Three Confederate prisoners, Gettysburg, Pennsylvania

Ilargi: Labor Day, Monday September 7, marks the first anniversary of the US takeover of Fannie Mae and Freddie Mac. Prior to the takeover, the two had for over 70 years bought over half of US mortgage loans from lenders and sold them on, packaged as securities, to investors. If you put it in in the right terminology, Fannie and Freddie are just one step shy of the Red Cross and Salvation Army. The Financial Times gives it a try:

[..] many have enjoyed lower interest rates on their home loans because the two companies kept money flowing through the market. Backed by an implicit government guarantee, their mission was to support the US housing market by providing liquidity, stability and affordability for those in need of a mortgage.

This is the sort of description of Fannie and Freddie's activities that has become standard in the US media. But there is something missing, and something crucial at that. By allowing lenders to rake in commissions and other fees for a loan they originate, while selling off the risk of default on that loan to global investors, in a set-up that provides implicit government (re: taxpayer) guarantees for that risk, Fannie and Freddie serve to drive up real estate prices, and dramatically so.

There was a time when mortgage loans were provided for maximum 50% or 60% of the purchasing price, and when they were standard paid off in 5 or 10 years. At today's prices, compared to people's incomes, that is unthinkable. Loans are now paid off in 25, 30 or even 40 years. Moreover, when all accumulated fees are taken into consideration, home-"owners" will more often than not have paid 3 or 4 times the purchasing price of the home once the loan has been paid in full. This is not a typical US phenomenon, government "support" for homebuyers exists in many countries. For example, when I was in Portugal ten years or so ago, I noticed that multi-generational loans were all the fad.

It's a generally accepted sort of scheme, but that doesn't make it any more morally acceptable. The often lauded additional "affordability" offered through a government guaranteed home loan system is of course nothing but a hoax. In essence, what it delivers is the opportunity for someone who couldn't afford a $50,000 house under "normal" conditions to now get financing for the exact same abode for $350,000. And if everybody can "afford" to spend that much more, prices will, as if by magic, rise accordingly. After all, why would anyone try to sell a house for only $50,000 when there's that much credit in the market? Buyers wouldn't even want it, they'd think there was something wrong with it.

So if the home still costs about as much to build, where does all the extra money go? Well, builders become "project developers" and drive fancy cars. Suppliers get a share; until the crash the cement and plastics industries were doing just fine, thank you. Most of it, though, goes to the banks. That is the one and only real effect of Fannie, Freddie, their brethren around the globe, and the government guarantees they offer. Instead of a hard working family paying George Bailey's Building & Loan Association in "It's a Wonderful Life" 50% of their income plus 5% interest for 5 years, that same family, if it wants a home of its own, is forced to pay 30% or 40% of its income for 30 or 40 years to a bank that runs no risk whatsoever and that will charge it fees left, right and center on top of everything else. Is it any wonder that the real wealth of American families has been falling since the early 1970's?

The largest and most important purchase for everyone who wants a family has turned into the largest and most important transfer of money from Main Street to Wall Street. And now that Wall Street’s gambles with all the money raked in through the scheme, as well as the highly leveraged securities written on the loans, turn sour, the government guarantees kick in, and it's up to deeply impoverished Main Street to cough up the cash to pay the piper. Meanwhile, the banks still operate, their traders still make millions, Fannie and Freddie are about to be replaced by a side-scheme operated through Ginnie Mae and the Federal Housing Administration (which will need a taxpayer bail-out before the year is over).

There is one thing more crucial than any other to the present US economy: a program must remain in place which guarantees that people pay far too much for their homes. If that would be let go, there would be no financial or banking system left in the country. Sharply lower property taxes would bankrupt all states, counties and municipalities save for a precious few. And perhaps most of all, the previously incurred losses would be forced to the surface. You can't keep a $350,000 loan in your books for a home right next to a similar one that sold for $35,000.

If we want to ever shine a light on any of this. before the next step in this tragic drama is locked in by the White House, it would be good for an investigative journalist or two (hello, Huffington!) to dig up the answers to a few questions such as these:

- What is Fannie and Freddie's securities portfolio valued at presently?

- How did Ginnie Mae end up with over $1 trillion in loans?

- How did the FHA become insolvent?

- What is the situation at the various Federal Home Loan Banks? What is the precise role they play in the scheme?

- What happened to Fannie and Freddie share prices recently that makes them compliant with NYSE rules once more?

- Who puts money into companies with a combined negative asset value of $260 billion?

- What would have been the estimated effect if both had been de-listed?

Do Fannie Mae and Freddie Mac provide "affordability for those in need of a mortgage"? No, clearly not, they provide the opposite. They raise home prices by guaranteeing loans at steeply elevated prices. They pervert the market.

Is it true that "many have enjoyed lower interest rates on their home loans" because of Fannie and Freddie? Well yes, but who of sane mind would rather pay 5% + fees on a $350,000 mortgage than 6% + no fees on a $50,000 loan? What sort of discussion is that to begin with? If the government and media keep repeating the positive sides often enough, and god knows they’ve been at it for 75 years now, who will dare be critical?

A system with government guarantees for real estate could work, but never if it is provided through a banking system that seeks to maximize its profits at the expense of the taxpayers whose money is being spent by that government.

It won't stand. The system is broken beyond repair. The boondoggle has extracted so much capital out of the economy that there cannot be a market any longer at the higher price levels. Sure, according to the S&P-Case/Shiller index, prices are down 30% from their peak already. But if you think that’ll be all, imagine what would happen if Fannie and Freddie, or their taxpayer-guarantee providing successors, would be taken out of the market.

Real estate prices can no longer be kept at such artificially high levels, since people can't afford them anymore no matter what guarantee they come with. At the same time, if real estate prices are allowed to fall, by taking the guarantees away, the housing market will implode overnight, taking individual homeowners as well as the banking system and indeed the entire American economy with it.

A real life conundrum. If you don’t want the banks and the economy to implode, you need to keep prices high. But if you keep prices high, there are no buyers, which means the banks and the economy will implode (just a bit slower).

Now, you would think a government would choose the lesser of two evils. Instead, the present administration elects to embrace both evils. What should a government do? In the end, it all comes down to Garrett Hardin again, who said the main task of the shepherd is to minimize the suffering of the herd. What the Fed and White House do instead is try to minimize the suffering of the rich. The only consolation for the rest of us is that it won't work. Unfortunately, we’ll pay a high price to figure that out.

Houses to put in order

Edward DeMarco is all too conscious of the burden he carries as the man in charge of ensuring the vast majority of US mortgages are soundly backed – and that outsiders who invest in them are given due protection too. The acting director of the Federal Housing Finance Agency is regulator of Fannie Mae and Freddie Mac, America’s twin home loan enterprises. "Financing for millions of mortgage transactions executed at kitchen tables, metal desks and bank offices around the country has come from investors all over the global capital markets," he says in an interview.

But as Americans gather at kitchen tables and elsewhere to celebrate Labor Day on Monday, the holiday that traditionally marks the end of summer has added resonance as the first anniversary of Fannie’s and Freddie’s rescue by the federal government. For decades, the two so-called government-sponsored enterprises (GSEs) – private companies operating under a federal charter – had been silent partners in more than half of all home loans made to US borrowers. Their role was to buy loans from banks and other lenders, package them into securities that they guaranteed and sell those on to investors or hold them on their balance sheets.

Individual homeowners were thus seldom aware they had a Fannie- or Freddie-backed loan – but many have enjoyed lower interest rates on their home loans because the two companies kept money flowing through the market. Backed by an implicit government guarantee, their mission was to support the US housing market by providing liquidity, stability and affordability for those in need of a mortgage.

All that was thrown into question on September 7 2008, when their mounting losses and increasingly acute funding difficulties pushed the two abruptly into Washington’s arms. Fannie and Freddie had succumbed to multi-billion dollar credit losses as the housing bubble burst in 2006 and millions of borrowers defaulted on their mortgage payments, eroding their already thin capital cushions. A year into the global credit squeeze, investors became increasingly fearful of collapse and stopped lending money to the two companies, forcing the government to step in.

