Washington's Leader Theater: Now playing: The serial "Invisible Ray"

And, from 1916, Douglas Fairbanks in "The Americano" and a short called "The Return of Draw Egan."

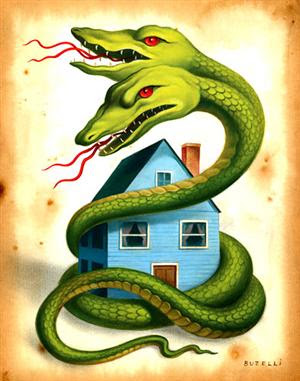

Ilargi: Perhaps this is a way to explain the global financial situation that will grab people's attention. Total wealth in the UK fell by $1.2 trillion in the past year, or $2 million per minute.

If we suppose that the US economy is five times as large as the UK, American wealth has declined by about $6 trillion, or $10 million per minute.

Every single minute, day and night, for a whole year. And the losses continue. And accelerate. Inflation, anyone?

Credit crunch wipes $2 million a minute from British wealth

The credit crunch has wiped a total of £600bn – more than £1m a minute – from the UK's total wealth since it started a year ago, according to accountants PriceWaterhouseCoopers.

Their analysis focuses on the impact of lost wealth in housing and the collapsing share values of financial firms, the sectors that have been most severely affected by the credit crisis. In broad terms, the PWC estimates that it comprises a loss of £400bn in residential property and £200bn on the stock market valuations of the banks and other financial institutions.

This level of wealth destruction, says PriceWaterhouse-Coopers, is expected to lead to around £12bn to £16bn of lost expenditure over the coming year as these negative stock market and housing wealth effects filter through. Such asset price deflation leaves households with less equity to withdraw from their homes, less collateral to borrow with and smaller pension pots, all of which will affect spending patterns.

Depressed markets also create a "feel poor" effect that further inhibits spending. PWC calculates that the loss to GDP is about 1 per cent, which couldbe sufficient to push the UK economy close to or into recession, with household spending growth slowing to only 0.5 per cent over 2009.

This remarkable destruction of wealth is sure to have been mirrored around the world, and will have also have struck larger economies, such as the United States, harder still, in turn driving global trade and growth trends lower.

John Hawksworth, head of macroeconomics at PWC, commented: "The fall in UK house prices... has driven down the level of wealth tied up in UK housing by around £400bn, representing a 9 per cent fall in the value of the UK's housing stock".

Mr Hawksworth added that the stock market loss had been "around £200bn" and concluded that the £600bn loss would "add to downward pressures on UK economic growth over the next year". PWC says that its perspective is "conservative", and that this is its best case scenario, excluding the impact and likely spill-over of other important related sectors, such as commercial property and commercial paper.

I.O.U.S.A.

A private-equity billionaire, a former federal government official and a Baltimore newsletter editor have made a documentary film that they hope can do what an endless parade of policy papers has not: Convince Americans that debt has created a looming economic crisis that would make the Great Depression look like a market correction.

The movie, "I.O.U.S.A.," debuting Aug. 21, is an 87-minute alarum on what it calls the tsunami of debt bearing down on the United States' future, caused by the rising national deficit, the trade imbalance and the pending costs of baby boomers cashing in on entitlements.

Early reviewers have dubbed the film "An Inconvenient Truth" for the economy, meaning it's not exactly the feel-good movie of late summer 2008. Except for budget wonks in love, it hardly counts as a date movie. The film's thrilling action sequence has a guy going to a refrigerator for a Tab. There are no car chases and nothing blows up. Except, possibly, for the entire economic future of the U.S.

"I.O.U.S.A." offers up as its action hero David Walker, former head of the Government Accountability Office. With movie-star looks that scream "accountant" rather than "Terminator," Walker has been the Cassandra — or Chicken Little — of America's growing deficit for some time.

