Thirteen-year old sharecropper boy near Americus, Georgia

Ilargi: The US administration is trying a new approach to patching up the broken land it rules over. While it moves away from universal health care, it now aspires to turn itself into a landlord. And a big one. I'd say that's about halfway towards the Bulgaria model, an yardstick I've used on a regular basis to measure where we stand. In the heyday of the Sofia empire, all Bulgarians were renters. But they did have free health care, though probably not at the level of France or the Netherlands.

Personally, I don't think the choice is the best possible one. I know from personal experience how much of a weight a community provided health care system lifts off people’s backs. Of course, calling it "community provided" doesn't sound nearly as ominous as provided by "big government". That whole storyline about "big government" gets more distorted by the day anyway. The American government appropriates at least as much money from its citizens as for example the German one. At least. A $14.8+ trillion US stimulus bill so far leaves no doubt about that. The main difference is that where US taxpayer money is handed to corporations, the Germans use the money their citizens pay in taxes to alleviate the problems those same citizens find themselves in, whether it's through health problems, job losses or other causes. Take your pick.

Obama said a few days ago that Canada's health care system wouldn't work in the US. I didn't see him elaborate on that. Might be interesting if he would. But it's apparently already too late. If you're still inclined to cut him some clack, you can say he fought the -corporate- law and the law won. Which is very bad news for most Americans. If they don't yet understand why, they will soon enough. Accidents and illnesses are mostly plenty bad, thank you very much, even if they don't bankrupt you and your family in the bargain. In the US, though, that's a common feature of the system. Medical bills are still -by far- the single largest cause of US personal bankruptcies. In Western Europe, the very idea would be impossible, unheard of and considered unacceptable.

In a better political system than it has at present, the US government would stay away from the housing market. There is no better one, though. In a system so proud of the free market moniker, government policies, paid for with taxpayer money, have ironically been greatly perverting domestic real estate for decades through Fannie and Freddie, transferring ever larger profits from US citizens to its banking conglomerates, culminating in 2005 highs and having only onw way -down- to go from there. All under the guise of helping the less wealthy acquire that much vaunted humble abode for themselves. Myths tend to die hard.

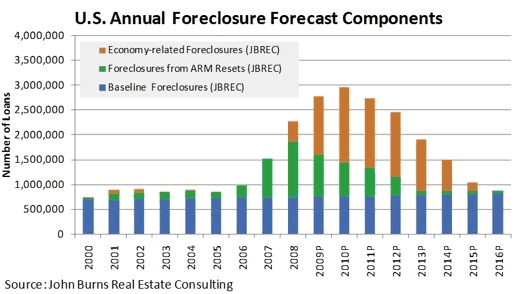

This practice has now led to its own logical and inevitable conclusion: the "less wealthy", the middle class, have today become the new poor. Don't worry, you're next in line. Like so many other great looking ideas, this one also works only in times of growth. If growth stalls, it turns against its maker, very much in the same way the sorcerer's apprentice did. We already know that a minimum of 4 million homeowners will receive foreclosure filings this year. Many of these will indeed lead to repossessions. And there is no end in sight to the tidal wave of people being forced out of their homes, the wave is gathering strength.

You would think someone in the Oval Office would consider the idea of dramatically overhauling a system that has so bitterly failed a nation and its people. But you would be wrong to think so. There is too much to hide, to much to gain for some, and too much to lose for all the rest, and those who stand to lose -and gain- the most have a very firm grip on power. They won’t let go till their hands are long gone, bitterly cold and eerily lifeless.

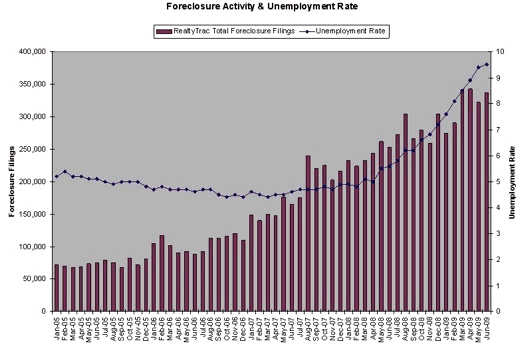

Ultra-low interest rates predictably lead to a few more sales, as do all sorts of modification plans and purchase subsidies. All serve to superficially improve a few numbers. But you don't need to look at projected foreclosure numbers for more than two seconds, if that, to understand what is in the offing, especially if you also realize the strong connection between foreclosures and job losses, and if you're aware of present unemployment numbers.

The average unemployed American is close to exhausting his/her 26 weeks of initial benefits, the present number is 25.1 weeks and rising. Think about that for a moment, please, and then realize how fast that number goes up. In the next 4 months, 400.000 people each and every single month are set to exhaust even all of the hastily improvised extended benefit initiatives. Yes, you saw that right. That's 5 million of them on an annual basis. People who've been without a job for more than 52-79 weeks, depending on which state they live in. and these also are fast rising numbers, heading for the gutter without hardly being registered by the mainstream economic radars that have so far this summer focused exclusively on rising stock markets.

If that doesn't spell Bulgaria to you, you probably need a dictionary.

Washington has gotten the message, though, and new plans are being put into place. Stealthily and under that same radar, of course. There will be a momentous shift in the residential mortgage loan and securities markets, from Fannie and Freddie to the seemingly virgin Ginnie Mae. It will come with a greatly increased role for the FHA (Federal Housing Administration), as well as in all likelihood the FHLB (Federal Home Loan Banks) and the great -and greatly failing- supervisor FHFA (Federal Housing Finance Agency).

These are agencies with largely unblemished records, yet large "growth possibilities". Ideal for the purpose. Keep the game going at all cost. If Washington would withdraw from the housing market now, home prices would revert to levels that people can actually afford. I don't know if you ever heard of a thing named "supply and demand", but you can look it up in the same dictionary, at the other end of where you found "Bulgaria". Supply and demand, or free market principles, if they were applied to the US real estate market today, would instantly bankrupt all of Wall Street, plus a few thousand smaller banks, plus Fannie and Freddie, and the parade wouldn't stop there. In other words, the entire economy is held together by the government taking money from its people and their children, and using it to prop up a financial system that guarantees those same children will not be able to afford a home of their own.

Let's be clear: there is no legitimate reason for this shift other than the, of necessity temporary, preservation of the existing banking system, which holds tens of trillions of dollars in lost racetrack wagers in its books. Fannie and Freddie, who've been buying any and all loans offered to them recently, have such stunning losses on their books, transferred to them (i.e. the taxpayer) by the banks, that something needs to be done lest someone somewhere smells too many dead rats.

Rest assured, it is being done. The GSE losses, which will run in the trillions of dollars, remain largely hidden so far, and won’t be revealed till the new system is in place, and even then only piece by piece, to prevent too many people from having a seizure and/or a pitchfork. This, like so many others, is a problem that's only getting worse, and fast. Default rates on more recent loans outdo those on older ones by large margins.

In order to prep the new regime, a bunch of "key" people are being replaced. In short time period, James Lockhart resigned as head of the FHFA, while Ginnie Mae president Joseph Murin quit after just one year. Ginnie, incidentally, has -alongside the FHA- behind the scenes already taken on a portfolio approaching $1 trillion. Mind you, that's only in government guarantees for mortgage securities, Ginnie's "core business".

In order to ever have a healthy economy and society again, one in which people don't need to constantly and consistently blandly lie to each other's faces, books, ledgers and balance sheets have to be dug up, opened and exposed to daylight. Losses have to be paid off, bets have to be settled, and cheaters have to be run out of town or locked in the county jail. It is something that cannot be avoided, it will one day happen no matter what.

Unfortunately for the common man, the less wealthy middle class which will wake up to find themselves relabeled as the newly poor, or the Formerly Well Off, all and any efforts of the entire political and financial class over the past few years have been geared towards hiding reality from reality, and towards putting $14.8 trillion worth of lipstick on a bunch of pigs so long deceased their meat is way beyond any date safe for human consumption.

And we now know there's more to come. Lipstick on Ginnie. And for millions of Americans: no job, a rental concrete slab, no health care. What do you think the chances are you're going to wish you were born in Bulgaria? Don't answer too fast. Think it over.

PS: As always when I refer to the Bulgaria model, I have nothing against that country or its people. I'm merely using it as a metaphor.