Now, as the White House begins to draft reform proposals for Fannie and Freddie to be presented along with the government’s 2011 budget in February, the future of these two venerable institutions still hangs in the balance. Supporters of Fannie and Freddie warn that aggressive changes to the way they operate could make mortgages more expensive and put home ownership out of reach for many. Critics counter that downsizing or killing off government support for the two companies would allow markets to assess risk more effectively and curtail the excesses that led to the housing market collapse. The administration of President Barack Obama has so far offered few clues on the nature of its long-term plans for the institutions. An official says only that it is still considering a long list of options and that "no one option is under strong consideration at this time".

Any new structure for the two companies will need to balance political demands for the government to subsidise home ownership with the exigencies of delivering that subsidy efficiently and in a way that poses no systemic threat to the US economy. "There are no obvious choices," says a consultant close to both Fannie and Freddie. "When a bank fails, we know it eventually becomes a bank again, but when a GSE fails, there simply is no model. They have such an important social function that this will largely be a political decision, not an economic one."

What is also clear is that the FHFA will be at the forefront of executing the administration’s plans. "In aggregate the US mortgage market is $12,000bn," says Mr DeMarco, indicating his preferred approach by adding: "I think it would be fruitful to ask, before deciding among the wide variety of possible legal and ownership structures for the GSEs, what do we want the secondary mortgage market to look like? This will shape our other decisions." Acknowledging the importance of Fannie and Freddie to markets as well as holders of the underlying home loans, he says: "Our task now has to be to decide what are going to be the connections between the individual mortgages and the big securities transactions."

Before the takeover, the government’s implicit backing ensured low funding rates for the two companies because investors in the US and abroad were content to buy billions of dollars of Fannie- and Freddie-backed securities at returns only slightly above US Treasuries. But that hybrid public-private model has since been widely criticised for fuelling excessive risk-taking by Fannie and Freddie during the housing boom. Their executives were able to boost returns for shareholders while using the unspoken federal guarantee as a backstop.

The government takeover has come at enormous cost to US taxpayers. Fannie Mae and Freddie Mac have so far tapped nearly one-quarter of a $400bn Treasury lifeline. The Federal Reserve also stepped in with commitments to buy $1,250bn of their mortgage securities and a further $200bn of their debt. As a result of the degree of management and financial control the government now exercises, the Congressional Budget Office will this year begin accounting for Fannie and Freddie as federal operations. It says that will increase the federal deficit by $291bn this year. As the costs of Fannie and Freddie’s conservatorship mount, working out an exit strategy becomes ever more demanding for the government. Both companies and their regulator have said they think it is unlikely they will ever be able to repay the Treasury funds, which are structured as senior preferred stock purchases that carry an onerous 10 per cent dividend.

Complicating the picture is that since the onset of the credit crisis two years ago, and even more so since their takeover last September, Fannie and Freddie’s role in the housing market has swelled. They have backed more than 70 per cent of new home loans since 2008, stepping in as private lenders all but disappeared from the market. Under conservatorship, they have also become the engines of government policy to tackle the foreclosure crisis. They are at the forefront of programmes to modify the terms of home loans for struggling borrowers and refinance those that now exceed the value of the properties on which they are secured.

The sums involved are enormous. At the end of July, the two companies had $5,500bn of outstanding debt and guarantees on securities, approaching the $7,200bn US public debt. The two also hold a combined $1,500bn of mortgages and mortgage-backed securities on their balance sheets. James Lockhart, whom Mr DeMarco replaced as regulator, says: "Over the long term, this high GSE and government share [in the mortgage market] is unhealthy." But others point out that any attempts to reduce the size of Fannie’s and Freddie’s portfolios, combined with the Fed’s own plans to reduce its holdings of GSE securities, could be destabilising for the market. "Who would be the buyers?" asks one former executive at Fannie Mae.

Fannie Mae declined to comment, directing questions to the regulator. For his part, Ed Haldeman, Freddie Mac’s chief executive, says: "It has been made clear to me that the GSEs would have a seat at the table, although not a decision-making one, but I have not yet seen or heard anything official that would give me much guidance as to the government’s direction." Analysts say the government has three basic options. The first would be the equivalent of nationalisation. Fannie and Freddie could be turned into a single government agency that would provide explicit federal insurance on all mortgages that conformed to its requirements. This would allow the government to preserve liquidity in the mortgage market while giving it direct control over providing affordable housing to targeted communities.

Under this model, the existing assets and liabilities of the GSEs could be taken over by a separate "bad bank" that would be capitalised by the government and managed while the mortgages gradually mature or pay off. Alec Phillips, analyst at Goldman Sachs, says: "Nationalisation of at least some of the GSEs’ operations seems probable because Congress seems very likely to want to maintain the GSEs’ affordable housing mission." However, there have also been warnings that such a model would come with all the risks of moral hazard but without the discipline imposed by private shareholders. "What I have seen is that government insurance programmes are high risk and full of moral hazards," said Mr Lockhart in a speech shortly before his resignation. "It is often difficult in a political environment to calculate or charge an actuarially fair price, avoid mission creep and keep federal risks from increasing."

Second, both could be put back entirely into the private sector, perhaps breaking them up into several smaller companies in the process. Private companies would in theory offer the benefits of greater competition and greater efficiency. But both the administration and Ben Bernanke, Fed chairman, acknowledge it was government backing that allowed the two to continue to produce and sell mortgage securities when private firms could not. The third option would be to return Fannie and Freddie to their status before they were taken over. A restored hybrid public-private model could come with a requirement to reduce their portfolios and hold more capital. It could also involve a good-bank/bad-bank split.

The companies could be subject to much more stringent oversight. This could involve regulated returns, similar to utilities such as electricity companies, or supervision by bank regulators. It would also be possible to make the government’s guarantee explicit, with transparent premiums for that privilege paid by the two companies to a government insurance fund. Don Brownstein, chief executive of Structured Portfolio Management, a mortgage-focused hedge fund, says: "The government has little choice at this stage but to make the guarantee explicit. The toothpaste is out of the tube now – every investor in the world knows these companies are too big to fail."

Policymakers will thus have their work cut out for them in the months ahead. The administration’s proposals, whichever direction they choose to take, are likely to require an act of Congress – and the wrangling over Fannie’s and Freddie’s future could continue well into 2010. Recent experience is likely to drive lawmakers to believe some form of government backstop may be necessary to ensure the mortgage market can continue to function even under the most stressed conditions. But as Mr Phillips at Goldman Sachs points out: "It seems unlikely that lawmakers will explicitly endorse returning the GSEs back to their ?previous model after burdening ?taxpayers with billions of dollars of losses."

When the US Treasury and Federal Housing Finance Agency took over the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation – the twin institutions better known as Fannie Mae and Freddie Mac – on September 7 2008, a financial conflagration of unprecedented size was about to erupt. The following days and weeks brought the collapse of Lehman Brothers, the investment bank; AIG, the insurance behemoth; and Washington Mutual, the largest bank failure in US history. The period also saw the hurried acquisition of Merrill Lynch by Bank of America, which has since become the subject of congressional hearings and investigations by the New York attorney-general. The rapid takeover of the government-sponsored mortgage financiers was intended to reassure investors that the home loans market could continue to function even as defaults by homeowners widened their losses.

By July last year, the scale of the losses had prompted the administration of George W. Bush to pass legislation to regulate the two enterprises more closely. Far from taking comfort, however, investors grew nervous. The new regulations called for Fannie’s and Freddie’s regulator to oversee a contraction in the companies’ balance sheets, which in turn led to investors pulling back from buying their debt, fearing it would be less easy to trade. This made it increasingly difficult for the GSEs to fund their operations. "By early September, it was clear that there was no other choice than conservatorship if the enterprises were going to continue to fulfil their mission of providing stability, liquidity and affordability to the market," says James Lockhart, their regulator at the time.

John Koskinen, appointed as chairman of the board at Freddie Mac after the takeover, says government officials "had a pretty good focus on stability. They wanted to conserve the company’s ability to operate and to serve the mortgage market. They felt that if investors lost confidence it would be a major problem for housing." However, just as the July legislation had destabilised the market for Fannie and Freddie’s debt, the structure of the takeover had damaging unintended consequences for the rest of the financial world.