Last August, he compared the U.S. to the final days of ancient Rome, which he said was militarily overextended and fiscally irresponsible. Since 2005, Walker has been traveling the country on the catchy-sounding "fiscal wake-up tour," preaching his apocalyptic message to half-empty rooms, at least at the start. The tour picked up steam after Walker's message was featured in a "60 Minutes" piece in March 2007.

In March of this year, Walker resigned from the GAO so he could be even more vocal on the debt crisis, becoming chief executive of the newly formed Peter G. Peterson Foundation, set up by Peterson, billionaire co-founder of the Blackstone Group, a major private-equity player.

Their message: You probably know that the national deficit stands at $9.6 trillion and rising. What you don't know is how bad things really are. If you include all the unfunded entitlement obligations — Social Security, Medicare, Medicaid and so forth — we are actually in a $53 trillion hole, Walker says. And it will only get deeper as we get older.

In an interview, Walker is full of grim one-liners, such as: "The debt has increased our risk of being held hostage by foreign lenders" and "Our situation is serious, and it is deteriorating with the passage of time" and "The financial condition of the U.S. is worse than advertised."

The nation's debt now accounts for 66 percent of the gross national product. But unless things change, the film argues that the cost of aging baby boomers will push that proportion to 244 percent by 2040, twice what it was at the end of World War II, our highest level of national debt. A debt that high, even super-investor Warren Buffett says in the film, "could create real political instability."

At this point in the movie, we're wishing we'd rented "The Towering Inferno" instead. Happier ending.

The film generally skirts specific solutions — it does not recommend one form of Social Security reform over another — but suggests broad entitlement overhaul, tough budget controls, conservation of energy and, at the no-duh level, not buying things you can't afford. Walker said that tax deductions and exemptions will have to be reduced and a national consumption tax should be considered.

"It's inevitable there will be some tax increases on fat cats like myself," Peterson said. "But any idea you're going to solve most of this problem with taxes is not realistic." Not everyone agrees that the U.S. is headed off a credit cliff. There's Arthur Laffer, for instance, developer of the famous Laffer Curve, which says that if taxes rise too high, people lose incentive to work. Laffer argues that as long as the debt level stays where it is, it can be financed down over time, like a homeowner with a mortgage.

"Arthur Laffer said to me, 'Addison, I'm not a debt guy,' " said Addison Wiggin, executive producer of the film and editorial director at Baltimore's Agora Financial. "But that doesn't take into account everything that's coming down the pike," said Wiggin, co-author of the 2005 book, "Empire of Debt."

One L of a global banking crisis

One of the world's leading authorities on the global financial system confirmed something that we suspected long ago: This is the market from L.

That letter is important if you care at all about the future of your money, home and job, because it depicts Mohamed El-Erian's view of the shape of a painfully stretched-out global recession over the next couple of years.

Celebrated for guiding big money at Harvard and Salomon Brothers before taking on the task of steering $865 billion at bond giant Pimco last year, El-Erian believes that the solvency issues now challenging big U.S. banks are destined to spread out into a full-blown economic dislocation that engulfs and endangers innocent bystanders the world over.

In an interview this week, he insisted that regional banks and local governments can no longer stomp their feet and claim they are immune from danger because they did not speculate on high-risk real-estate loans or structured finance: Collateral effects are going to crash into every institution that has ever lent a dime as excessive levels of debt are violently wrung out of the global financial system.

"I live in a world where crisis management is the norm, not the exception, and you learn a few things" El-Erian said. "You learn never to underestimate the destructive power of negative feedback loops." The insidious loop now has spun its way from Wall Street to the everyday lives of Americans as a financial crisis has become an economic crisis.

Damaged money-center banks are lending less, leading to lower levels of production and curtailed expansion at companies. That has led to job cuts, which in turn have led to cutbacks in consumer cash flow and spending, which are feeding back into creating problems for credit card, auto and home loans made by smaller banks. Those troubles will in turn lead back to a diminished appetite to lend locally for projects with the slightest whiff of risk.

What makes El-Erian stand out among so many skeptics today is his view of the length of time these loops will need to play out. He argues that current stock and bond valuations are still so lofty, even after recent declines, that they suggest most investors believe solutions will come quickly -- creating a V-shaped recovery.

