

I'll dribble out some of my observations.

I went on a cruise, from Rome, Egypt, Turkey, Greece.

Almost every port had a ghost fleet, surplus capacity, or moth balled fleets.

I saw more ships tied up that what was working.

As a future job ... recycling iron, (from ships)

----

What does Egypt do concerning "leaky condos'?

NOTHING!

The housing infrastructures are in a shameful deteriorated conditions.

What should be considered high priced waterfront is nothing but rundown high rise slum property.

jal

Re: Intelligence, or at least Language Arts

I was in late elementary school or middle school, I think, when I read letters from virtually any soldier during the civil war. The spelling were interesting, but the language was poetic.

And these were the grunts.

It was clear then how far we had already fallen.

I include myself.

Cheers

jal: "What does Egypt do concerning "leaky condos'?

NOTHING!

The housing infrastructures are in a shameful deteriorated conditions.

What should be considered high priced waterfront is nothing but rundown high rise slum property."

My understanding, from my visit years ago, was that a very large proportion of condos/apartments/luxury hi-rises etc in Egypt are completely illegal from the outset. You know, when you visit the Pyramids, and see all that lovely desert- then turn around? Almost that entire city is completely illegal. And- EVERYBODY knows it. Not legal to build on crop land- or around the Pyramids- so- what you do is set a big construction team to work, pay off a couple lower down cops- who will claim "gosh, I thought they had permits!" - and have the building up- and inhabited- before anyone likely to do anything notices. If you can find anyone, anyway.

So- when you complain to the authorities that your condo leaks- they either say "ah, what condo??" - or "You have no legal right to be there- please move elsewhere so we can tear it down."

With a very polite smile.

On the other hand- the friend I was there with charged fearlessly off the main streets- and in 2 blocks we were in 800 CE, as far as I could tell. And the structures were basically sound, if extremely idiosyncratic. And the stairs to the roof are on the outside, and 1 foot wide, and no rail, ever. Good whitewash, though. And aside from the occasional goat and chicken, fairly clean, really.

Everybody smiled, nobody asked for baksheesh, nobody was carrying guns- way less threatening than our hotel.

Greenpa.

I see the same sort of odds...more in the dark,before sleep,when I am doing the hard thinking that requires not being distracted by life.

That O-man is Gorby...and has the wisdom to try and keep enough resources at hand to keep starvation to a minimum,and not let total chaos become the norm....will ensure a place in whatever history exists as a heroic,if tragic figure...

Or he may listen to the stupid ones who try and "keep order"at the point of a gun,and trigger what they fear most...a popular, general uprising of very unhappy,heavily armed citizens who have decided to use the second amendment for what it was designed for,a RESET button for the .gov.

This gives me nightmares.

"Educated People" think the hate spewed forth from the propaganda folks has little/no real effect on the population at large they are wrong.In certain sub-culture in America,Obama is hated with the same passion reserved for satanist,child molesters and rapists.That same sub-culture...the born-again evangelicals... has a large percentile with more than passing familiarity with firearms...

They hate Obama with the same fire as the left did the Bushies,but are not of the "Lets talk about this"Mindset.

We all have friends,or family,or know ,folks that are like this.

I am completely convinced should this administration try to force ANYTHING remotely construed as heavy gun control things would get real ugly ,real .real fast.

Any attempt to use Blackwater type Merc troops ,as was Trial Ballooned"at Katrina,would cause the same type of detonation.In spades.

These are the type of things I can see leading to the "New Dark Age"as you described it Greenpa

Not light thoughts...but have a Halloween flavor.I like the Mex version"The Day Of The Dead"

Snuffy

Submit,

Showoff!

We can't get greens to grow well in the shoulder seasons, since we're at the same latitude as St. Cloud, MN. In the forever that it takes gai lan to get big, it collects some really nasty flavors. I could boil it out of 'em, but it goes against the head cook's training to give them anything more than a quick pass thru the wok - and she must be obeyed.