In an attempt to draft the takeover in a way that would compensate the Treasury for taking on the risk of the two institutions, the Treasury’s investment was made senior to $36 billion of preferred stock sold by the two companies. This so-called "cramdown" of the preferred stock – the securities were made close to worthless by the move – led to investor reluctance to commit capital to other needy financial institutions, as the risk of later government intervention was seen as too great. Much of the preferred stock had originally been issued at the behest of Fannie’s and Freddie’s regulator. In addition, regulations on investments in Fannie and Freddie by banks were loosened to expand the market for such securities.

Regional banks, together with US insurers, held the majority of the two GSEs’ $36 billion of outstanding preferred stock, prompting writedowns for many small financial institutions at a time when they were struggling with troubled investments in commercial property and home equity loans. "So now the government has a conundrum," says a former executive at Fannie Mae. "It will be very hard to persuade investors to return to these two companies. There will be a clearing price [a price investors are willing to accept] but for Fannie and Freddie to be effective, investors have to feel confident enough to accept returns lower than on, say, General Electric. That is going to take some work."

Investors Find Love in $260 Billion Black Hole

Some things I’ll never understand. How can a show called "Flip This House" still be on television? Why didn’t the Utah Jazz basketball team change its name after leaving New Orleans? And why in the world did the common shares of Freddie Mac and Fannie Mae go berserk last month? The last of those questions is by far the most difficult to answer.

In case you hadn’t noticed, America’s worst financial companies were the market’s best-performing stocks until a few days ago. The price of Freddie’s common shares more than tripled in August, as did Fannie’s, although this week they have given up some of their gains. It was the same story at their fellow ward of the state, American International Group Inc. While the stock-market values of these government- controlled companies have soared this summer, it’s debatable what those values are.

For instance, you might say Freddie’s market capitalization is about $1.1 billion, based on the company’s $1.64 stock price and the 648.3 million common shares outstanding that Freddie disclosed on the cover page of its latest quarterly report. These are the inputs investors normally use to calculate market caps. It also would be accurate to say Freddie’s market cap is $5.3 billion. That figure is based on the fully diluted shares outstanding of about 3.3 billion that the company used to calculate its loss per common share last quarter.

Similarly, Fannie’s market cap is either $1.5 billion or $7.8 billion, depending on which share count you use. (The stock closed yesterday at $1.37.) The larger share counts include warrants issued to the U.S. Treasury that would allow the government to buy 79.9 percent stakes in the companies’ common shares at a nominal cost. As of yet, those warrants haven’t been exercised, and so the shares haven’t been issued.

The situation at AIG is even more confusing. The cover page for its latest quarterly report shows 134.6 million common shares outstanding, which is about the same as the fully diluted share count on its income statement. Yet in a footnote to an Aug. 13 press release, AIG also disclosed a hypothetical share count, assuming that someday it would have to convert a big slug of the preferred shares it pledged to the government into common stock.

AIG had 697.4 million common shares using that method. Thus, depending on which figure you use, its market cap is either $5.1 billion or $26.5 billion, based on AIG’s $37.95 stock price. All three companies are leaving investors to sort out for themselves which share counts are the right ones to use. Go figure. The larger question is why anyone would pay anything to own any of these companies’ common shares. Elsewhere in their disclosures, Fannie and Freddie tell you straight up that their common equity is worth less than zero.

Unlike other companies, the two government-backed mortgage financiers publish quarterly fair-value balance sheets showing estimates of the real-world values for all their assets and liabilities. (Fair value is the price at which an item would change hands in an orderly, arm’s-length transaction.) As of June 30, Freddie said the fair value of the net assets attributable to its common shareholders was negative $122.6 billion. At Fannie, the number was negative $138.1 billion. Together, from the standpoint of a common shareholder, the two companies amount to a $260 billion black hole.

The only place you’d find a bigger deficit is the federal budget itself.

By comparison, from 1990 through 2007, before they were seized by the government, Freddie and Fannie reported total net income of $35.9 billion and $59.8 billion, respectively. Even if the companies returned to their former glory, there is nothing in their histories to indicate they have the ability to earn their way out of their present deficits. Hope springs eternal anyway. As for AIG, the insurance company’s common shareholder equity was negative $35.4 billion as of June 30, once you take away its $44.2 billion of deferred customer-acquisition costs and $6.4 billion of goodwill. Those assets exist only on paper and can’t be sold by themselves.

In effect, what we have here are three extremely expensive Powerball tickets. Perhaps the bet is that the Treasury might bestow a gift on the common shareholders one day, by forgoing some of its ownership rights in the event the companies can’t repay all their debts to taxpayers. Or maybe the recent rally was just the result of a monstrous squeeze on short sellers who were forced to cover their bearish bets. There’s no way to know what’s going on in Mr. Market’s head at the moment. At least when you play the lottery, the odds of winning and losing are measurable.

Fannie and Freddie woes trump banking debacle

Federal banking agents will be out again late this afternoon, walking into the nation's most troubled banks and taking them over, if today is like most recent Fridays. The government likes Fridays because it gives staff the weekend to reorganize the bank so customers can get to their money when it reopens for business. It has seized an average of four banks each Friday since the end of June, up from one every other week last year, and none in 2005-06. No bank around Philadelphia has failed in this cycle. A lot of the doomed lenders were near Atlanta and other centers of reckless optimism. More than 80 banks have closed to date in 2009. Should we get worried, or angry? Are taxpayers going to get robbed again?

Nope, it's what banks do, every so often, and banks are taking care of the problem, said William Isaac, who headed the Federal Deposit Insurance Corp. under President Ronald Reagan during the run-up to the last big round of bank blowups. "I don't see a whole lot of diffence between the bank failure occurring this time and last time," Isaac told me earlier this week. "Banks get too aggressive in lending, and now they're in substantially weakened condition, and it's time to clean it up. We'll be doing that for the next couple of years," he said from his Florida home, where he rested between calling on bank executives around the country as chairman of LECG Corp.'s financial-services business.

LECG is the national consulting firm that last month agreed to buy the largest Philadelphia-area-based accounting firm, Smart Business Advisory & Consulting L.L.C., of Devon. Richard X. Bove, a bank analyst for Rochdale Securities L.L.C., estimates that maybe 150 to 200 more banks will fail this cycle. Isaac calls that "reasonable," though he notes that only the FDIC really has a good idea, and it keeps the truth hidden, under federal bank-secrecy laws, until a company is actually taken over. Won't FDIC run out of cash at this rate? "Not yet," Isaac said, citing the FDIC's fund balance (about $10 billion) plus billions more in accrued insurance payments that Isaac said the agency had set aside to cover future losses.

If FDIC does run low, Isaacs said, it ought to borrow from Treasury, instead of increasing insurance charges on banks, as it did last year. "Congress does not want the FDIC to be raising premiums at a time we're trying to get banks lending again," Isaac said. "Every dollar the banks put in the FDIC is $10 they don't lend," since banks typically keep about $1 in reserves for every $10 they lend out, and insurance premiums come out of those reserves. Banks - not taxpayers - finance FDIC. Though banks do pass the cost along to the public, like other expenses, as higher fees or lower shareholder profits.

"Fannie Mae and Freddie Mac are much more serious problems," with tens or hundreds of billions in as-yet-undeclared losses on bad mortgage loans, Isaac added. The government's alternatives, since it effectively took over Fannie and Freddie last year: "Keep them as wards of the state forever," Isaac urged. "Or truly privatize them - break them down into much smaller pieces and sell them off. There's no way the private sector can deal with something that large." How'd we get to this point? "Everybody believed [Fannie and Freddie] had the government's backing" when they financed increasingly questionable loans in the 1990s and early 2000s, Isaac said. "They weren't subject to enough discipline."

The Fannie-Freddie debacle is just the latest example of how public support for private enterprise seems to lead to some of the worst economic outcomes. As with health care and college tuition, home loans have been financed in part by taxpayers (through implicit guarantees for Fannie and Freddie debt), but actually spent by private institutions. When the people approving and receiving government-backed payments aren't the people raising the cash (or making the guarantees), institutions like hospitals, drugmakers, and colleges start getting used to the extra cash, and boosting costs. That is also what happened in the home real-estate business, until it blew up in the mid-2000s.