A look at the opportunities in the volatile market, with Mohamed El-Erian of Pimco and CNBC. In contrast, El-Erian thinks U.S. government action has been so slow and timid that the recovery will instead drag out into the shape of an L and that it will curve upward into a U only when regulators and lawmakers worldwide are bludgeoned by losses to coordinate their approach despite dramatic regional differences in growth and indebtedness.

"Policy change in Washington, D.C., has been too little, too late," he said. "In a crisis like this, leaders have to be much bolder." He gives Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke an A-plus for effort but only a B-plus for execution and outcome, which is not good enough to effect a swift recovery.

A big part of the problem, he says, is that U.S. financial leaders have failed to communicate the extent of the problem, insisting that everything is fine and thereby creating false expectations. He also believes that the Federal Reserve has erred badly both by taking on too many responsibilities and by not prioritizing them effectively. The Fed, he says, started with this mandate: to guide short-term interest rates in a way that supports U.S. economic growth without causing inflation.

In March, it appeared to add another mandate: to promote financial stability by mediating deals to keep faltering broker-dealers from collapsing, as it did by assisting the takeover of Bear Stearns by JP Morgan. And the Fed then appeared to add one more mandate when Bernanke began to talk up the value of the dollar, which is something no predecessor had done.

These mandates conflict with each other, particularly in an economy in need of radical deleveraging, or the shedding of debt. Unless Bernanke can pare back his obligations and clearly articulate that he will help promote growth as a top priority, it will be difficult to assure investors that the central bank is being guided by policy focused on restoring profitability to banks and companies.

Since Bernanke has not clearly made that choice, El-Erian believes that investors should essentially consider the Fed hostile to their interests. And thus as a practical matter, he thinks we should dramatically underweight equities in our portfolios. While most Americans probably have 90% of their investable funds in U.S. stocks, he recommends that they cut back to having just 50% of their money overall in stocks and, of that, apportioning just 30% to U.S. companies. That would mean just 15% of an overall portfolio invested in American stocks.

Why so little U.S. exposure despite seemingly low prices? As the son of an Egyptian diplomat who is fluent in Arabic and French as well as strong enough in English to have published the best-selling book "When Markets Collide" this year, El-Erian says that Americans need to realize that the United States and Europe have lost their role at the center of the investment universe.

He observes that we are currently at a unique moment in world history when the richest countries on Earth are borrowing heavily from the poorest countries -- and, paradoxically, Western banks are hitting up Eastern investors every time they find a new hole in their pocket.

To put this into perspective, El-Erian says that the world is no longer "flat," as suggested by the title of a seminal 2005 book by New York Times op-ed columnist Thomas Friedman. Instead, El-Erian says, the world is "upside down" when you consider the strange turn of events that have led irresponsible New York banks to go hat in hand to Abu Dhabi, Singapore and China's sovereign wealth managers in search of new capital. "Poor countries are recapitalizing the rich countries. It's a complete change," he said.

As a result of this transformation in world finance, emerging economies are buying developed countries' assets on the cheap and thus will be first to benefit when global deleveraging is complete. And even at present, while heavily indebted consumers in the United States, United Kingdom and Australia are cutting back on their purchases, dampening their countries' economic growth, consumers in Eastern Europe, China and India who have never had credit cards or subprime mortgages are actually accelerating their purchasing, helping their local economies power ahead.

Going forward, El-Erian believes we should anticipate a widespread realignment of the U.S. banking system, with dozens of medium-sized and large banks disappearing and a few supersized entities, such as, potentially, JP Morgan, emerging. If you care to speculate on this change, he advises that you focus on companies whose fundamental value is proven and then stick to the highest level of the capital structure, which means super-senior bonds rather than equities. But even then, don't expect much over the next year as our world sinks further into a living L before finding its happy U.