Dr. J, I appreciate learning about oolichan, although I see that the smelt runs were pretty much finished here on the Columbia a decade or more ago. Figures.

Re: antibotics and other medical supplies/procedures. For most people these things will not be of great importance, although they are obviously vitally important to a small portion of the population now.

The average person should be more concerned about protecting their general health - think basics: nutrition, sanitation, learn to deal with stresses of hard times, etc.

In pre-industrial society growing food/tending livestock was the most common occupation (most people did not live in the city). I presume that's why Ilargi was curious it wasn't no.1 on more people's lists. Think simply. Food, water, shelter, clothing. These are the basics of life.

El Gallstone: I love your take.

"Maybe Dick Cheney will get confused in his paranoid labyrinth-like ideation and orchestrate another controlled demolition, this time at 85 Broad Street, first flying a flock of inebriated, Arabian pigeons into the upper windows as a diversion."

But all seriousness aside, never underestimate the wrath of pension funds that find that they have been defrauded.

I realize being the least bit optimistic here is futile (and where the hell is Rapier, anyway?) but any wound that can be inflicted on GS makes my day.

Zero Hedge also predicts massive dollar short squeeze as does Our Lady, with dramatic consequences. Also believes that Dr. Doom is really Dr. Doom Lite.

http://www.zerohedge.com/article/roubini-dollar-carry-reversal-and-why-he-only-half-way-there

Also, it appears that the crash has been kicked down the road a little bit. It will happen when the Gollum wants it to happen. The free markets are controlled.

I stumbled across a movie that speaks eloquently to the issue of mental preparedness for coping with collapse, disaster and being human in truly challenging and dangerous circumstances. It's called "The Snow Walker", and can be viewed for free at hulu.com .

Not incidentally, I should mention that it is completely accurate in the fine details of arctic survival, and the general character of the Inuit people I knew in 1960 when living a year in the wild with my family along the coast of the Arctic Ocean.

D. Benton Smith

Is the movie based on the Farley Mowat short story? It formed the title piece of an excellent collection of his short stories which I read several years ago.

Yes, Wyote - all seriousness aside :-)

Blogger Dr J said...

" ... Dr. J's Inuit buddies will probably not be pressing out the oil with their mukluks."

Interesting that you should bring that up. In fact, on the west coast, the native people from the Aleutians to northern California extracted the oil from the oolichan fish (also spelled eulichon).

I had the experience of sampling oolichan grease with dried, smoked salmon with some Bella Coola Indian friends at dinner one evening. One would have to acquire a taste for it to enjoy it. A piece of dried, smoked salmon is dipped into a bowl containing the grease and eaten. Like dipping a nacho in salsa.

Just listening to a report On CBC radio about disability insurance. Apparently many have been paying premiums for disability insurance and only now discovering( via Nortel unwinding) that they don't have disability coverage. So what have they been paying into and for what if the plan doesn't provide disability coverage when req'd?

I'll be following this Cdn story to-day. More fine,fine print scams?

Insight into this story from others most welcome!

Snuffy- "That same sub-culture...the born-again evangelicals... has a large percentile with more than passing familiarity with firearms..."

So true. While this is not "deep" secret, neither is it much known- apparently one of the scenarios under discussion in the think tanks is a South-North civil war- started by the South this time, and driven by exactly those folks; a religious war this time. And the industrial balances are different this time- Texas has more weapons building facilities than any other state. (how did that happen, we wonders.)

The historic parallel that frightens me the most- Islamic culture was once the most enlightened, tolerant, and open in the world. Until a rabidly conservative group of imams started herding their sheep in the opposite direction; and teaching that INTOLERANCE was what god wanted.

The results are obvious, and should terrify anyone with a notochord. Really terrify.

If it were a laughing matter, I'd say this is one more reason why the rest of the galaxy won't talk to us- my ET anthropologist friends boggle at the idea we allow intolerant philosophies to exist.