Shanghai Stocks Lead Fall, Drop 5.8%

Shanghai stocks lost 5.8% Monday, suffering their biggest percentage drop so far this year, as lower commodity prices, persistent worries over tightening in bank loans and weak economic data dampened investor sentiment. Hong Kong shares were weighed by the performance in China as well as a steep fall in U.S. stock futures and commodity prices. In Tokyo, exporters were dragged down by the yen's strength as risk-averse investors bought the low-yielding currency in search of a perceived safe haven.

"The U.S. fall on Friday helped to reduce the risk appetite for speculators holding Asian assets, said Ben Collett, head of cash equities at TFS Derivatives. He added, "What we're seeing is guys getting a little risk averse and cutting their losses." China's Shanghai Composite index posted its biggest percentage drop since November and ended at 2,870.63, its first close below 3,000 since the end of June. In Shenzhen, the main stock index dropped 6.6% to 955.87, while Hong Kong's Hang Seng Index skidded 3.6%, led by a slump in China-related stocks.

Metals stocks were hit hardest, with Angang Steel and Yunnan Copper dropping by the day's 10% limit in Shenzhen, while Aluminum Corp. of China and Jiangxi Copper dropped by as much in Shanghai. Sentiment was also hurt after Yunnan Copper reported a loss for the first half of the year. "The large gains in (China markets in) the first half recreated a bubble in the market, so when the government showed signs of tightening bank credit there's a selloff," said Zhang Yong, an analyst at Great Wall Securities.

The drop coincided with data showing foreign direct investment into China slumped 35.7% to $5.36 billion in July from the year-earlier period. Foreign direct investment flows for the first seven months of the year were down 20.3% compared with a year earlier, noted Moody's Economy.com economist Sherman Chan. "As the central government is determined to achieve the annual growth target of 8%, policymakers may have to step up efforts to boost momentum in coming months," she wrote in a report.

Japan's Nikkei Stock Average of 225 companies ended down 3.1%, Australia's S&P/ASX 200 ended 1.6% lower, South Korea's Kospi ended down 2.8% and India's Sensex was 4.1% lower. Taiwan's Taiex ended 2.0% lower, while New Zealand's NZX 50 lost 2.1%. Dow Jones Industrial Average futures were recently down 163 points in screen trade, adding to the late selling pressure in the region. The Sydney stock market performed relatively better, with Fortescue Metals up 2.9% after it struck an iron ore price deal with China. The pact is the first China has made in protracted iron ore price negotiations, and the China Iron and Steel Association said that talks are ongoing with other iron ore miners. It hopes the pact with Fortescue will be followed by other miners.

Data showing Japan's second-quarter gross domestic product registered its first quarterly growth in five quarters, did little for the Tokyo markets. GDP grew 0.9% from the quarter before, compared with a 1.0% rise tipped in a Dow Jones Newswires poll of economists. Royal Bank of Scotland economist Junko Nishioka, however, noted that capital expenditure by Japanese companies dropped for a fifth straight month. "As corporate free cash flow decreases, we expect capex to continue to contract throughout the year," said Ms. Nishioka. "Given exports started to slow down in June, especially to China, and household consumption is quite fragile due to the deterioration in the labor market, we believe GDP will slow in Q3 and beyond. In addition, the effect of the economic stimulus packages is likely to gradually diminish."

Among Japanese exporters, Sony Corp. lost 4.1% and Toyota Motor Corp. gave up 2.7%. Among commodity-related companies, BHP Billiton lost 3% and Rio Tinto shrank 4.8% in Sydney, Tata Steel shares dropped 6.8% in Mumbai trading, Inpex gave up 4.8% in Tokyo and Korea Zinc Co. shed 5.9%. The September Nymex crude oil futures contract was down $1.71 at $65.80 per barrel. On Friday, the surprise drop in the latest survey of U.S. consumer confidence triggered a selloff in oil futures, with Nymex crude losing $3.10 to $67.51 per barrel, breaking out of the $68-$70 range it's held since the start of August. Spot gold prices gave up $12.04 to $935.20 a troy ounce.

Base metals prices were lower across the board, mirrored by falls in crude oil and equities and strength in the U.S. dollar, raising concerns that this time the correction could be deeper and more extended than recent mild sell-offs.

London Metal Exchange three-month copper was at $6,057 a metric ton, down $183. On the Shanghai Futures Exchange, the benchmark November copper contract settled down 4.8% at 47,880 yuan a metric ton. LME three-month nickel broke support at $19,000 and was down $1,075 at $18,500 on heavy volume. Taiwanese stocks were weighed by worries of rising bad debt and insurance payouts because of damage and casualties from heavy floods in the southern part of the island. Waning optimism over improved trade between Taiwan and mainland China also pulled shares lower.

The South Korean market was being pulled lower by weaker-than-expected U.S. consumer sentiment data released Friday, said Lee Sun-yup at Goodmorning Shinhan Securities. KB Financial was down 4.8% and Samsung Electronics shed 2.5%. Korean Air was down 5.1% on news of Korea's first H1N1 deaths over the weekend. In Mumbai, concerns over the impact of poor monsoon rains were in play, dragging shares of tractor maker Mahindra & Mahindra down 5.3%, motorcycle maker Hero Honda Motors 5.9% lower and consumer products major Hindustan Unilever down 2.7%.

Singapore's Straits Times Index was down 3.3%, while Philippine shares were 2.8% lower. Thailand's SET Index dropped 2.9%. Markets in Indonesia were closed for a holiday. In foreign exchange markets, the yen was stronger against the euro and the U.S. dollar. Hiroshi Maeba, a senior dealer at Nomura Securities, said Japan's GDP result had little impact on the yen was it was largely in line with expectations. He expected the dollar to be biased lower against the Japanese currency in thin trade this week, because U.S. consumer sentiment data introduced more uncertainty over the pace of the global economic recovery, to the benefit of the safe-haven yen.

After Dow's 42% Run, Roadblocks Looming

Now that economic indicators and credit markets are returning to levels seen before Lehman Brothers melted down in September, some investors are starting to wonder what is keeping the stock market from getting there, too. In one example of the economy's resilience, the Institute for Supply Management index of manufacturing activity is within a whisker of where it was in August 2008. Even risky high-yield bonds have recovered all the ground they lost. Yet the Dow Jones Industrial Average's rally of 42% since March 9 still leaves the blue chips down 18% from 11421.99 on Sept. 12, the last trading day before Lehman tumbled into bankruptcy and Merrill Lynch was sold to Bank of America. After closing Friday at 9321.40, the Dow is 34% below its all-time high close of 14164.53 in October 2007.

Stocks have roared back from their bottom in March with ease, shrugging off the recession and unrelenting loan losses at banks. That combination of momentum and psychology could carry stocks back to pre-Lehman levels soon. Holding onto that ground, much less another upward jolt that carries stocks to new highs, will likely be much tougher, many market watchers contend. Some suggest the market could be stuck in a holding pattern until 2011. "In order for the stock market to deserve to go back to pre-Lehman levels, we need to see a lot of growth," says Ben Inker, director of asset allocation at GMO, a Boston asset-management firm, "and it's just not clear where that growth is going to come from in the near term."

One potential roadblock is corporate earnings. The rally since March has come in two distinct legs, each driven at least partly by companies beating very low profit expectations through aggressive cost-cutting, even as revenues fell. Second-quarter earnings inspired a July-to-August rally that broke stocks out of a monthlong trading range and raised hopes that the way was clear for them to soar even higher. Now the rally seems to be sputtering, particularly after last week's disappointing data on July retail sales and August consumer sentiment reinforced doubts about consumer spending.

"Significant earnings recovery will be difficult to accomplish without a more robust consumer than we currently have," says Rich Hughes, co-president of Portfolio Management Consultants, a Chicago firm managing more than $7 billion in assets. And if it takes years for corporate profits to return to precrisis levels, as many observers predict, it probably will take the stock market about that long to get there, too. Companies in the Standard & Poor's 500-stock index are on track to post combined per-share earnings of $59.59 this year, according to Thomson Reuters. That would be 28% lower than their 2007 earnings of $82.54 a share.

While the 26% profit surge expected in 2010, giving the 500 big companies combined earnings of $74.90 a share, would be impressive considering the doom and gloom of the past year, analysts don't expect earnings to reach a new high until 2011. Companies in the S&P 500 are projected by analysts to earn $91.39 a share in 2011, or 11% higher than in 2007. The S&P 500 index now trades at a relatively cheap 13 times 2010 earnings, appearing to give it more room to rise. But that optimism assumes analysts aren't being irrationally exuberant about the pace of profit recovery.