Economic Slump in U.S. to Worsen as Consumers Get 'Squeezed'

The U.S. economic slump will extend into 2009 as the longest expansion in consumer spending on record comes to an end, according to a Bloomberg News survey. The world's largest economy will grow at an average 0.7 percent annual pace from July through December, half the gain in the first six months of the year, according to the median forecast of 50 economists surveyed from Aug. 1 to Aug. 8.

Household spending, which has grown every quarter since 1992, is projected to stall in the last three months of the year as the impact of tax rebates fades, wages fail to keep up with inflation and property values fall. The jobless rate, now at 5.7 percent, will reach a five-year high of 6 percent in early 2009.

"The consumer is very much squeezed," said John Lonski, chief economist at Moody's Investors Service Inc. in New York. "The downside risks swamp whatever the economy's upside potential would be."

Spending is likely to grow at a 0.6 percent annual pace from July through September, down from a 1.5 percent pace in the previous three months when the arrival of almost $78 billion in tax rebates helped Americans overcome the surge in fuel and food prices. Most of the remaining rebate checks were sent out by mid July.

Analysts say the impact of the rebates, part of a $168 billion economic stimulus plan President George W. Bush signed in February, will be gone by the fourth quarter. "What's it going to look like once that stimulus runs out?" said Jonathan Basile, an economist at Credit Suisse Holdings USA Inc. in New York. "The profile that we think consumers are going to follow over the remainder of the year is one of lower spending."

Economists anticipate economic growth will keep slowing next year, with gross domestic product expanding 1.5 percent compared with the 1.6 percent projected for 2008. Last month, economists said the economy would grow 1.7 percent in 2009. The odds of a recession occurring within the next 12 months are 51 percent, little changed from last month's projection, after climbing as high as 70 percent in the April survey.

Slower growth may ease inflation concerns. Consumer prices will rise 4.3 percent this year, the most since 1990, before drifting down to 2.5 percent by the end of the third quarter of 2009, the survey showed. "The inflation rate is going to come down," said Michael Hanson, a senior economist at Lehman Brothers Holdings Inc. in New York. "The rapid increases in the oil price that we saw earlier in the year are not likely to continue."

Household incomes will suffer as salaries fail to keep up with inflation. The Labor Department last month said wages in June decreased 0.9 percent after adjusting for inflation, the biggest drop since September 2005, and were down 2.4 percent over the last 12 months. The decline in buying power is one reason economists forecast spending will slow.

Retailers are feeling the pinch as consumers spend a greater share of their income on food and fuel. Sales at U.S. stores open more than a year grew 2.6 percent last month, the smallest gain since March, the International Council of Shopping Centers said Aug. 7.

Wal-Mart Stores Inc., the world's largest retailer, last week said August sales won't grow as quickly as July's. The company's stock fell the most since 2002 following the announcement. A weakening labor market also is weighing on consumers. The survey indicates that after rising to 6 percent in early 2009, the unemployment rate will remain at that level through the first nine months of the year. Economists last month forecast unemployment would peak at 5.8 percent.

Payrolls dropped in July for a seventh month, for a total of 463,000 jobs lost so far this year. The increase in the jobless rate will not prevent Federal Reserve policy makers from raising the benchmark interest rate, economists said.

"The unemployment rate will probably drift upwards, but if it doesn't accelerate, the Fed will probably feel like it can begin safely raising rates," said Tom Fullerton, professor of economics at The University of Texas at El Paso. "It would be surprising if the Fed did not raise short-term interest rates."

The Fed will keep its benchmark interest rate at 2 percent through March 2009 and then raise it by three-quarters of a percentage point by the end of September, according to the survey. That forecast is unchanged from last month's survey.

Bonds Show Inflation Peaking As Slowing Growth Deflates Commodities Prices

Schroder Investment Management's David Scammell is so convinced inflation has crested that the bond fund manager this quarter has sold securities designed to protect from rising consumer prices.

The money manager, who in the first half of the year bought all the so-called index-linked bonds he could find as crude oil rose above $100 a barrel, says the global economy has become too weak to sustain a rally in commodities, capping inflation.