Fannie, Freddie shares jump on NYSE compliance

Mortgage finance providers Fannie Mae and Freddie Mac said on Friday they had regained compliance with New York Stock Exchange share listing rules, reviving their respectability among investors. Shares of Fannie Mae gained 6.7 percent to $1.75 and Freddie Mac rose 4.3 percent to $1.95 in mid-morning trade. The news came 10 months after the companies were notified they had failed to satisfy the NYSE's continued listing criterion when their common stock prices fell below $1.00 during a 30 day period.

The U.S. government was forced to bail out Fannie Mae and Freddie Mac during the depths of the credit crisis in September 2008 and their return to NYSE listing compliance was seen as a modest step in their recovery. "Some people are assuming that because they are going to remain on the NYSE, perhaps that implies something about how the government will treat them going forward," said Charles Lieberman, chief investment officer at Advisors Capital Management, adding that the outlook was buoying the stocks.

Options activity also picked up in the government sponsored enterprises as investors started to believe the companies' shares would recover. "As the stocks have performed well in the past few weeks, we have seen heavy speculative call option buying in the front month September $1 and $2 strikes," said Joe Kinahan, chief derivatives strategist at thinkorswim, a division of TD Ameritrade Holding Corp. "The fact that their option premiums are so cheap in real money terms makes it an easy for investors to be involved and have low risk for a nice potential return."

Fannie Mae and Freddie Mac, along with a few other financial stocks, have dominated trading on the New York Stock Exchange in late August with many attributing the recent rally to short-squeezes. Fannie Mae stock is off a year-low of 30 cents reached on November 21 while Freddie Mac shares traded above a 52-week low of 36 cents hit on March 9. Freddie Mac Sept $1 and Sept $2 calls were among the most active contracts early on Friday. During the first 30 minutes of trade, the Sept $1 FRE call traded 15,834 times, exceeding its previous existing positions of 13,956 contracts. The Sept FRE $2 call had volume of 6,648 lots, according to Reuters data.

Fed Tries to Prepare Markets for End of Securities Purchases

The Federal Reserve is trying to prepare investors for an end to its housing-debt purchases, while keeping interest rates near zero, reflecting an economy pulling out of a recession with little momentum. Federal Open Market Committee members discussed extending the end date of the agency and mortgage-backed bond programs, minutes of the group’s Aug. 11-12 meeting showed yesterday. The move would be aimed at avoiding disruptions in housing credit at a time when recovery prospects are clouded by rising unemployment and slowing wage gains, analysts said.

While the economy is projected to expand this quarter, central bankers had "particular" concern about the job market, signaling that the FOMC may need to see a peak in the unemployment rate before it begins withdrawing monetary stimulus. Some policy makers saw dangers of "substantial" declines in the inflation rate, yesterday’s report showed. "They need to see labor markets improve and inflation stabilize, and not fall, before they even have a serious discussion about increasing interest rates," said Michael Feroli, an economist at JPMorgan Chase & Co. in New York and former member of the Fed’s research staff.

A government report tomorrow is projected to show the unemployment rate rose to 9.5 percent in August from 9.4 percent in July, threatening to curtail consumer spending. Other areas of the economy have indicated the deepest recession since the 1930s has ended: manufacturing grew for the first time in 19 months in August, and home sales and prices have risen. Chairman Ben S. Bernanke and his fellow FOMC members next meet Sept. 22-23 in Washington. "They see positive economic growth, no job growth, a very slow decline in unemployment, and a huge vulnerability to anything that could shock confidence," said Christopher Low, chief economist at FTN Financial in New York. "I would be really surprised if they tightened at all next year."

Treasury securities rose yesterday as the minutes said Fed officials expressed "considerable uncertainty" about the strength of recovery. Yields on benchmark 10-year notes declined to the lowest level in more than seven weeks, before closing at 3.31 percent in New York. Stocks dipped, with the Standard and Poor’s 500 Index closing down 0.3 percent to 994.75. Bernanke, 55, was nominated to a second term as chairman by President Barack Obama last month after overseeing a record expansion of the central bank’s balance sheet in a campaign to prevent a depression. Seeking to unfreeze credit and revive growth, the Fed has loaned to banks, provided backstop financing for the commercial paper and asset-backed securities markets and injected liquidity through direct purchases of securities.

Central bankers extended their $300 billion U.S. Treasury securities purchase program by a month in August and continue buying up to $1.25 trillion in agency mortgage-backed securities and $200 billion in the debt of agencies including Fannie Mae and Freddie Mac. A number of policy makers judged that a "tapering of agency debt and MBS purchases could be helpful," the Fed minutes said. Officials postponed a decision on extending the initiative, which is scheduled to end in December. An extension would be "an attempt to make quantitative easing potentially less disruptive when it ends," Feroli said. Central bank officials have indicated differences on when to begin withdrawing the monetary stimulus.

"We have to begin to pull back from our extraordinary programs," Philadelphia Fed President Charles Plosser said yesterday while noting a risk of faster inflation in the future. Speaking in an interview with CNBC, he declined to say whether the Fed should begin raising the main interest rate next year. Fed district bank presidents Jeffrey Lacker of Richmond and James Bullard of St. Louis last week said the central bank may not need to complete its purchases of mortgage securities. New York Fed President William Dudley by contrast stressed an exit is "premature," citing "high unemployment" and weak growth.

Policy makers saw the economy recovering "slowly" in the second half of this year, and still "vulnerable to adverse shocks," the Fed minutes said. U.S. Treasury Secretary Timothy Geithner cautioned yesterday that it’s too early to remove policies aimed at reviving the economy. "We’ve come a very long way but I think we have to be realistic, we’ve got a long way to go still," Geithner told reporters in Washington as he prepared to leave for a meeting of Group of 20 finance ministers and central bankers on Sept. 4-5 in London.

Most Fed officials expected "subdued and potentially declining wage and price inflation over the next few years," the minutes said. "A few saw a risk of substantial disinflation." The Fed’s preferred measure of inflation, the personal consumption expenditures price index minus food and energy, rose 1.4 percent for the 12 months ending July. "They are not tightening anytime soon," said Mark Spindel, chief investment officer at Potomac River Capital LLC in Washington, which manages about $100 million. "They are going to be sitting there with unemployment approaching 10 percent and inflation falling."

Troubles For 'Prime' Borrowers Intensify

The long recession and rising joblessness are taking an increasing toll on the nation's most credit-worthy borrowers, who are now falling behind on their mortgage and credit-card payments at a faster pace than people with poor financial histories. The mortgage-delinquency rate among so-called subprime borrowers reached 25% in the first quarter but appears to be leveling off, rising only slightly in the second quarter. The pace of delinquencies for prime borrowers is accelerating. Since prime loans account for 80% of U.S. bank exposure to mortgages and credit cards, these losses could ultimately exceed those from weaker borrowers. "The subprime pain is in the rearview mirror," says Sanjiv Das, head of Citigroup Inc.'s mortgage business, which is seeing delinquencies rise among prime borrowers, who make up three-quarters of its mortgage portfolio.In many cases, these "prime" customers, whose high credit scores afforded them the best interest rates on mortgages and credit cards, lost their jobs over the past few months and only now are running out of temporary fixes that have been keeping them afloat. The trend signals more bad news for U.S. banks. Rising delinquencies on prime mortgages helped drive the total mortgage-delinquency rate to a record 9.24% in the second quarter, according to the Mortgage Bankers Association. The data reflect loans at least one payment past-due. Such delinquencies on mortgages made to prime customers rose 5.8% in the second quarter, compared with a rise of 1.8% among subprime customers. Still, the delinquency rate for prime loans was 6.4%, far below the 25.4% rate for subprime loans, according to the Washington-based trade group.