For instance, the financial sector likely won't soon regain its old strength in any sustainable way. Credit losses still are piling up, and the amount of leverage available to supercharge bank profits is substantially lower than at the height of the credit bubble. In 2007, financial firms generated roughly a third of the S&P 500's overall earnings. Shell-shocked consumers are widely expected to stick to the frugality they adopted after the bubble burst. That poses a hurdle for the economy and corporate profits beyond the inventory-rebuilding bounce expected in the second half of this year. "I asked all of our senior analysts when they see earnings in their sector getting past their prior peak," says Barry Knapp, head of U.S. portfolio strategy at Barclays Capital. "I didn't get a single analyst to tell me it would happen in 2010."

While a lackluster stock market would frustrate bulls, some strategists warn that bears shouldn't expect a big market swoon. So far, stocks have shown amazing resilience in the face of bad news, and a stubborn refusal to put in a major correction of 10% or more. One reason could be the residual skepticism about the recent rally and future earnings. That always excites contrarians, who cling to the old saw that stock markets climb walls of worry. "Negativity is a welcome sign," says Ryan Detrick, senior technical strategist at Schaeffer's Investment Research in Cincinnati. "It lowers expectations, and then when they are beaten, the market keeps trucking higher." Partly for that reason, Mr. Detrick figures the S&P 500 could get back to its pre-September level of about 1250 within six to nine months.

Of course, there is always the risk of a big swing in either direction. September and October can be perilous months for stocks, and analysts cite rising foreclosures and disappointing economic data as potential triggers for the correction bears have been waiting for. There also could be sudden rushes to the upside. Central banks around the world still have their monetary floodgates open. Trillions of dollars sitting in money-market accounts might be pushed back into the market if investors increasingly worry about missing out on the rally.

A wave of stock buying would be cheered by investors still dreaming about their portfolios fully recovering from the past year's damage. But another rally could dissipate just as fast if the fundamentals don't keep up, many experts say. "We could have a run-up because of momentum, but you've got to look through it to the underlying economy," says George Feiger, who oversees $1.3 billion as chief executive of Contango Capital Advisors, a subsidiary of Zions Bancorp., a regional bank based in Salt Lake City. "The world is not ending, but it is far from repaired."

Foreign Direct Investment in China Fell 35.7% in July

Foreign direct investment in China fell for a tenth straight month in July as companies stalled expansion plans amid the global financial crisis. Investment declined 35.7 percent from a year earlier to $5.36 billion, the Commerce Ministry said at a briefing in Beijing today. That compared with a 6.76 percent drop in June. The situation for foreign direct investment in China remains "severe" even as "positive signs" have emerged in the past two months, Vice Commerce Minister Fu Ziying said last week. Japan emerged from its worst postwar recession in the second quarter, the Cabinet Office said today in Tokyo, and a Bloomberg survey of users shows confidence in the world economy surged to a 22-month high in August.

"This is a reflection of global overcapacity and the earlier credit squeeze," said Ben Simpfendorfer, an economist with Royal Bank of Scotland in Hong Kong. "The monthly data is very volatile." The detention of four Rio Tinto Group staff since July 5 may weigh on business investments in the country, U.S. State Department spokesman Philip J. Crowley said Aug. 13. The four were formally arrested on charges of trade secrets infringement and bribery, China’s Supreme People’s Procuratorate said Aug. 11, according to a Xinhua report. Australia’s Prime Minister Kevin Rudd said July 15 that the world was "watching closely" how China handles the case.

China’s economy will expand 9.4 percent this year, topping the government’s official 8 percent target as a 4 trillion yuan ($585 billion) stimulus and record bank lending spurs growth, Goldman Sachs Group Inc. said last week. Growth rebounded to 7.9 percent in the second quarter, after slowing to 6.1 percent in the first, the weakest pace in almost a decade. In Asia, Singapore and Hong Kong emerged from recessions last quarter, as did Germany and France in Europe. "China’s FDI is still healthy compared to the global slump in investments," said Commerce Ministry spokesman Yao Jian at today’s briefing. "We can say that China is one of the most attractive places for investments."

Chances Dim for U.S. Public Health Plan

The Obama administration gave its strongest signal yet that it would be willing to compromise on plans to expand the government's direct role in health-insurance coverage as it fights a growing crescendo of opposition to its effort to overhaul health care. Health and Human Services Secretary Kathleen Sebelius said Sunday that a new, government-run, health-insurance program wasn't the "essential element" of any overhaul plan.

Robert Gibbs, the president's press secretary, said President Barack Obama wants "choice and competition" in the insurance market. Mr. Obama "has, thus far, sided with the notion that can best be done through a public option," or government-run plan, Mr. Gibbs said Sunday on CBS's "Face the Nation." However, he said the bottom line is simply that "what we have to have is choice and competition in the insurance market." A day earlier, President Obama defended the public option at a town-hall meeting in Grand Junction, Colo., while leaving the door open to alternative approaches that expand coverage and reduce costs, but don't increase the federal deficit. The public option, "whether we have it or we don't have it, is not the entirety of health-care reform," Mr. Obama said. "This is just one sliver of it, one aspect of it."

The comments come after a bruising two weeks in which the president's call for a public plan to "keep insurance companies honest" has been interpreted by Republican opponents and some members of the public as a push to drive private insurers out of the marketplace. Insurance companies have fought a public plan, objecting specifically to one that would use the government's buying power to negotiate rates. The worry is that hospitals and doctors would charge private companies more to make up for being underpaid by the government. Concerns have also been raised that insurers would be unable to compete with such a plan, and that the public option would be a precursor to national health care.

The implications for consumers of nonprofit health-insurance cooperatives, one alternative way to help individuals and small businesses get coverage, are unclear. Much will depend on how and how quickly the co-ops can organize -- a daunting task that could involve setting up the equivalent of new insurers on a state or regional basis. The savings wrung from this extra competition could help cash-strapped patients, though it is unlikely that the co-ops would bring prices down as significantly as the government could.

Obama administration officials have indicated before that they could support a health-care overhaul without a government-run insurance option. "Nothing has changed. The president has always said that what is essential is that health-insurance reform must lower costs, ensure that there are affordable options for all Americans and it must increase choice and competition in the health-insurance market. He believes the public option is the best way to achieve those goals," Linda Douglass, communications director for the White House's health-reform office, said Sunday.

But as the debate over Mr. Obama's ideas for a health-system overhaul grows more shrill, proponents have indicated willingness to drop some controversial elements in order to get a plan passed. Aides to Senate Minority Leader Mitch McConnell (R., Ky.), an opponent of the public option, labeled Ms. Sebelius's comments a "shift" on the issue in an email pointing out various occasions on which President Obama had said a health plan should include a public option. Some liberal advocates interpreted the administration's position as a shift in emphasis, but not away from the public option. Mr. Obama wants to "broaden the conversation so people understand that health-care insurance reform is bigger than just one element," said Jacki Schechner, spokeswoman for Health Care for America Now, a grass-roots campaign for health-care reform.

Ms. Sebelius's comments come as some senior Democrats in the Senate are urging the administration to give up on the idea of a public plan run directly by the government. The House has already passed a bill with a robust public option. But House Democrats might be reluctant to vote for a final bill that includes a government-funded plan -- exposing themselves to attacks from the right -- if the White House appears willing to bargain that away too quickly.

The insurers set to breathe the biggest sigh of relief if the public plan is dropped are Wellpoint Inc., which operates Blue Cross and Blue Shield plans in 14 states, and the dozens of other not-for-profit Blue plans across the country.

They are currently the biggest sellers of individual health policies, the kind that would compete with new public or co-op plans. Companies such as Aetna Inc. and Cigna Corp. have less to lose from a public plan as they market mostly to employers. Robert Laszewski, a consultant at Health Policy & Strategy Associates, said nonprofit co-ops aren't necessarily an easy victory for insurers, though. If they don't work down the road, and the government has to bail them out, they might be a precursor to a stronger government role in health care, he said.

He pointed out that the barriers to entry for new insurers are high: They need to set up information-technology infrastructure, build networks of providers and raise significant capital to hedge against catastrophic claims. A co-op that doesn't navigate those challenges smoothly runs the risk of being shunned by potential customers. America's Health Insurance Plans, the lobbying group that represents the industry, is also cautious about the idea of co-ops, saying it hasn't seen any details on how such a system would operate. Robert Zirkelbach, a spokesman for the group, said that reforms the insurers have proposed -- such as accepting patients with pre-existing conditions -- are enough to fix the health-care system. "If we do those things, a government-run plan -- including a co-op -- is not necessary," he said.