"What are you thinking!!??" they laugh. "Do you send your children to school with rabid weasels for teachers??! Give them all school uniforms dipped in weaponized anthrax??!! There's no difference! It's incomprehensible to any sane culture. Do you invite rabid weasels to your town meetings? Hell NO!! Do you explain the truth and morality to them? Hell NO! You kill them, immediately. Duh! Nothing else WORKS - and they will kill your children, if you don't."

Yes, I know- a very frightening and dangerous way of thinking. What you MUST realize -truly REALIZE - is that the opposite pattern is already deeply established, in multiple regions. The rabid weasels are totally convinced- and teaching- that the rest of us are a lost cause; unreachable- and god wants us dead.

How many religious wars happened in the Dark Ages? And how beneficial did they prove?

Very bad things, down the road.

I know, Snuff- that won't exactly cheer you up!

Keep in mind, everyone- a major selective factor in the upcoming bottleneck will be whether the selectee is making plans based on reality; or based on fantasy (and never mind the crap about "what is reality?"- you can't afford that shit anymore). And just like in evolution everywhere- doing everything right does not mean you'll survive. Only that the chances are a little better.

Yup; big pollyanna here. Happy November.

:-)

Interesting- Peggy Noonan (Reagan writer) seems to be about ready to join the staff at TAE-

http://tinyurl.com/yz9mt6f

Coy, others re: Denninger

What is the point of a war if not to kill and destroy? Any routine reader can adjust for Denninger's hyperbole, but is his view that far away from our probable future?

The past 50 years have seen "limited warfare" with restricted "rules of engagement". I strongly suspect the next 50 will see a return to "ruthless efficiency", more like the prior 100 years, where killing people and breaking the back of a nation was the typical goal. The notion of "civilian" will again become meaningless, as enemies are reduced to subhuman stature by PR machines prior to massacre.

The world is overpopulated. War will be a key tool in getting back to historic norms as energy and prosperity declines. Modern niceties of war will fall away along with other veneers of civilization.

What anyone will do when people around them start dying on a large scale - the answer to that is not hard to find - just look at populations that have had precisely these experiences. Holocaust survivors, refugee populations, historical examples.

My own observations: There's a percentage of people who simply can't get beyond the trauma and flashbacks. It is not possible to know in advance if you will be able to function through this stuff or not (and it depends a lot on what you see and who it affects around you). Studies I've seen suggest that refugee populations end up with more than 1/3 of the people completely disabled by trauma, and the numbers are close to 1/4 for the Holocaust.

But that points out that the vast majority actually do keep functioning. There are a couple of ways of doing this - the first is the classic medical model, in which you manage to detach for a time, drawing powerful lines between "mine and not mine" and allowing things like grief and anger to enter one's functional territory only when the "mine" line (often very narrow) is crossed.

Then there are the "just get through it" folk - they seem to be able to function for a while on the "I can endure anything if I can just get out" - they often then choose never to speak of or fully acknowledge what happened again.

There are plenty of other variants. It tends also to play out across generations - people who have been deeply, deeply traumatized often make very messed up parents. But there's not much any of us can do about this information - I don't believe in mental preparedness as a practice for watching the people you love die, or enduring the unendurable. Meditation smeditation - you learn to keep putting one foot in front of the other through the worst kinds of hell by doing it. Not looking forward to the education.

Sharon Astyk

Greenpa said,

"Do you invite rabid weasels to your town meetings? Hell NO!! Do you explain the truth and morality to them? Hell NO! You kill them, immediately. Duh! Nothing else WORKS - and they will kill your children, if you don't."

You've got this about right, but the wrong parties. This is what a warfaring gov't says about their target just before hostilities commence.

This is why Ahmadinejad is so dangerous for Iran. He basically takes out ads saying, "Look at us - we're all rabid weasels here! Hoping to eat your children soon!"