"We view this as a change in the nature of the problem. These borrowers were underwritten conservatively, and they were able to manage their payments for some period of time," says Michael Fratantoni, vice president of single-family home research for the mortgage bankers' group. HSBC Holdings PLC, which was one of the first banks hit by a wave of subprime defaults in the U.S., says its portfolio of prime credit-card loans is performing worse than its subprime group. One reason for the switch, the bank has said, is that many of its subprime borrowers are renters, who have demonstrated a better payment history on their credit cards than prime borrowers, who are homeowners now getting hit by falling house prices.

The focus on prime borrowers comes more than two years after the housing meltdown took its first aim at subprime borrowers, who found themselves locked into unaffordable mortgages and weighed down by credit-card debt. These subprime borrowers tend to have fewer financial levers to pull to stay current on their debt payments, so they default relatively quickly. Many of those bad subprime mortgages have worked their way through the financial system, causing billions of dollars in losses to the nation's banks. Credit-card issuers, meanwhile, have been quick to cut off these subprime borrowers, who were in the first wave of delinquencies and defaults.

For prime borrowers, this recession has been especially tough because declining home prices have taken away one of the typical crutches for them since it is harder to tap the equity in their homes to pay their bills if they lose their jobs, according to a report issued this week by Standard & Poor's. In addition to cutting back on spending, strapped prime borrowers often can keep up with their bills longer than subprime borrowers by draining savings accounts, reducing contributions to retirement plans and turning to family members for money. They also are typically slower than subprime customers to seek help for financial problems because they are concerned about the stigma associated with such assistance, credit counselors say.

About 40% of the strapped consumers seeking help from the OnTrack Financial Education & Counseling center in Asheville, N.C., are prime borrowers, up from 15% last year, says Tom Luzon, director of counseling services at the United Way agency. Many of these clients already scaled back their lifestyles after losing their jobs or seeing their salaries slashed. Some are small-business owners whose companies foundered as a result of the recession. "They have made adjustments and made adjustments, but then you get to a point where you can't adjust anymore," says Mr. Luzon, who is a former banker. "People who are middle-class wage earners initially may have severance pay and think they have plenty of time to find a job, but then they start using credit cards to support living expenses," he says.

Recession Job Losses: 3 Views

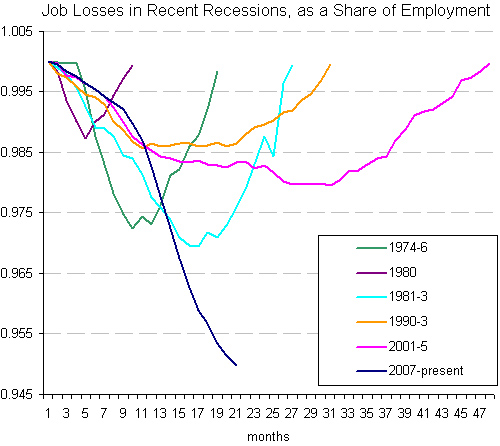

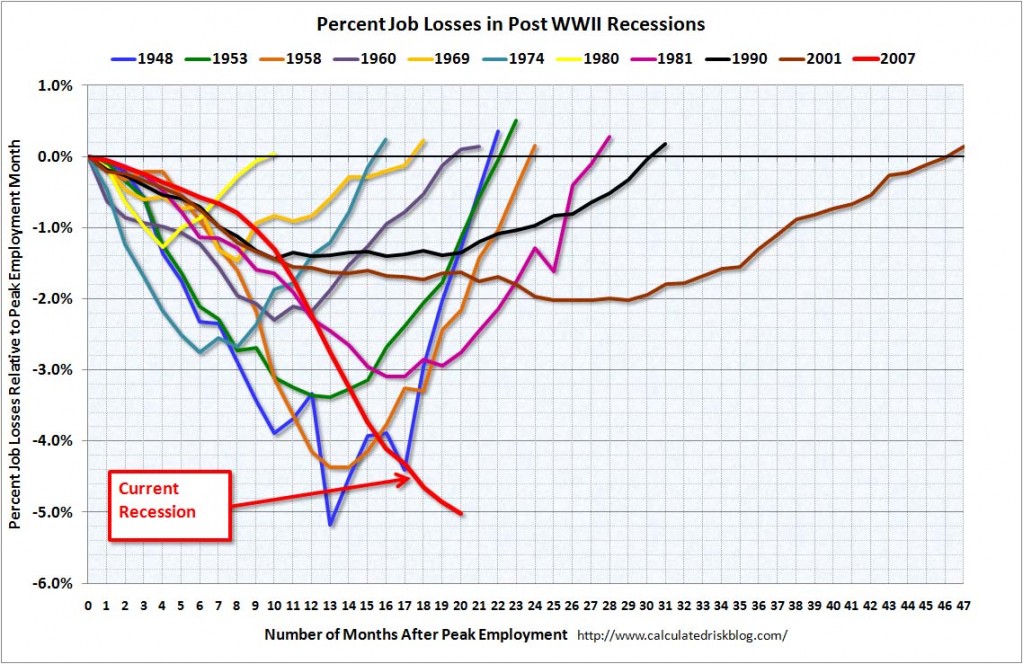

If a picture is worth a 1,000 words, well then consider the following 3k word sworth of info on the current recession (in size order):>

Comparing Recession Percentage of Job Losses

via Chart of the Day>

Comparing Recession Job Losses as % of Employment

via Economix>

Comparing Percentage Job Losses, post WW2

via Calculated Risk

Unemployment Is Much Worse Than You Think

There's another disturbing trend in the unemployment data (as if the headline rate wasn't enough):In the average recession, most job losses are attributed to temporary, cyclical factors--i.e., when the economy comes back, the jobs will, too. In this recession, however, more than half of jobs lost are gone for good.

PIMCO portfolio manager Tony Crescenzi explains (charts from Bloomberg):

Structural rather than cyclical influences on unemployment are running well above normal during the current recession, as is highlighted by the percentage of the unemployed that are “not on temporary layoff.”

Data from the Bureau of Labor Statistics show that 53.9% of the unemployed were not on temporary layoff in August, up from 39.1% a year earlier and well above the 30-year average of about 34%. The current level is well above the peak of previous cycles, which tended to move above 40% and was as high as 44.9% in May 1992. Many job losses are occurring in industries with broken business models and jobs won’t return quickly. This will put downward pressure on wages.

In terms of numbers of people, data from the BLS show that 8.1 million people were characterized as "not on temporary layoff" in August, up from 7.880 million in July and 3.72 million a year earlier. The not-seasonally-adjusted figure for "Permanent" job losers totaled 6.406 million, up from 3.609 million. These figures represent a very large proportion of the roughly 7 million decline in nonfarm payrolls (the tally on payrolls is produced via a survey of business; the figures on unemployment and both the "not on temporary layoff" and "permanent" job losers categories are derived from the survey of households).

Sen. Byron Dorgan (D-ND) saw it coming 10 years ago

Fixers Aim to Fix Fixes With Another Phony Fix

by Bill Bonner

From California comes word that the summer program of Singularity University came to an end this week. The idea of SU is simple enough. Put smart people together with the latest technology; let them figure out solutions to the world’s problems.‘The Singularity’ is an idea from Ray Kurzweil. The gist of it is that computers will soon be smarter than humans; by the middle of this century they’ll be smart enough to figure out how to get smarter and smarter, faster and faster.

No doubt, many of them will go into finance. And no doubt, many will make a fast buck. But will more smartness really make the world a better place? According to the singularists, increased brainpower will be able to solve all sorts of problems – from global climate change to market crises.

But the brain is a big disappointment. No mechanical engineer has ever improved the old-fashioned kiss. Nor has any brain ever straightened out the business cycle. Dumb as a slide rule, the brain does what it is told to do; it doesn’t ask questions. Tell it to build a bridge and it is on the case. Put it to work packaging tranches of toxic assets or selling aluminum siding…it is just as happy with one task as with the next. And the more a man’s brain bends to a challenge, the more it elbows out of the way his finer senses…and the dumber the man becomes. He turns his back on his own intuition as well as the accumulated wisdom from previous bust-ups and bruises. Like a man who has gone crazy, as G.K. Chesterton put it, all he has left is his sense of reason. Then, with nothing more to work with, he comes down on his work like a blacksmith’s hammer on a fine Swiss watch.