President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an "ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities. The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

Analysts say the approach takes a wrecking ball to Bush’s heavy emphasis on encouraging homeownership as a way to create national wealth and provide upward mobility for low- and working-class families, especially minorities. Housing and Urban Development Secretary Shaun Donovan’s recalibration of federal housing policy, they said, shows that the Obama White House has acknowledged that not everyone can or should own a home. In addition to an ideological shift, the move is a practical response to skyrocketing foreclosure rates, tight credit, and the economic crisis.

"I’ve always said the American dream should be a home - not homeownership,’’ said Representative Barney Frank, chairman of the House Financial Services Committee and one of the earliest critics of the Bush administration’s push to put mortgages in the hands of low- and moderate-income people. Conservatives, however, believe that President Obama and HUD shouldn’t head too far in the other direction; in some cases, rent can be more expensive than a mortgage payment. Done properly, they say, homeownership can bolster the tax base and bring stability to neighborhoods and families, reducing crime and helping people achieve financial independence.

The $4.25 billion set aside for the creation of rental housing will come from $14 billion that HUD has received from the federal economic stimulus package. Another $4 billion of the money will be used to fix up the nation’s existing public housing stock of 1.2 million units. The funds for new units will be available under competitive grants, and officials in Massachusetts said they will be among the states aggressively competing for the money. In Boston, more than 20,000 households are on a waiting list for affordable rental housing, said Lydia Agro, a spokeswoman for the Boston Housing Authority. "There’s definitely a need out there,’’ she said.

City, state, and federal officials said they could not yet estimate how many new rental units will be created with stimulus money, but HUD said the "tens of thousands’’ of apartments and town houses it will produce nationwide will ease an increase in homelessness that has resulted from the foreclosure crisis. Carol Galante, HUD’s assistant secretary for multifamily housing, said HUD will still be in the business of helping people buy homes using existing lending subsidies.

The difference from the Bush administration, she said, is "we’re trying to have a balanced policy. We’re not trying to say homeownership isn’t important, because it is. But we have to be sure we’re helping people get into homes that are sustainable for them.’’ RealtyTrac, a private company that follows homeownership trends, reported Thursday that the number of foreclosure notices issued to homeowners nationwide increased 9 percent during the first half of 2009. At the same time, the US Census Bureau reported that the vacancy rates for homeowner housing nationwide crept up for the second consecutive quarter, further signs of the ongoing mortgage crisis. The foreclosures are displacing large numbers of families, who will need new housing.

"People who were owners are going to be renting for a while,’’ said Margery Turner, vice president for research for The Urban Institute, a Washington think tank that studies social and economic policy.

"There is a housing stock that is sitting vacant. There is a real opportunity here’’ to use those homes as rental property and solve both problems, she said. In addition to the stimulus money, Obama’s budget also seeks $1.8 billion for the construction of rental housing, the same amount that Congress approved in the last year.

David John, a senior analyst at The Heritage Foundation, a conservative policy center, said it remains to be seen whether the Obama administration’s decision to step away from the Republican administration’s "ownership society’’ will have a positive effect on minorities and the working class. John said the benefits of homeownership are greater than just building equity in a house. For example, he said, children of parents who own homes do better in school. "There’s more stability in the family and overall an improvement in society,’’ he said. "Usually, homeownership brings with it a sense of building towards the future, rather than living day to day.’’ Still, he said, renting is better than putting a family in a house that it cannot afford. "It’s a mixed bag,’’ he said.

In the past few weeks, Donovan, the former housing commissioner in New York City, has embarked on a series of cross-country trips to cities like Seattle and Anchorage to highlight the federal stimulus money being used to build low- and moderate-income rental housing units. Donovan was unavailable for an interview. Bush made homeownership a signature issue of his tenure. In remarks before a panel discussion on promoting minority homeownership in 2002, Bush said America is "a nation of owners. Owning something is freedom, as far as I’m concerned.’’

But that vision disappeared over the last two years as the housing market plunged, leaving homeowners struggling under mortgages they could no longer afford for a home that was no longer worth what they paid. As mortgage defaults piled up, banks that made the risky loans imploded, helping trigger the global financial crisis. "This notion that a home was your source of wealth was a recent one,’’ Frank said. "People thought that prices would go up, and up, and up, and up.’’ Frank said he never bought the idea that Americans could keep borrowing to support higher and higher home prices. "My answer was, I wish I could eat more and not gain weight,’’ he said.

FHFA Report On Restructurings

by Bruce Krasting

The FHFA released a report on their refinancing activity for the year to date. As usual it was cast in glowing terms. It is clear that FHFA is doing something. In my view that ‘something’ is consistently the wrong thing. From the report:Washington, DC – Fannie Mae and Freddie Mac refinanced more than 2.9 million mortgage loans in 2009 through July of this year. Since the inception of the Making Home Affordable Refinance Program (HARP) in April, Fannie Mae and Freddie Mac refinanced almost 1.9 million mortgage loans through July.

A little clarity. This first paragraph reads as if the Agencies have addressed and restructured 2.9mm loans under the Harp program. That is not correct. Of the total of 2.9mm only 190k were under the HARP program. The balance were ReFi’s where the borrower got a lower rate and likely took some additional money in a cash out.

In the first seven months of the year Fannie and Freddie did all the ReFi's that they could at lower interest rates. During this period the D.C. lenders were 90% of the mortgage market. The opportunity to lower a mortgage interest rate had a very beneficial impact on those lucky borrowers. The claimed ‘savings’ of 1.3% on 2.7mm mortgages with an average balance of $200k comes to $7 billion a year. An effective stimulus for sure. But now the rates for mortgages have risen. On a mark to market basis those new mortgages are underwater. Because the folks at F/F do not have to bother with trivialities like mark to market there is no reported loss from this activity. But it will be a drag on future income for the next decade. We again follow a policy that steals from the future to pay for current excesses.

Anyone can make cheap loans. That is not success. This is a policy decision by the federal government to stimulate consumer demand. If F/F are tools of government policy their status should be resolved so that role can be debated. Making low interest rate loans and then having the Fed buy $1.25 trillion of these loans is a subsidy. It has a current and future expense. This needs to be understood and accounted for. Mr. Lockhart said. "Importantly, over 60,000 borrowers with mortgage loans that exceed 80 percent of the house value up to 105 percent have been refinanced. We are now seeing significant results from the HARP and the Home Affordable Modification Program (HAMP), but much more work needs to be done. I commend the Fannie Mae and Freddie Mac teams for helping drive this effort."

Historical data shows that the bulk of mortgage defaults occur when the borrower has a change of circumstance (illness, death of spouse, loss of job) and not high LTV loans. The Agencies are relying on this with these new high LTV loans. That is terrible policy. Up until 2007 there had never been a year where there were nationwide declines in RE values greater than 5%. So relying on old reasoning does not apply when prices can decline by 25% in just one year. The most significant cause for default today is that borrowers are ‘upside down’. When the Agencies make high LTV loans they put all of us at risk. High LTV loans have default rates in the 20%+ range. We need to stop policies that encourage defaults. Mr. Lockhart lauds these results. He is just writing a taxpayer check.

Under HARP, borrowers whose loan-to-value (LTV) ratio is above 80 percent up to 105 percent are able to refinance without added mortgage insurance requirements, a previous key barrier to refinancing.

The Charters of both Fannie and Freddie spell this out in their definition of Conforming Loans. It is simple. 80% LTV to a borrower who can demonstrate they can make the payments. Insurance industry lobbyists created a carve-out to this rule with Mortgage Insurance. This allowed F/F to buy 103% LTV loans and avoid their own restrictions. It has proven to be a disaster. The ‘enhanced’ loans are one of the largest contributors to the pool of busted mortgages. Now they are just waiving those Charter restrictions away. By what authority do they do that? Congress is supposed to be looking after this mess. Who is minding the store here? Is Barney Frank still involved with this? Is he writing taxpayer checks too?

Through July, Fannie Mae had refinanced 1.7 million loans. Of that total, approximately 138,000 loans were refinanced under the company’s DU Refi Plus and Refi Plus flexibilities that were put in place to support the HARP. Freddie Mac refinanced 1.2 million loans through July. Of that total, approximately 53,000 loans were refinanced under the company’s Relief Refinance program that was put in place to support HARP.

The 190k loans restructured under HARP guidelines are the problem loans. While FHFA crows about this success they fail to mention that they have a backlog of more than one million borrowers that are seriously delinquent. Nor do they mention that as many as 50% of these ReFi's will go back into default in less than six months.