Greenpa

For once I totally agree with you. And the oligarchs will, as usually, completely manipulate the "kill a libral for Jesus crowd." So they will get what remains of the financing. Will it be streamed on the Internet - hate to miss it :-(

We must be talking to the same ET crowd. Most of the ones I talk to are engineers though, not anthro- apologists.

Sharon Astyk

"It tends also to play out across generations - people who have been deeply, deeply traumatized often make very messed up parents."

And nations.

El G,

"Is the movie based on the Farley Mowat short story?"

Yes, it is, and the movie producers deserve extra credit for treating the material with loving care.

It's a simple story, but the setting (arctic tundra and winter ice fields) had to entail incredible hardships for the actors and crew... not least of which are the clouds of mosquitoes that plague the summers up there. We have a photo of my brother wearing a red plaid shirt that looks more like gray felt because it's covered in a solid layer of the little suckers.

@Ed Gorey

Kevin Depew The Debt Crisis Is Not a Conspiracy, thinks the US$ will get stronger for about four weeks.

Dollar up : stock market down. I think the market will move to a temporary low in about two weeks (11/16). If you short put on a tight stops, maybe 3%.

Paleocon said...

"You've got this about right, but the wrong parties. This is what a warfaring gov't says about their target just before hostilities commence. "

Absolutely true- it's a well known and effective crowd manipulator.

What I'm suggesting is that those of us who have been meticulously NOT succumbing to this kind of behavior- preaching, and living- tolerance; frequently wind up making the horrendous mistake of not killing rabid weasels.

Believe me, I know how slippery this is, and how difficult to do anything about- which does not change the fact that when a rabid weasel bites your children- it may be your fault for allowing them to just breed in peace. They are a deadly disease for anything resembling a "civilization."

Just watching the market this past week, I think that the hamster is getting really tired. The PPT gives feeding it speed, but its adrenals are shot.

Ed_Gorey wrote

"The fact that we still have a functional bond market tells you everything you need to know."

Are you kidding, The Bond market is absolutely dysfunctional. Had the Bond market been working without gov't manupulation, interest rates would have been significantly higher.

The gov't is pressing down on the thumb screws to force rates low and it will keep them low as long as the fed wishes them to below.

Although neither the fed and the gov't can't control both the interest rates and the value of the US dollar at the same time.

FYI: Martin Weiss, a Deflationist for the past 27 years switches side and proclaims we are headed for an inflationary spiral.

http://www.marketoracle.co.uk/Article13695.html

Bottom line, Weiss determined that it only took the Fed 112 dates to stop deflation and will not permit deflation at any costs. US gov't is bankrupt and has no choice to devalue its currency to prevent a hard default.

NZSanctuary:

In pre-industrial society growing food/tending livestock was the most common occupation (most people did not live in the city). I presume that's why Ilargi was curious it wasn't no.1 on more people's lists. Think simply. Food, water, shelter, clothing. These are the basics of life.

----

Going back to the occupations discussion, I agree ... although I'm one who would add low-tech healthcare to that list of basics (while also agreeing that nutrition and an active life can combat many 'modern epidemics'.)

Yet even paring it back to the basics, for people like me - and some of those close to me - who have until recently lived hopelessly impractical lives in industries like corporate communications - knowing where to start in terms of reskilling is not as easy it sounds!

Still, personally, got it pretty much sorted now I think - and my parents are thrilled to bits that I'm finally showing an interest in their not inconsiderable gardening and fibre arts skills.

El G - Market up 140 early this morning, now in the red. That hamster is slowing down.

Re: Obama

Perhaps Obama is more aware of the situation than we realize.

"[Obama]said past U.S. growth had been "debt-driven" and that was no longer feasible. With the United States running record budget deficits as it spends furiously to try to stimulate the economy, Obama said it is going to be vital to find innovative new ways to finance growth."