During the bubble period, the big banks were the biggest employers of top graduates from the world’s top schools. Oxford, Cambridge, Harvard, Yale…the financial sector drew them in like flies to an open latrine. The financial industry made so much money it had a hard time explaining it. The smart dudes did not toil in the fields, neither did they spin. Then, what did they do? They earned millions, bought BMWs and got dates with actresses. They claimed they were doing a fine job of allocating the world’s wealth and making everyone better off.

But when the bubble blew up, it was apparent that the financial world they created was fragile and perverse. Not a single one of the largest Wall Street banks survived without government handouts. And a news report from this week tells us that Americans were so damaged by the Bubble Epoque that their discretionary spending has now been cut to levels not seen in 50 years. The geniuses wiped out a half-century of economic progress in the richest, most successful economy the world has ever seen.

Smart people were also to blame for the biggest single error of the last century: central planning. The central planners thought they could fix the supposed evils of the natural economy with logic and reason. The idea was so alluring half the world fell for it. If the Nobel Committee had been on the ball they would have given Karl Marx a prize.

If the bug had come from stupid people…smart people might have avoided it. They might have come through the period without permanent scaring. But the wheezy intellectuals behind it were too clever for their own good. They soon infected the top universities…and the government. They convinced almost everyone that central planning was the wave of the future and that anyone who stood against it was a bumpkin, a parasite or a fool. Then, in the name of human progress, they took control in two of the world’s largest countries and turned them into prison camps.

But by the last decades of the 20th century it was obvious even to central planners themselves that it wouldn’t work; in both Russia and China, the planners simply gave up.

Central planning didn’t work because people had plans of their own. They resisted. Then, the planners brought down their hammers. "If you’re going to make an omelet, you have to break some eggs," said chef Vladimir Lenin. The "Black Book of Communism" puts the death toll as high as 100 million.

Then too, central planning didn’t work for less obvious reasons. Planning requires information. The planners had plenty of it. But private individuals had far more – local, current, more accurate information from first-hand observation and experience. With better information, they could make better plans. Most important, individuals didn’t limit themselves to only the fresh fruit of their rational brains. They put their hearts in it…and drew on instinct and tradition – the distilled spirits of previous generations – giving them a huge advantage over the apparatchiks.

But the brains kept at it. When the forensic experts sifted through the debris from the 2007-2008 financial blow-up they found fingerprints from a whole list of Nobel winners. It was they who had developed the formulae and the theories that deceived investors, and themselves. They believed they could tame risk…by calculation! They figured out the odds and worked out prices – to as many decimals as needed to put investors to sleep. And then along came a risk they had not foreseen – the risk that their own formulae were claptrap and that they were idiots.

Meanwhile, the brains were at work in the public sector too. There, they were still pushing central planning…albeit on a much less ambitious scale than in the last century. In Western countries, government economists fixed lending rates and credit policies in order to encourage over-consumption. In the East, they fixed exchange rates and recycled credit back to their customers in the West in order to encourage over-production. And what ho! Wouldn’t you know it; now the world has too much debt and too much capacity.

And so the brains are back on the job. In China, the government boosts production. In America, the central planners are trying to boost consumption. In short, the fixers are still fixing. And soon, the world will be in an even worse fix than it is now.

Stiglitz Says U.S. Economic Recovery May Not Be 'Sustainable'

The U.S. economy faces a "significant chance" of contracting again after emerging from its worst recession since the 1930s, Nobel Prize-winning economist Joseph Stiglitz said. "It’s not clear that the U.S. is recovering in a sustainable way," Stiglitz, a Columbia University professor, told reporters yesterday in New York. Economists and policy makers are expressing concern about the strength of a projected economic recovery, with Treasury Secretary Timothy Geithner saying two days ago that it’s too soon to remove government measures aimed at boosting growth.

Stiglitz said he sees two scenarios for the world’s largest economy in coming months. One is a period of "malaise," in which consumption lags and private investment is slow to accelerate. The other is a rebound fueled by government stimulus that’s followed by an abrupt downturn -- an occurrence that economists call a "W-shaped’ recovery. "There’s a significant chance of a W, but I don’t think it’s inevitable," he said. The economy "could just bounce along the bottom." Stiglitz said it’s difficult to predict the economy’s trajectory because "we really are in a different world." He said the crisis of the past year was made worse by lax regulation that allowed some financial firms to grow so large that the system couldn’t handle a failure of any of them.

"These institutions are not only too big to fail, they are too big to be managed," he said. Finance ministers and central bankers from the Group of 20 nations meet in London Sept. 4-5 to lay the groundwork for a summit in Pittsburgh later this month, where leaders will consider measures to overhaul supervision of the financial system. The U.S. Treasury Department, in a statement yesterday, said it wants a global agreement requiring banks to increase their capital cushions to be reached by the end of next year.

Stiglitz, 66, said that while $787 billion in federal government stimulus is propelling growth this quarter, there’s no guarantee the economy will maintain its momentum. On whether the U.S. needs another injection of stimulus, Stiglitz said it’s best to "wait and see." "We did have a very big stimulus, and that stimulus has added to economic growth and will be adding in the current quarter," he said. "But the question going forward in 2011 is the stimulus is coming off, and that’s a negative."

A U.S. government bailout of Lehman Brothers Holdings Inc., which filed for bankruptcy a year ago, wouldn’t have prevented the global economy from sliding into a recession, Stiglitz said. "Whether Lehman Brothers had or had not been bailed out, the global economy was headed for difficulties, a fact that seems increasingly evident as the world sputters in its recovery," he said. U.S. GDP shrank at a 1 percent annual rate from April to June, following a 6.4 percent pace of contraction in the first three months of the year. The drop was the fourth in a row, the longest contraction since quarterly records began in 1947. The world’s largest economy has shrunk 3.9 percent since last year’s second quarter, making this the deepest recession since the Great Depression.

Stiglitz won the Nobel Prize in economics in 2001 for showing that markets are inefficient when all parties in a transaction don’t have equal access to critical information, which is most of the time. With so much excess capacity, the American economy faces a short-term threat of disinflation and possibly deflation, Stiglitz said. Wages may even decline, given recent high productivity and the likelihood of an extended period of high unemployment, he said. Longer term, he said the Fed’s aggressive monetary policy will mean inflation becomes the greater threat. "With the magnitude of the deficits and the balance sheet of the Fed having been blown up, it’s understandable why there are anxieties about inflation," he said.

While the Fed says it has the tools to deal with it, there are still concerns, Stiglitz said. Because monetary policy takes six to 18 months to have its full effect, the central bank will have to begin withdrawing monetary stimulus on the basis of forecasts. The Fed’s record on its economic forecasts isn’t enough to reassure investors and, as a result, the U.S. currency may suffer, he said. "Whether or not they’re able to do it, the uncertainty today about whether they can do it can contribute to the weakness of the dollar," Stiglitz said. "That’s one of the reasons there is increasing interest around the world in discussing alternatives to the dollar system."

Stiglitz, who is a member of a United Nations commission that will study the global financial system and currency regimes, said "the logic is compelling" for a new global currency. The current system creates instability, weakens global confidence, and is fundamentally unfair to developing countries that are in essence lending the U.S. trillions of dollars and bearing the risk, he said. "In most quarters, there is a feeling we should move away from the dollar system. The question is do we do it in an orderly way, or a chaotic way," Stiglitz said. "The size of the deficit and the size of the balance sheet of the Fed have just increased the anxiety and the desire that something be done."

While some think it would hurt the U.S. to no longer be able to borrow cheaply in dollars, "that era is over," he said. "We’re moving to a more multi-polar world." Between the fall of the Berlin Wall and the collapse of Lehman Brothers was "the short period of American triumphalism, where we dominated the global scene. That period is over," Stiglitz said.

Economic Recovery? What The Hell Are They Talking About?

They are telling us the economy is getting better and is already in recovery. It's like some cheerful pal is visiting a friend in the hospital. The poor guy's lying there deep in a coma, totally paralyzed, unconscious, every bone broken, and a well wisher walks in and shouts in the ear of the patient, "You look fabulous. Your toenails are still growing. That means you're on your way!"