The Federal Housing Finance Agency recently announced the expansion of HARP to allow borrowers with LTVs up to 125 percent to participate. Fannie Mae will begin accepting deliveries of refinanced loans with LTVs over 105 percent up to 125 percent as of September 1. Freddie Mac will begin accepting deliveries of these loans on October 1.

This is insane. No private lender in their right mind would make a 125% loan. These are just losses to be. The FHFA is perpetuating the cycle of default. They are making things worse, not better.

•••

The Federal Housing Finance Agency regulates Fannie Mae, Freddie Mac and the 12 Federal Home Loan Banks. These government-sponsored enterprises provide more than $6.3 trillion in funding for the U.S. mortgage markets and financial institutions.

The FHFA always ends its communications with this sentence. I do not know if they are proud of this number or whether they point this out to remind us of how powerful they are. No single entity should have this much exposure to the credit market. It defines systemic risk.

The Coming Foreclosure Wave

Has housing hit a bottom? Fox News declared that the bottom is in, as had many other talking heads.In fact, the reality of the situation is a "good news, bad news" scenario.

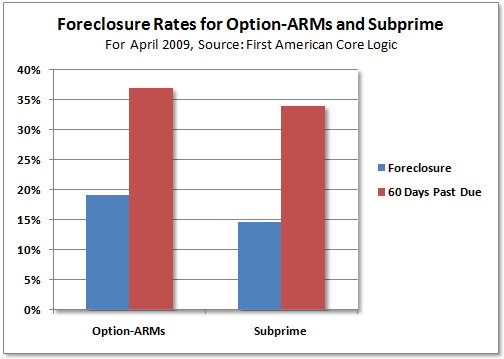

(Bloomberg) -- The wave of "option" adjustable-rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller than "feared" because many borrowers will default before their bills change, Barclays Capital analysts said.So you see, the coming tsunami of foreclosures will be much small than expected because much of the foreclosure wave will hit earlier.

The subprime crash is largely over, but the Option-ARM bubble was supposed to be spread out over many years.

Instead the Option-ARM mortgages are blowing up ahead of time. Why are they blowing up early? Because they are already underwater, and "negative equity is a necessary condition for foreclosure" according to the Boston Federal Reserve.

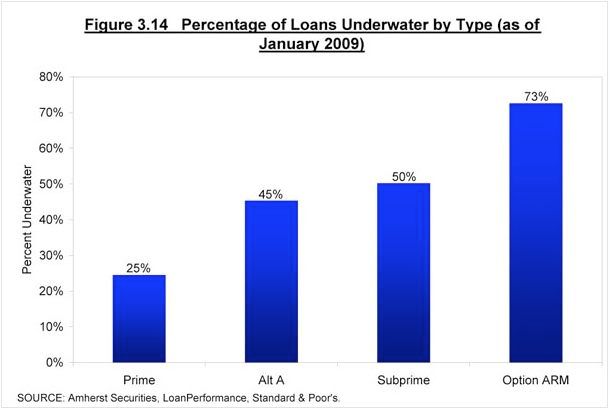

Option-ARM holders are the worst of the worst. While 24% of all mortgage holders are currently underwater, and that number expected to rise to 48%, Option-ARM borrowers are expected to peak at a number closer to 90%.

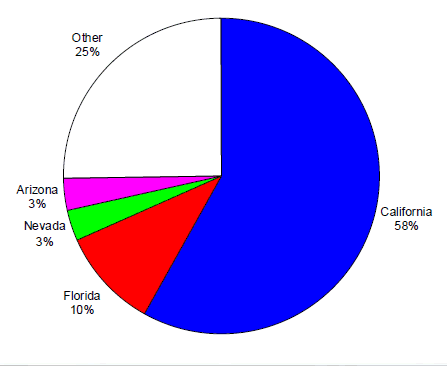

40% of Option-ARM borrowers are already delinquent. This is especially bad news for California, where an overwhelming percentage of Option-ARMs originated.

"The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock," the New York-based analysts including Sandeep Bordia and Jasraj Vaidya wrote.

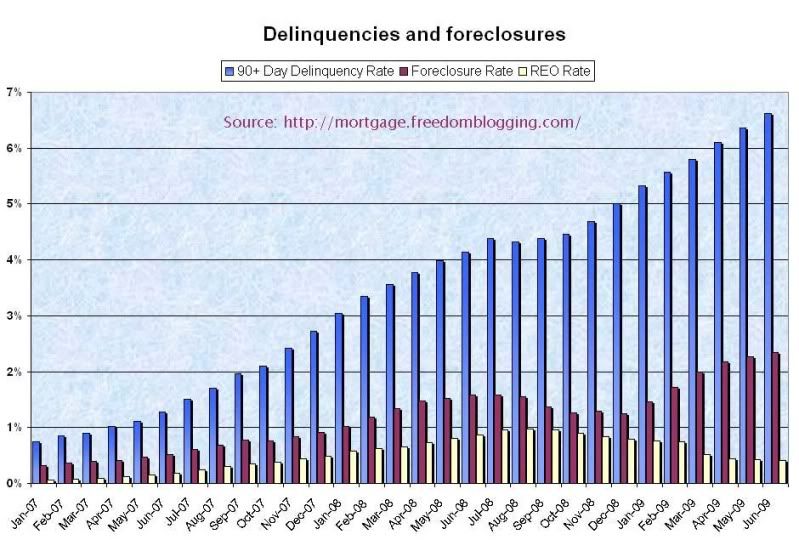

So what does the coming foreclosure wave look like and when will it hit? After all, foreclosures and foreclosure inventory is already at all-time highs.

"To say there is a second wave implies the (current) wave has receded. I don’t see that the wave has receded."

- Sam Khater, senior economist, First American CoreLogicAnother factor you must take into the coming wave of foreclosures is the high unemployment rate.

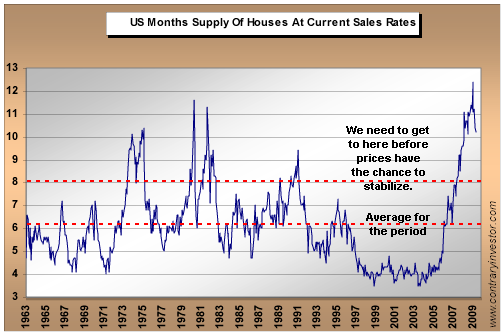

Another factor weighing on the housing sector is the near record level of inventory.

And that's only the official housing supply. The Shadow Inventory is far, far larger.

"The number of homes listed officially on the market, while still at historically high levels, might be only the tip of the iceberg," said Stan Humphries, chief economist at real estate website Zillow.com in Seattle, Washington.According to Zillow's latest Homeowner Confidence Survey, 12 percent of homeowners said they would be "very likely" to put their home on the market in the next 12 months if they saw signs of a real estate market turnaround, 8 percent said "likely," while 12 percent said "somewhat likely."

Survey results could translate into around 20 million homeowners trying to sell their homes, a startling number given that the Census bureau indicates there are 93 million U.S. houses, condos and co-ops, Humphries said.

According to the National Association of Realtors, the market is currently on track to sell 4.89 million homes annually.

"At this pace, it would take about four years to run through this amount of backlogged inventory," he said.

And if that wasn't enough, the banking sector has its own "shadow inventory" that it refuses to sell at this time because it can't afford to book the losses. Estimates are somewhere north of 600,000 homes.

Speaking of the banks, what effect will all these foreclosures have on them?

The Barclays analysts, who wrote that about 88 percent of option ARMs packaged into securities in 2007 will eventually default, said that after a rally in prices they no longer suggest owning related bonds, "a trade we have been recommending for months."

...

More than $750 billion of option ARMs were originated between 2004 and 2008 as borrowers used their low initial payments to afford higher-priced homes, according to newsletter Inside Mortgage Finance.All those losses that banks will eventually have to book one way or another, will take their toll on balance sheets. The Congressional Oversight Panel created to oversee the U.S. banking bailout, had this to say about the state of the banking system.

In its latest assessment of the $700 billion financial system bailout, the Congressional Oversight Panel warns that banks still hold many risky loans of uncertain value. If unemployment rises sharply or the commercial real estate market collapses -- as many economists fear -- the banking system could again lose its footing, the panel says in a report to be released Tuesday.No mention of Option-ARMs, but then maybe no one wants to talk about it.