Obama Warns More Job Losses Coming

I guess the "innovative new ways" essentially involve taxes using any name but taxes. My prediction, the gov will announce a new retirement savings program which essentially involves Social Security 2.0 (major major tax increase disguised as a gift from the benevolent leadership).

D Benton Smith,

I stumbled across a movie that speaks eloquently to the issue of mental preparedness for coping with collapse, disaster and being human in truly challenging and dangerous circumstances. It's called "The Snow Walker", and can be viewed for free at hulu.com .

I heartily recommend that film. It's truly one of my favourites :)

Tech Guy,

FYI: Martin Weiss, a Deflationist for the past 27 years switches side and proclaims we are headed for an inflationary spiral.

http://www.marketoracle.co.uk/Article13695.html

Bottom line, Weiss determined that it only took the Fed 112 dates to stop deflation and will not permit deflation at any costs. US gov't is bankrupt and has no choice to devalue its currency to prevent a hard default.

IMO Martin Weiss will switch back again soon enough. Large-scale rallies suck in a lot of people, and the last-minute conversion of the most ardent bears is often an indicator of a coming trend change.

Deflation has not been prevented, only postponed for a few months by a last gasp of collective optimism (a temporary suspension of disbelief that the government could actually do what it promised). The optimists are about to be disappointed, and when they are the momentum to the downside should pick up substantially.

Bluebird

You're going to have a lot of antsy meth addicts. All available inventories are going into the Wall Street Hamster. Just keep that wheel spinning, my good rodent.

Thanks to all for mental preparedness comments.

Thanks to DBS, I just watched The Snow Walker, a fitting complement to the TAE message. The lead character time and again desperately clings to familiar technology as the leading lady patiently proceeds to save his life with ancient skills.

Perverting Sharon's post a bit, maybe the best mental preparation is to keep putting one foot in front of the other. Might Bosuncookie recommend suspending judgment, attachment and resistance while doing so?

That hamster looks really tired today. I imagine him huffing and puffing and wheezing like he's about to keel over from a heart attack.

Dr J

"[ollichan oil] I became curious as to why they went to so much trouble to collect that one fat so I had it analyzed. It turns out it is very much like olive oil."

Subjects like alternate sources of desirable food oils strike me as being right on topic, because of the likelihood that we'll need access to such items if/when we all wind up on short rations.

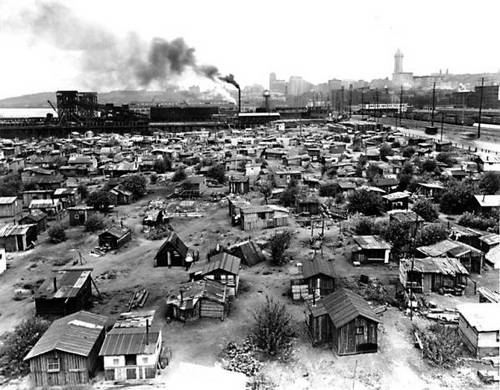

Seattle's Hooverville 1930's History:

http://www.historylink.org/index.cfm?DisplayPage=output.cfm&File_Id=741

Interesting read.

@greenpa,

"The historic parallel that frightens me the most- Islamic culture was once the most enlightened, tolerant, and open in the world. Until a rabidly conservative group of imams started herding their sheep in the opposite direction; and teaching that INTOLERANCE was what god wanted."

yes but its not just their rabid conservatives. we've got intolerant catholics, protestants, hindis and jews now too.

we've built fuses of political corruption on powderkegs of religious intolerances lit by sparks of economic deprivation.

god has left the building.

This is the fastest growing form of human habitation. For many more people this will be the future.

El G, thanks for the lengthy response. I enjoy reading your reflections on Costa Rica. The house on 5 acres with fruit trees seems attractive.

I've been busy gardening in inland So. FL with very high temperatures -- today 120 F degrees in full sun at 1 PM, according to thermometer. No rain in three weeks! Irrigation and shading fabric are essential here. Gardening in this area is a real challenge, to say the least.