But who are the people who are telling us we're in recovery? Who are they? The news anchors? The political pundits? Economists? Manufacturers jacked up on caffeine and already a nervous wreck about Christmas sales? The reptoid aliens lulling us all into a dizzy sense of false hope? Somebody must behind this blissful point of view. And if you don't see it, if for some reason you don't share this spoonful of Mary Poppins sugar, then what's wrong with you? Should you take an anti-depressant so you can get with it? Maybe you need Ambien to keep you asleep through what is proving to be the most profound transformation in American economic history any of us have ever seen.

I don't want to sleep through it.

I don't want to go broke either.

As far as I can see, the economy has not bottomed out at all. Pluto is going direct at zero degrees Capricorn the second week of September, and that is very likely to be a rude awakening for everybody who believed the old days were coming back and fell for the notion that we've seen the last of tough times. We are not, however, all on our way to Pleasure Island. You've got to step back and see the bigger picture. The direct motion of Pluto signals not only a fifteen year trend while in Capricorn, but a new ninety-five year trend in global economic policies and world political alliances we have not seen since the start of World War One. Think about that and draw your own conclusions.

Nobody can deny that unemployment and health care are certainly real concerns here in America, but they could actually turn out to be mere symptoms of a deeper and more serious unease underlying the collective psyche, and thus distractions from the enormity of the changes taking place in American societal values. In astrological clinical situations we constantly witness the fact that Pluto brings enforced changes. It's never voluntary. It's rarely pleasant, and it always involves tremendous displacement and discomfort wherever it transits. In Capricorn it engenders fear on the part of leaders that their authority is being undermined and their power put in jeopardy.

As a result they cling more fiercely to their positions. They pass their fear on to the people they govern, knowing full well that the way to control people is to make them afraid and give them the sense that only their leaders can protect them from calamity. For a long time the masses accept this parent-child relationship. The few dissenting voices are silenced or passed off as wackos and even traitors. Little by little, however, corruption begins to be exposed and those who were supposedly being protected, eventually feel that they are not being protected, but oppressed. A confrontation between the forces of order and chaos becomes inevitable. In order to maintain social order, those in the position to govern seek to control the masses even more, mainly because they know that a revolution can cause more chaos than any oppressive or unjust regime it overthrows.

We are heading toward such a confrontation. People aren't totally stupid. They know something is going on when stores are going out of business right and left and it costs twenty dollars to buy lettuce, tomatoes and mayonnaise they can't even make a sandwich with. On radio and TV they hear every day advertisements for those who are going to relieve them of their credit card debt, urge them to send in their gold for cash, promise quick cash for their homes to avoid foreclosure, and all sorts of seductive offers to give them the sense that somebody is going to save them.

For one thing there is nowhere to run and nobody is going to save you. This is not the moment to lift our eyes to a rainbow coming out of the clouds and walk toward it with glassy hope in our eyes. On the other hand, I'm not getting hysterical and heading for the hills with a generator and a hundred pounds of beef jerky. I feel hopeful, but only as I am willing to keep working my ass off. It's a period for grim determination and the knowledge that enlightened dedication is the key to prosperity. You have to know that you're going through it and you'll come out of it with no illusions that it's all behind you already.

In every market place, competition is going to be keener than it has ever been in our lifetime. If you are in the work force and have a product or service to offer, you have to throw yourself into it and make sure that product or service is unique, elegant and economical. That is the path to economic prosperity. People are going to demand quality again. They can no longer afford to buy, throw out and buy new. Unique, elegant, economical. Remember those three words. One more thing: Sooner rather than later you will have to take sides between those who refuse to yield to change and those who demand it.

Sinking Feeling

As Treasury Secretary Timothy Geithner headed off to London on Thursday for two days of meetings with central bankers and finance chiefs of the Group of 20 nations, he carried a letter outlining the Obama administration's plans to boost capital levels for banks around the world. Now, most people who haven’t been following this issue may scratch their heads and wonder, "Hasn’t this been done already?"

That’s an awfully good question. The financial system went into spasms last year, requiring a staggering bailout by the taxpayers, because major banks took reckless bets on derivatives and shaky mortgages—capital levels be damned. When the Titanic sank in 1912, it only took a few months for the U.S. and British governments to conduct inquiries and then to take action, boosting the number of lifeboats on sailing vessels. Heck, the U.S. Senate convened an inquiry within hours.

Yet here we are, a year later, and it’s hard to find much in the way of concrete steps to prevent a future apocalypse from taking place. A Pecora-style panel of inquiry has been created, but hasn’t done anything yet. And as for the root causes of the crisis, scant action has been taken. Geithner was quoted saying on Wednesday that boosting bank capital levels are "a critical part of making the financial system safer in the future." So why the delay?

Bank capital is just part of the picture. It’s far from clear that raising bank capital levels by itself will affect the behavior of banks. Surely it won’t be of much value if banks seek out loopholes—such as by playing around with off-balance-sheet structures—or if they simply act irresponsibly. What’s needed is a concerted effort to change the culture of both the banks and the regulators we rely upon to keep the banks honest.

Keep in mind that bank CEOs are fully aware of how much of a capital cushion they have at any given time, just as Captain Smith knew perfectly well how many lifeboats he had hanging off the boat deck. It’s now a matter of historical record that Bear Stearns CEO Alan Schwartz, and his predecessor James Cayne, failed to raise a sufficient amount of capital, despite pleas by insiders, long before the bank went belly-up. Likewise, Lehman Brothers CEO Dick Fuld was so hyperfocused on short-sellers like David Einhorn that he failed to keep a proper inventory of his financial lifeboats.

While all this was happening—while two major banks were behaving like overgrown hedge funds—regulators were asleep at the switch. The Securities and Exchange Commission not only failed to push these two banks to increase their capital levels but also seemed oblivious to the whole thing. After Bear Stearns collapsed, SEC chairman Christopher Cox told the Senate Banking Committee that Bear Stearns had a "capital cushion well above what is required to meet Basel standards…up to and including the time of its agreement to be acquired by J.P. Morgan Chase." Capital, he pointed out, is not synonymous with liquidity, and not a full measure of a bank’s financial health.

I think that Cox was downplaying his agency’s mismanagement of the financial crisis. But I’d agree with him to this extent: A capital cushion is not synonymous with responsible, ethical management, particularly when regulators like Cox lack a proper grasp of what is going on. That’s where the "corporate culture" of regulators comes into play.

A good example of the deep-seated problems there emerged on Wednesday, in a damning report by the SEC Office of Inspector General on the Bernard Madoff scandal. The OIG report is a recitation of serial incompetence, inexperience, and, at times, downright cowardice—SEC officials visiting Madoff, being alternately charmed and bullied by him, and failing to take the most elementary steps to ensure that an adequate investigation was conducted. The SEC’s incompetence was not solely a failing of the Bush administration, but reached back into the 1990s, when Arthur Levitt, a self-proclaimed "investor champion," chaired the SEC.

It’s impossible to imagine an FBI white-collar investigation being handled quite so grotesquely. The reason is that the FBI, whatever its other failings, is geared toward the handling of "bad guys." To the SEC, however, the people it regulates—the Madoffs and Dick Fulds and Alan Schwartzes of this world—are "industry giants," politically potent friends, and, of course, potential employers. This is what is known as "regulatory capture."

That attitude, unfortunately, persists not just at the SEC but among all regulators, including the Federal Reserve and the Treasury, where ex-New York Fed chief Geithner has a history of being far too close to Wall Street. Radical action is needed, led by the federal government, to change the behavior of Wall Street. Safeguards need to be put in place to prevent banks from taking risks that put the economy in jeopardy—and the penalties need to be draconian. It will require a tough attitude, more steely J. Edgar Hoover-like confrontation and less Chris Cox-style cluelessness. Boosting capital levels is a start, and a weak one. Leaving it at that is a recipe for yet another disaster.

Where is the pent-up demand?!?

by David Karsboel

Please tell me!