Treasury puts Fannie and Freddie under renewed scrutiny

Lawmakers need to renew Treasury's ability to buy Fannie assets by December

Almost one year after Fannie Mae and Freddie Mac were effectively nationalized in the midst of an expanding economic crisis, policymakers in Washington have still yet to come to a conclusion about what to do with the quasi-governmental mortgage giants. This has Republican lawmakers steaming about the companies, which they believe should be reformed right away. Democrats -- including those in the White House and Treasury -- have put the issue off until after their current bank restructuring endeavor is completed, which in itself is a momentous undertaking that is only scheduled to be wrapped up by year-end.

"Fannie Mae is something we will take seriously, study and take our time and come back to folks next year," said Treasury Assistant Secretary Michael Barr. Nevertheless, with the Obama administration's bank regulatory reform proposals out the door, key Treasury Department officials can begin thinking about expanding on options for the entities it released in June guidelines. Possible reform ideas involve nationalization, privatization and a series of hybrid approaches.

The mega-institutions became a symbol of the financial crisis when they were taken over by the government in a conservatorship in September as the crisis expanded. Government regulators took over Fannie Mae and Freddie Mac because they believed their collapse would have had an even more wide-ranging explosive impact on the markets than the failure of Lehman Brothers. Fannie and Freddie purchase whole loans, and package them as a means of ensuring that capital is available to banks and other financial institutions that lend money to home buyers. They either hang on to the mortgage securities or sell them to investors with a government guarantee.

So far, Fannie Mae has received $34.2 billion in taxpayer-funded bailout money, while Freddie Mac has received $51.7 billion. Taxpayer investments may go up as defaults on home mortgages swell. It's unclear how high their losses will be but the government recently expanded a regulatory limit of $100 billion in losses the entities will accept to $200 billion each. Nevertheless, there are growing reasons to reform the entities, which have become almost the sole provider of mortgage financing in the United States. Legislation approved in 2008 gave the Treasury the authority to purchase Fannie Mae and Freddie Mac securities through Dec. 31, 2009.

Christopher Whalen, director of Institutional Risk Analytics, said he expects lawmakers to draft legislation extending this authority, which would allow the government's conservatorship of the entities to continue through 2010. The debate about what to do with troubled assets of Fannie Mae and Freddie Mac is part of a broader discussion about the two mortgage giants. Charles Horn, partner at Mayer Brown LLP in Washington, said there are calls for the government to reduce the size of the entities, perhaps by requiring that they wind down their assets over a period of time. One possible approach to achieve this would be to create a "bad bank" taking hundreds of billions of dollars of Fannie Mane and Freddie Mac bad loans off their books. The bad bank would seek to collect as much of the debts as possible.

Fannie Mae securitized roughly $94.6 billion of whole loans held for investment in its mortgage portfolio in the second quarter of 2009. It had total non performing loans of $171 billion as of June 30, up from $144.9 billion in March and $119 billion in December. A second part of this approach, which is one of many under consideration by the White House, would be to privatize by creating new quasi-governmental corporations or "good banks" that would resemble the old entities with public offerings that accept private equity and debt investments.

However, Whalen doesn't believe restoring their previous hybrid quasi-public-private status is in the cards. "I think losses at Fannie and Freddie will be so high in both of these entities that by the time we get into next year, Congress won't be interested in privatizing Fannie and Freddie," Whalen said. "I cannot imagine a rational argument to have private equity investors in these entities. The only role for private capital should be in bonds."

However, Dwight Smith, partner at Alston & Bird LLP in Washington, said there are advantages with a public model - in particular funding from shareholders and creditors -- if it can be structured in a way that limits the possibility that their collapse could cause massive damage to the markets. Smith argued that a public model with a government guarantee could work if Fannie and Freddie were dissolved into many smaller public companies, a prospect that is also under consideration by Treasury.

"If Fannie and Freddie were to have failed, that would have thrown the entire residential market into incredible turmoil," Smith said. "However, if you have ten or twelve smaller Fannies, then, if one of them were to fail, it doesn't mean that the others would fail as well. If investors know they can't rely on government to bail out a mini-Fannie that would restore market discipline."

However, Whalen said that a more useful approach would be to merge Fannie and Freddie, as many expect to happen, and create a Ginnie Mae type structure out of the entities, known as Government Sponsored Enterprises. Unlike Fannie and Freddie, which buy whole mortgage loans and mortgage securities from financial institutions, Ginnie Mae only provides government guarantees for mortgage securities. The agency currently guarantees $771 billion in mortgage securities and it has guaranteed roughly $2.9 trillion in assets since its inception in 1968.

Whalen argues that having a Ginnie Mae type entity is important because it creates a secondary market for banks by giving them an option have their mortgage securities receive a government guarantee. Before Fannie and Freddie become a Ginnie Mae type entity they would need become smaller, which would happen "if the government is disciplined" and pays off the massive debts that exist to support their retained portfolios of loans and securities. A substantial size reduction is necessary, Whalen added, because it would limit their "too- big-to-fail" quality.

However, Smith argues that such an approach would limit Fannie and Freddie's flexibility in the mortgage market. By only guaranteeing mortgage securities and not whole loans, a new consolidated Fannie and Freddie could hurt struggling smaller financial institutions that rely on the entities to prop the market for whole loans. "Originators who now sell whole loans to Fannie or Freddie would be left out, leading to further industry consolidation," Smith said.

Smith added that he was worried that an entity that only guarantees high quality mortgage securities would not be in a position to limit the fallout from a financial crisis, unlike the Treasury's current program that includes purchases of subprime mortgages and problematic mortgage securities. "Treasury purchases would have a smaller impact," Smith said. Treasury also may restructure Fannie and Freddie into public utilities, where government regulates their profits, sets fees, and provides guarantees for their assets.

The approach has pro's and cons. Smith said that with a utility model, regulators could prevent abuses in advance in a way that the current model can't. "In this environment, mortgage lenders have shown that when they compete they do a bad job and impose billions of dollars in costs on taxpayers. The government needs to be sure that this business is managed much more closely and on a day to day basis," Smith said. "However, a utility model would represent the most intrusive government regulation of all the options and would reduce the flexibility of lenders to offer mortgages."

Will Ginnie Mae be the next shoe to drop?

The more things change, the more they stay the same. You might think that with all the government take-overs and financial industry failures that the practices that lead to the near total collapse of the mortgage industry have been weeded out. Not so. The practices are simply being performed by the government rather than the private sector.

When you get a mortgage, it is often guaranteed by a third party. It could be private company or a federal agency like the FHA. The mortgages are bundled into a pool and investors can buy shares in the pool. To sweeten the deal, a fifth party enters the deal and guarantees payments to these investors. If you don't pay your mortgage, the mortgage is covered by the mortgage guarantor and the investor is covered by the mortgage backed security guarantor. The idea is to minimize the risk to the loan originator while providing them capital through investors, whose risk has also been greatly removed. In theory, the fees charged by the intermediaries would cover the cost of backing up the loans.

This is fine when defaults are in the 2-4% range. When they get higher than that large "institutional players" (the intermediaries) go under water. If it's a private company, it goes out of business or is taken over by the government. The government might also arrange for another private company to take it over. In the case of a government agency, they simply go to Congress, the Fed or the Treasury for more cash. The system works great for loan originators and investors, but with default rates at 7% and higher, the intermediaries have gotten clobbered. The private sector can't do it anymore. This is why the taxpayer now owns Freddie Mac, Fannie Mae, AIG and others who are "too big to fail". Actually they are only "too big to fail" if you intend to perpetuate the status quo, which is exactly what's happening.

The government's solution, under both Bush and Obama is to cut out the middle man and just take the losses directly to the taxpayer. Ginnie Mae writes guarantees for FHA and other government agency backed mortgages. The down payment requirement for FHA backed loans is 3.5% and there's no credit score requirement. Ginnie Mae now has almost 18% of the agency backed mortgage bond market. Their portfolio has doubled in just over two years and is expected to grow by another 30% over the next year. Sub-prime lending and trading hasn't gone away. It's being consolidated and your money is funding it.

Home Prices: There's No Quick Recovery Ahead

So, is our long national nightmare over? Has the housing market finally hit bottom? There has been some muted -- albeit exhausted -- cheering from homeowners in recent weeks. But before we break out the champagne, look out for further potential problems just down the road. The good news? According to the closely watched Case-Shiller Home Price Index, which tracks home prices across 20 major cities nationwide, the three-year housing slump slowed sharply in April and May.