Orlov has a great post on climate change...

Stoneleigh - great interview! This is the first time I read every single word that was posted. All of it VERY good. Thank you for sharing that interview! (and great job on the choice of pics. Leave the men guessing! ;-) )

(Ilargi - thanks for the large Hooverville, just drove past the site on Saturday)

The end of the world as we know it... What I keep wondering, is if this truly happens, what do the rich people do? What are they doing with their million dollar bonuses? What will they do when TSHTF? You can't convince me they are stocking up on food and bullets too. Do they intend to all go somewhere and live in a rich persons community? I can imagine another Great Depression, or a little worse. But not as drastic as some here would think. Call it my naivety and optimism.... But I can't imagine that they would willingly destroy the financial market and the world, unless they have some way of saving their money from loss and keep from getting killed in the blood bath that follows. They are too greedy and corrupt to lose that easily.

Or are they dumb enough to go down with the ship?????

But just in case, I will be mentally ready to try to keep my family safe in the worst, but hope for the best outcome.

But my 14 year old teenager? She is hoping we go back to hunter gatherer era. But only after she gets her masters degree in bio engineering and develops a cure for cancer. :D

D. Benton Smith - "Subjects like alternate sources of desirable food oils strike me as being right on topic, because of the likelihood that we'll need access to such items if/when we all wind up on short rations."

This worries me, too. There aren't plant sources of oil that don't require a lot of effort and technology for extraction. The oolichan is a dwindling fishery and is fairly localized on the northwest coast now. I figure chickens and pigs, except, come slaughter-time, I think I would become too attached to the pigs.

Sharon said...

"I don't believe in mental preparedness as a practice for watching the people you love die, or enduring the unendurable. Meditation smeditation - you learn to keep putting one foot in front of the other through the worst kinds of hell by doing it. Not looking forward to the education.

Sharon Astyk"

Acceptance is the best way to get through grief or trauma. But real acceptance requires people to stop lying to themselves and to unlearn a lot of cultural idiocy around our place in the world. For that reason most people will never do it.

gyllygrll- "yes but its not just their rabid conservatives. we've got intolerant catholics, protestants, hindis and jews now too."

precisely, ergo my "parallel"...

:-)

"god has left the building" - ow. That hits pretty hard.

Stoneleigh- beautiful presentation. I'll be passing that one around; thanks.

Just got in and browsing the comments...

D. B. Smith - I agree wholeheartedly about "Snow Walker."

Isn't that the one where the young gal saves the life of the flyer?

It is a bit dramatized and capsuled for entertainment, but is both enjoyable and makes several good points about survival.

Also a great flick for young women to watch as it can boost their confidence.

Paleocon - OK. I take your point and agree as long as the "war" is one of self defense. Go total!

But these actions of attacking other peoples around the world for vague and questionable perspectives I am totally against and always have been. I am convinced they hurt more than they help.

"WMD's

"Domino Theory"

"Gulf of Tonkin incident"

"Grenada invasion"

"Panama mission"

etc. etc.

Concerning Karl, I think his dogging of the financial corruption is laudable and I read it regularly. But I don't agree with his neo-libertarian politics.

Dr. J -" There aren't plant sources of oil that don't require a lot of effort and technology for extraction"

Oh, not really so. Hazelnut, pecan, and hickory up north.

Native Americans had a perfectly good way of processing/extracting hickory. Put the whole nuts in a mortar, and apply the pestle. Crush everything (including a weevil or two.) Boil in water. Cool. Settle. Skim- top is pure oil better than butter, and they used it exactly that way. Water is stock for soup. Bottom of kettle is - shell and whatever.

Those nut oils are as good as olive any day- better, perhaps. http://tinyurl.com/yapuglt

"Hickory" is supposed to be another word like "kangaroo", which means "what are you talking about??" in Aborigine.