Yes, we respect the momentum in stocks. Yes, we can see the stimulus – both monetary and fiscal. Yes, there might be "cash on the sidelines". Yes, frightened fund managers might be chasing their benchmarks. Yes, the recession has been long and deep. Yes, housing has become so much cheaper. Yes, earnings have already dropped a third. Yes, we can!

But please tell me where the pent-up demand is? Show me how the roasted demand-pigeons will fly into the mouths of the priced-for-perfection equities. The rally in equities seems to imply that Western consumers have set aside thousands of dollars and Euros in every one of the bubble years. But if that is the case, why are they continuing to default on their debt obligations? Indeed, why are they spending less and less and paying off more and more of their debt? Why are "cure rates" (i.e. the share of delinquent mortgages that begin generating cash again) on even prime mortgages collapsing? According to the Fed, 6.49% of all US bank loans and leases are now delinquent - the most since 1985, when data began.

To me, it looks like the consumers have finally hit the wall where there is essentially no pent-up demand left. After decades of systematic and constant demand stimulation via artificially low interest rates and the emergence of the "demand-driven economy" (as if there ever was any such thing!), we have succeeded in borrowing so much from future demand that our present GDP has

been overstated by 10-30%. How many resources have been put to use in order to make American consumers push their excessive debt-financed consumption to new highs? How many malls, shopping centers, financial intermediaries, debt extension companies and SUV dealers have been set up for which there is no long-term use? And by how much has that overstated prior GDP figures, since these types of companies were mal-investments and need to be written off?

Pent-Up Demand

There is no fixed definition of pent-up demand – the demand that Keynesians assume will be released if rates are cut enough – but if we assume that it consists of the last two years of savings and the home equity, the following picture emerges:

Note, how much pent-up demand policy-makers could unleash in 1982 by cutting rates or taxes. The total pool was more than 250% of GDP. Today, as a result of persistently low savings rates and massive home equity extraction, the total pool of pent-up demand is below 100% of GDP – and only rising due to a higher savings rate in recent quarters. In other words, the pent-up demand by this definition has never been lower since 1960.

This is why the Keynesian central bankers can’t sleep at night: Their eternal demand-stimulation does not work any longer. The pent-up demand is non-existent (by historical standards) and therefore cannot be released, even if rates are aggressively cut. Total bank lending has dropped almost 6% from the top in late October 2008. That has never happened before. The picture is the same in the Eurozone and (of course) in Japan:

Bank credit is being reduced because de facto insolvency is widespread in the financial system and because there is no effective demand for new credit. As long as consumers are frightened of being laid off, the savings rate will stay high and probably approach the level of the 60s and 70s. Too many consumers have become painfully aware of how much they have depended on credit lines from the bank system and how much that means in today’s world.

Demand is going to disappoint

The Keynesians never get tired of telling us that 70% of GDP is consumption. This is obviously a misleading statement – as if we can consume ourselves rich. If we want growth in the Western economies, this percentage has to come down and investment and savings should be higher. This is the only long-term solution to the extreme difficulties that we are confronted with. Only by growing our capital base will we be able to increase production and growth. It is time we learn from the Chinese or simply look in the history books and be inspired from how the economy of our ancestors could grow even though they didn’t consume 70% of their income immediately.

The future economy of the Western countries will be investment-driven – if driven at all. Unfortunately, it also means that the companies that are most dependent on consumption will be underperforming in the years to come. Demand is permanently impaired and will not come back to 2007 levels soon.

Lehman downfall triggered by mix-up between London and Washington

A breakdown in communications at the highest level between the US and the UK led to the shock collapse of the investment bank Lehman Brothers in September last year, a Guardian/Observer investigation has revealed. The downfall of Lehman, which triggered the biggest banking crisis since the Great Depression, came after a rescue bid by the high street bank Barclays failed to materialise. In London, the Treasury, the Bank of England and the Financial Services Authority all believed that the US government would step in with a financial guarantee for the troubled Wall Street bank.

The tripartite authorities insist that they always made it clear to the Americans that a possible bid from Barclays could go ahead only if sweetened by US money. But in Washington, the former Treasury secretary Hank Paulson has blamed Lehman's demise on Alistair Darling's failure to let Washington know of his misgivings until it was too late. Paulson has told journalists that during a transatlantic phone call the chancellor said he was not prepared to import the American "cancer" into Britain – something Darling strongly denies.

With finance ministers and central bank governors from the G20 countries meeting in London on Saturday, the first-hand accounts of those handling last year's events underline a rift between London and Washington over who was to blame for the demise of Lehman, which triggered a month of mayhem on the financial markets. Lehman's demise sent shock waves around an already fragile financial system and raised fears that any bank, anywhere in the world was vulnerable to collapse. Within three days, HBOS had been rescued by Lloyds TSB. A month later RBS, HBOS and Lloyds were propped up with an unprecedented £37bn of taxpayer funds.

Hector Sants, the chief executive of the Financial Services Authority, said: "I have sympathy for the US authorities given the complexity of the problems they faced that weekend but I do believe it was a mistake to let Lehman's fail." As well trying to find a solution for Lehman, the US authorities were also aware that Merrill Lynch was on the brink and that weekend it was taken over by Bank of America. While admitting the UK authorities had botched Northern Rock a year earlier, Sants said the collapse of Lehman had more dire consequences. "Without the future market shock created by Lehman Brothers' collapse, RBS may not have failed," said Sants.

"Was Lehman the cause or was it the manifestation? It was our view that if Lehman had been supported you would not have seen such a dramatic reduction in liquidity." Sir John Gieve, deputy governor of the Bank of England last September, said: "It was a catastrophic error. It caused a loss of confidence in the [US] authorities' ability to handle the financial crisis which really did change things and proved hugely costly." The UK tripartite authorities – the FSA, the Bank of England and the Treasury – had expected the US government to stand behind Lehman in the way that it had backed two crucial mortgage lenders the previous week and helped to orchestrate the bailout for Bear Stearns in March.

No explanation has ever been given for the lack of government funds offered in the final weeks of the Bush administration, which had to step in to prop up the insurance company AIG days after Lehman's demise. The UK tripartite authorities were concerned about the financial system in the spring of 2007 and asked their American counterparts to participate in a "war game" to prepare for the collapse of a major US bank and develop a response to a financial crisis. However, the war game, which was to have included the UK, Switzerland, the Netherlands and the US, never took place because of a lack of willingness to participate by the US regulatory bodies.

Turning up the heat on non-bank lenders

by Elizabeth Warren

We know that big banks need reigning in, but Elizabeth Warren argues that it is time for serious oversight of non-bank lenders — like mortgage brokers or payday loan outfits — as well. A strong, well-funded CFPA would not only protect consumers from the abusive practices of these largely unregulated businesses, but it would also benefit the small banks that are hurting from the current system.

The big banks are storming Washington, determined to kill the Consumer Financial Protection Agency (CFPA). They understand that a regulator who actually cares about consumers would cause a seismic change in their business model: No more burying the terms of the agreement in the fine print, no more tricks and traps. If the big banks lose the protection of their friendly regulators, the business model that produces hundreds of billions of dollars in revenue — and monopoly-size profits that exist only in non-competitive markets — will be at risk. That’s a big change.

But there is an even bigger change in the wind: regulating the non-banks. Democrats and Republicans alike agree that the proliferation of unregulated, non-bank lenders contributed significantly to the financial crisis by feeding millions of dangerous financial products into the economic system. Non-bank institutions were active participants in the race to the bottom among lenders. From subprime mortgage loans to small dollar loans, they showed how to wring high fees and staggering interest rates out of consumer lending. Their fine-print contracts, and new tricks and traps, transformed the market.

Despite widespread agreement about the problem, the U.S. has never made a sustained, systemic effort to regulate non-bank lenders. As lending abuses became more obvious, there was no effort to close regulatory gaps and loopholes or to devote federal resources toward the oversight of non-bank institutions. The reasons are many, but one of the most benign explanations is that policymakers for too long assumed that states could deal with the non-banks because the non-bank lenders are often small and often operate locally (although Countrywide showed that state-based organizations can metastasize rapidly). As it turns out, the states actually faced several limitations in reining in these lenders.