May's decline was just 0.2%, the slowest in two years. And several cities actually saw prices rise -- among them Denver, Washington, D.C., Chicago, Boston, Cleveland and Dallas. Even Miami only fell about 1% in May. That's a great month down there. Previously, prices had been falling 3% a month. We'll get an even better picture of the situation when the Case-Shiller figures for June are released on Aug. 25. But these data aren't the only hopeful signs. Inventories of unsold homes have come down. According to the National Association of Realtors, there were about 3.8 million unsold homes on the market at the end of June. That's down a long way from 4.5 million a year ago.

And yes, housing affordability is dramatically better. People, obviously, need to live somewhere. At some point, housing gets cheap enough that the fundamentals start to look good. The average home is about a third cheaper than it was at the peak three years ago, a plunge unprecedented since the Great Depression. In the hardest-hit places, such as Phoenix, Las Vegas and Miami, average prices have been halved or better from their bubble peaks. Factor in falling mortgage rates as well, and housing starts to look cheap by many measures. Thirty-year mortgage rates, at around 5.5%, are still low by historic standards. A few months ago, when they fell below 5%, they were very cheap.

There's some other good news for homeowners from the rest of the economy. July's job losses were better than feared: The unemployment rate, which was heading vertical a few months ago, eased to 9.4% last month from 9.5%. Some are saying the worst is behind us, for the economy and the housing market. No wonder the iShares Dow Jones U.S. Home Construction exchange-traded fund (ITB), which tracks shares of home-building stocks, has bounced sharply since early July. So, is that it? Not so fast.

Prices may -- may -- be nearing the bottom in many markets. But beyond the headlines, there are plenty of reasons to stay cautious. There may even be fresh dangers just ahead. And even if prices have stopped falling, it may be years before they start rising sharply again. First, late spring is traditionally the strongest season in the real-estate market. And it's hardly a surprise the market saw some green shoots this time around. It's enjoying not one, but two, gigantic taxpayer subsidies -- an $8,000 refundable tax credit, or gift, for first-time buyers, as well as those cheap mortgage rates. The Federal Reserve has been spending billions of dollars to keep interest rates down.

Both are only short-term fixes. Any sustained economic upturn would be expected to send long-term mortgage rates rising again, dousing the real-estate market with fresh cold water. The picture on inventories isn't as good as it sounds, either. A lot of unsold homes have simply been put up for rent instead, especially in the most difficult markets like Miami. The result? A glut of empty rentals as well. New waves of foreclosures and distressed sales may be coming, too. In states such as California, it can take many months for delinquencies to turn to foreclosures, which means last winter's bad news may still be coming down the pike. Meanwhile, vast tranches of teaser-rate mortgages are due to reset later this year and in 2010.

As for the economy: Both unemployment and household debt levels remain at extremely high levels by the standards of postwar history. Either is bad news for housing. The combination is very bad. Dean Baker, co-director of the Center for Economic and Policy Research, argued in a recent paper that the fundamentals still aren't great. It still remains cheaper to rent than to own in many markets, he says. The biggest bubbles usually produce the deepest busts. And the 2002-2006 bubble was a doozy. The bad news may have ended after three terrible years, but maybe not. Japanese housing prices still haven't recovered from the late 1980s bubble. Western U.S. markets took six or seven years to recover after the last big bubble burst there in the early 1990s.

Yes, there are some hopeful signs, but don't let them fool you into thinking it's all clear. It might not be. As ever, anyone making a major financial decision needs to think more about his or her own situation than what "the market" is doing. A real-estate purchase needs to make sense on its own terms. And measure it on cash flow today, not the hope for capital gains tomorrow. When you factor in all the costs, is the purchase cheaper than renting? If you get a cheap mortgage and you are aggressive on price, you may get a bargain. That's especially true if the owner has to sell. Foreclosures and other distressed sales are selling for about 20% below the rest of the market. There are opportunities out there. But you can afford to take your time to shop around.

Housing Markets Won’t Recover Until Employment Does

Splinters of good news spurring optimism and a broad market rally over the past few months are also surrounded by various weak indications that the U.S. economy is not quite on a path of sustainable recovery-despite what is perceived by the capital markets. For example, as news across the pond pointed to the end of a recession in France and Germany on Thursday, another dip in retail sales (a monthly decline of 0.1% for July, leading to a 9% y-o-y decline) on top of a record number of homes receiving a foreclosure filings in July reminded us that we are still surrounded by a very weak economy. More importantly, the July labor report continued to indicate a bleak employment landscape in our opinion.

As various housing indicators continue to come in ahead of expectations, we remain primarily focused on the employment situation as the principal driver of the housing markets-affecting both demand and supply. Unemployed consumers can not buy homes, and protracted unemployment makes it difficult to service mortgages which can lead to forced sales or foreclosures, events that add to the current high level of unsold home inventory.While low home prices, a large supply of foreclosures, various government interventions and low mortgage rates may make buying a home more attractive, rising unemployment and stricter lending standards continue to deter any significant rise in demand.

On top of the optimism spurred by various home sales and price data that have come out over the past month, the unemployment report for July did show some "better-than-expected" numbers indicating that the employment decline has slowed. However, as our strategy team discussed in its analysis of the Bureau of Labor Statistics July Employment Report on Friday, there are many ways to look at the numbers and in the end people are still losing jobs-suggesting that housing demand will remain weak and mortgage delinquencies and foreclosures will continue to rise higher.

Credit card issuers have the last laugh

New pro-consumer credit card regulations issued by the Federal Reserve begin taking effect this Thursday, and the so-called Credit Cardholders Bill of Rights that Congress adopted to its own, self-congratulatory applause last spring will roll out early next year. But if you think the playing field between cardholders and credit card issuers is about to be leveled, I suggest you check your mailbox.

Last week, I was among hundreds of thousands of American Express cardholders who received letters disclosing what at first appeared to be good news. "We are pleased to let you know that we will not charge you a fee if you go over your credit limit," the letter said. The bad news, the unsigned notice added, is that AmEx is simultaneously hiking the interest rates it levies on purchases, cash advances and balances that have a penalty rate because of a late payment. And, oh yes: The onetime fee imposed on such late payments is going up, too.

I took all this philosophically, since I have neither exceeded my credit limit, made a late payment, carried a balance or even used the card in question for nearly a year. If recent news reports are correct, and I continue to lay off the plastic, AmEx will soon penalize my parsimony by canceling my card altogether, without notice to me, as it is lawfully entitled to do. The Wall Street Journal reported last week that AmEx, Bank of America, Citigroup and other major issuers all have been canceling card accounts, with no detailed explanation and with no advance notice to cardholders, in anticipation of new federal constraints on their fees and practices.

The timing of AmEx's latest mailing is hardly accidental. After the Federal Reserve regulations take effect this week, cardholders will be entitled to 45 days notice before an issuer can raise their interest rates, reduce their credit limits, or make other substantive changes in the terms of their agreements. Nothing in AmEx's letter suggests the company's decision to stop levying a fee on cardholders who exceed their credit limits is anything but a beneficent gesture toward the company's loyal customers.

But while legislation Congress adopted in May doesn't specifically outlaw the fees AmEx is rescinding, it does mandate that such fees be reasonable and proportional and bar issuers from imposing them unless cardholders ask permission to exceed their credit limit and agree to the penalty up front. AmEx seems to have concluded that, under those circumstances, it is more cost-effective to scrap the fees altogether. After all, the company can always make up the lost revenue by arbitrarily raising interest rates.

It might have been different if a majority of the federal lawmakers who adopted the Credit Cardholders Bill of Rights had been as interested in protecting consumers as they were in creating the impression that they were standing up to rapacious banks. But the one provision that might have given cardholders some real protection -- a cap on the maximum interest rate credit card issuers could charge, similar to the ceiling on what federal credit unions can charge their borrowers -- was rejected when it came to a vote in the U.S. Senate.

Michigan's junior Democratic senator, Debbie Stabenow, was among 60 senators who nixed the interest-rate cap proposed by Vermont independent Bernie Sanders. (Michigan's other senator, Carl Levin, supported it.) Stabenow said she worried that any limit on credit card rates would leave millions of households with no access to unsecured credit. Her mistake was assuming that issuers would wield their power more responsibly if they got their way on interest rates.

In the end, card issuers preserved both their right to charge whatever the market will bear and their right to abruptly cancel a cardholder's credit without advance notice. If that's your idea of a resounding victory for consumer rights, I've got a bridge I'd like to sell you. I'll even lend you the down payment.