Euro explorer pointed to boiling hickory soup, and said "what are those nuts called?" and the locals answered "Powcohicora", which means "nut soup".

Supposedly.

AlfaBetapowcohickora-

"The end of the world as we know it... What I keep wondering, is if this truly happens, what do the rich people do? What are they doing with their million dollar bonuses? What will they do when TSHTF? You can't convince me they are stocking up on food and bullets too. Do they intend to all go somewhere and live in a rich persons community?"

Who the hell cares? I just wanna know where they're gonna hide their wimmin.

:-)

Greenpa: ...apparently one of the scenarios under discussion in the think tanks is a South-North civil war- started by the South this time, and driven by exactly those folks; a religious war this time.

They have been planning this for years, and teaching their kids. About 20 years ago, while living in SC, I was privy to a conversation between my son and a friend he had sleep over. They were about 12 years old at the time. It was about guns, god, and the south rising again. Of course it was taught through vehicles the boy respected, his church, his grandpa and his mama. The churches are central to the elaborate plan. Years of planning, stockpiling and recruiting...

Maybe I should have killed him then. Instead I 'hoped'.

Stoneleigh:

Simply, thank you for all you do. Lifeboats are being built.

Stonelady - I took a tour of the squalid habitations! A very humbling experience indeed.

Thanks for the link.

The thing that immediately grabs me is the lack of space! We are so very fortunate who live away from any major cities if for that reason only.

I spend most of my time working (and playing) outside and feel very priviledged to have the time and space to do so!

Greenpa - you are correct about the nut oils, of course but it makes me tired thinking of how much work is involved. I think most Indigenous peoples rendered the fat from game animals as their major source of calories. For instance, I have dined in homes in the far north where bear grease was liberally spread on the meat and fish. They also rendered moose fat and caribou fat to be used in the same way.

The first thing I noticed about all those slum habitations is that they are beneficiaries of "trickle down" technology ... lots of sheet plastic and fabric. Of course long before all the plastic rots, there will be famine in the favelas ...

Re plant oils

Hemp seeds are extremely nutritious and tasty. Of course, it's illegal to grow hemp in the USA due to the lobbying of the cotton and chemical industries. Hemp growing does not use pesticides or herbicides, unlike cotton. Canada, France and China are major producers of hemp in the world today.

I love the taste of raw hemp seeds -- great source of omega 3 fatty acids and a complete source of protein (all amino acids).

http://en.wikipedia.org/wiki/Hemp

New post up.

Nice link to the slums site, Stoneleigh. The reason I harp on about nutrition and sanitation is that as more people become slum dwellers in urban areas, these will be the primary factors in determining community health. As slum communities become more numerous, disease will follow.

Greenpa, you do not want rich people's wimmen - boring and spoiled aren't attractive ;-).

Re:Acceptance - I think that's a viable solution for some forms of grief and trauma, and not for others. I've known a lot of Holocaust survivors, and there are things that you cannot accept in the world - and that you wouldn't want to be able to in many ways.

Re: Shantytowns - friends of ours live in an affluent suburb not too far away, and although the 1960s ranch houses are fairly close together, we noted that the numbers are counted by fours, implying that they expected to build more housing. My husband's observation "oh, that's for the interstitial shantytowns."

Sharon

Arce Dei says:

Very illuminating interview...

For those expecting immediate Armageddon in the share markets I

refer you to Lorimer Wilson's ohart comparing the S&P 500 to Japan's

Nikkei(with a lag of nearly ten years) for an eerily predictive look

at the future of the next year...

http://www.resourceinvestor.com/News/2009/9/Pages/Comparing-the-SP-and-the-Nikkei-1400-by-year-end-400-by-2014.aspx

You've been warned (grin)...

you Might have until Dec. 2010 and

some surreal revival of bubblemania

to get thee out of Dodge...

Can you please bring back the graphics? They have as much value as the interview itself.

It seems you are referencing theoildrum for them and they moved them somewhere.

Post a Comment