Deadline looms for Guaranty Financial bids

US banking regulators have asked prospective buyers of Guaranty Financial, a struggling Texas bank with $14bn in assets, to submit bids for the group by Monday, according to people close to the matter. The Federal Deposit Insurance Corporation is helping to manage the attempted sale of Guaranty, which last month said it was likely to join the lengthening list of banks that have failed this year. Guaranty’s fate has become intertwined in recent weeks with that of Colonial Bank, an Alabama-based bank that was forcibly closed on Friday and largely sold to BB&T, another regional bank, in an FDIC-backed deal.

The FDIC, which is juggling failing banks around the US in an effort to minimise the fallout to consumers, had initially wanted to resolve Guaranty’s problems before Colonial’s by arranging a sale of Guaranty, which is struggling under the weight of burgeoning losses on homebuilder loans and mortgage-backed securities. But regulators’ concerns over Colonial’s instability recently overtook their worries about Guaranty, because of Colonial’s deteriorating credit quality and its role in two federal investigations, so regulators contacted bidders and asked for offers for Colonial last week.

Regulators have been hoping that three banks that had bid for Colonial – Canada’s Toronto Dominion, JPMorgan and Spain’s BBVA – would step in instead as bidders for Guaranty. People close to the matter said TD and JPMorgan had expressed interest in Guaranty, which has also drawn interest from other regional banks.

Guaranty’s assets were not seen by banking experts as a direct substitute for Colonial’s higher-quality commercial banking assets, but Guaranty’s strong presence in Texas could draw interest from bidders. At least one private equity consortium, which includes Blackstone, Carlyle, Oak Hill Capital, TPG and Gerald Ford, is considering a bid for Guaranty. The FDIC, however, has long made clear that it prefers other banks as buyers of troubled financial institutions rather than private equity firms. Heading into the weekend, the private equity firms had not been given access to Guaranty’s confidential financial data.

Failed Banks Weighing on FDIC

Banks in the U.S. that failed in the past two years were in far worse shape than those that collapsed during the industry's last crisis, a looming problem for the government agency charged with insuring deposits. At three of the five banks that failed Friday, increasing the total to 77 so far this year, the financial hit to the agency's deposit-insurance fund is expected by the Federal Deposit Insurance Corp. to be about 50% of their assets.

The biggest hit on a percentage basis is coming from Community Bank of Nevada, a Las Vegas bank with $1.52 billion in assets and an estimated cost of $781.5 million. The failure of Colonial Bank, a unit of Colonial BancGroup Inc. that was sold to BB&T Corp., will cost $2.8 billion, or 11% of the Montgomery, Ala., bank's assets. For the 102 banks that have collapsed in the past two years, the FDIC's estimated cost averaged 25% of assets. That is up from the 19% rate between 1989 and 1995, when 747 financial institutions were closed by regulators, according to the FDIC.

The agency's insurance fund already has dipped to $13 billion, with more than 300 battered banks and thrifts still on an undisclosed FDIC list of problem institutions. One problem is that so many banks took risks when the economy was booming, and are seeing their capital dissipate with alarming speed. "Compared to the savings-and-loan crisis, banks these days have gotten much bigger and the economy has gotten much bigger," said Bob Patten, an analyst at Morgan Keegan & Co. "This crisis won't eclipse the last one in size, but the costs to the FDIC are showing the amount of leverage they really had on their books."

Regulators also have been blamed for not taking quick enough action and for allowing zombie banks to limp along. Inspectors general at the Treasury Department and FDIC, which serve as watchdogs, have issued more than a dozen reports that conclude regulators dithered while banks they oversaw plowed ahead with rapid and unsteady growth. "When you get these failing banks, they are much more like a fresh-caught fish than a fine wine. They don't get better with age and the losses keep piling up." said Bert Ely, a longtime banking-industry consultant.

Integrity Bank, of Alpharetta, Ga., was permitted to keep luring deposits paying unusually high interest rates for more than two years after examiners noted deficiencies in its loan underwriting, according to the FDIC's inspector general. Integrity failed last year, costing the FDIC $295 million. The FDIC's response to the report about Integrity noted that "greater concern for Integrity's loan administration and underwriting weakness identified could have led to earlier supervisory action."

As the number of bank failures escalates, FDIC officials have been trying to find investors and buyers for terminally ill financial institutions, increasingly by agreeing to shield acquirers from certain losses on assets of the failed bank. The FDIC and BB&T entered into a loss-share transaction on approximately $15 billion of the $22 billion in Colonial assets bought by the Winston-Salem, N.C., bank. FDIC Chairman Sheila C. Bair said in a statement that losses from Friday's failures "are lower than had been projected."

Fed Extends TALF Program Through June for New Commercial Loans

The Federal Reserve extended by three to six months an emergency program aimed at restarting credit markets, a move that may cushion the commercial real- estate industry from rising defaults and falling prices. The Term Asset-Backed Securities Loan Facility, with a capacity of as much as $1 trillion, will expire June 30 for newly issued commercial mortgage-backed securities, instead of Dec. 31, the Fed and U.S. Treasury said today in a statement in Washington. For other asset-backed securities and CMBS sold before Jan. 1, the plan was extended three months to March 31.

Chicago City Government Closed For Business On Monday

If you planned to check out a library book, visit a city clinic or have your garbage picked up on Monday, you're out of luck. The City of Chicago will basically be closed for business on Aug. 17, a reduced-service day in which most city employees are off without pay, according to a release from the Office of Budget and Management. City Hall, public libraries, health clinics and most city offices will be closed. Emergency service providers including police, firefighters and paramedics will be working at full strength, but most services not directly related to public safety, including street sweeping, will not be provided, the release said. That also includes garbage pickup. Residents who receive regular collection on Mondays should expect trash to be picked up the following day, the release said. Some other customers may experience a one-day delay as collectors catch up.

As part of the 2009 budget, three reduced-service days were planned for 2009, days which are unpaid for all affected employees -- the Friday after Thanksgiving; Christmas Eve; and New Year's Eve. The City Council recently approved moving the reduced-service day planned for New Year's Eve to Monday. The 2009 budget anticipates saving $8.3 million due to the reduced-service days. In addition to reduced service days, all non-union employees were asked to take a series of furlough days and unpaid holidays, and most non-sworn union employees agreed to similar unpaid time off. "Every dollar we save from these measures helps to save jobs, and in the long-term, maintain services for Chicagoans," Mayor Daley said in the release. "This plan relies on most of our civilian employees to be part of the solution to our very serious budget challenges. I want to thank them again for their sacrifice."

There's a sign on the door of a city clinic in Englewood telling patients all Chicago health offices will be closed Monday. A lot of residents CBS 2 interviewed didn't know about the partial government shutdown. It came as bad news to Denzel Thornton, a student at Chicago State who visited the library Sunday to find out it will be closed Monday. "Where am I supposed to go now?" he asked. "I have no other place to go. I don't have a computer of my own, so this is the only public place I can go to do what I need."

But for city workers like Marx Daniels, the day off is a mixed blessing. "I never took a day off, and I've never been late, so now the reduced days seem pretty good, you know," he said. Tomorrow the boots, shovels and jacket he uses while excavating and cleaning city sewers will sit at home. But he's happy to trade a day off here and there if it means keeping his job. "At first … I didn't think that I could live with it, and then when I found out the alternative was being laid off, I thought it was a good thing," Daniels said. Daniels will lose a little over $200 dollars for each reduced services day. And he says that can add up. "With me having two kids in college, that one day makes a difference," he said.

Social Security crunch coming fast

by Bill Fleckenstein

The debate over health care has captured everyone's attention, but it appears the next big government program that needs to be addressed will be Social Security. That's the focus of the July 30 article "The next great bailout: Social Security" by Allan Sloan, Fortune's senior editor at large. Those who've been paying attention have long known there is no money in the Social Security Trust Fund -- it's all been spent. Thus, former Vice President Al Gore's famous assessment that Social Security receipts should be placed in a "lockbox" was actually correct.

Given that so few people really understand the Ponzi nature of the current Social Security financing scheme -- created in 1983 by a commission chaired by none other than the world's greatest serial blower of bubbles, Alan Greenspan -- I decided to reprise Sloan's article. (The Social Security problem is especially important because it likely will put additional pressure on the dollar and on bonds, and exacerbate the funding crisis down the road.) The story begins: "In Washington these days, the only topics of discussion seem to be how many trillions to throw at health care and the recession, and whom on Wall Street to pillory next. But watch out. Lurking just below the surface is a bailout candidate that may soon emerge like the great white shark in 'Jaws': Social Security.