"We've been reducing index-linked bond holdings," said Scammell, whose firm is a unit of the U.K.'s largest publicly traded money manager. "Central bankers have to maintain their hawkish tone because they need to anchor inflation expectations, but the reality is we are seeing a spell of weak data."

Scammell is no lonely voice. A survey out today of 25 bond fund managers controlling $1.41 trillion of assets by Jersey City, New Jersey-based Ried, Thunberg & Co. found that 79 percent expect inflation "to moderate late this year into 2009."

Since June returns on government debt linked to consumer prices shrunk to 0.8 percent from 4 percent in the first half of the year, according to indexes compiled by New York-based Merrill Lynch & Co. At the same time, regular bonds gained 1.9 percent, after returning 0.1 percent in the first six months.

European Central Bank President Jean-Claude Trichet said Aug. 7 that the region's economy will be "particularly weak" through the third quarter. The Federal Reserve said Aug. 5 that a shrinking labor market and financial-market strains will hinder U.S. growth. Japan's government said Aug. 6 the economy is "deteriorating," acknowledging for the first time that the country's longest postwar expansion has probably ended.

The odds are "over 60 percent" that the U.S. economy, the world's largest, will enter a recession and any recovery will likely be shallow and lengthy, Henry Kaufman, the former Salomon Brothers chief economist, said last week. "We are in a downdraft," Kaufman, who has followed Wall Street for five decades and is president of his own investment management firm, said in an interview with Bloomberg Television.

At the same time growth is weakening, prices of commodities, which rose an average of 47 percent in the 12 months ended June 30 as measured by the Reuters/Jefferies CRB Index of 19 raw materials, are starting to retreat. The index fell 12 percent over the past month, easing concerns about inflation.

"We are probably getting close to the peak in inflation in the short term," said Brian Weinstein, who manages $9 billion in inflation bonds at New York-based BlackRock Inc. The firm is the largest publicly traded fund manager in the U.S., overseeing $1.43 trillion in assets.

Weinstein said he is shifting out of shorter-maturity U.S. Treasury Inflation-Protected Securities, or TIPS, into longer- dated ones, a sign that he doesn't expect a rise in consumer prices as being an imminent threat. The U.S. may say Aug. 14 that consumer prices rose 0.4 percent in July, compared with 1.1 percent in June, according to the median estimate of 52 economists surveyed by Bloomberg.

The difference in yields on 10-year TIPS and regular bonds narrowed in July by the most since 2002, according to data compiled by Bloomberg. The so-called breakeven rate, which represents the rate of inflation investors expect over the life of the securities, fell to 2.19 percentage points as of 12:19 p.m. in Tokyo from the peak this year of 2.6 percentage points on July 4.

"The slowing economic environment which we are seeing in Europe and in the U.S. will help moderate inflation," said William Chepolis, who oversees $9 billion of bonds as a fixed- income fund manager at DWS Investments in New York.

Chepolis, who said he favored TIPS earlier this year, "faded" the securities in July by buying regular bonds instead of the securities with new cash that flowed into his fund. He said TIPS are now "fairly priced."

In Europe, index-linked bonds, or linkers, were poised for their worst third-quarter performance in almost 10 years, returning 1.1 percent as of last week, Merrill Lynch data shows. The 10-year breakeven rate in Japan narrowed to 22 basis points after reaching a 12-month high of 59 basis points on July 7.

Investors are shunning index-linked securities even as global inflation accelerates at the fastest pace in a decade. The U.S. consumer-price index rose 5 percent in June from a year earlier, the most since 1991. In the euro region, the inflation rate rose to 4.1 percent in July, the highest since April 1992, and more than doubling the ECB's threshold of 2 percent. In Japan, prices excluding fresh food climbed 1.9 percent in June, the most in a decade.

"The biggest story in the bond market in the next six to 12 months is going to be a slowdown in global growth," BlackRock's Weinstein said. "There'll be realization that the housing crisis-led slowdown in the U.S. has led to a credit problem worldwide." The World Bank, a Washington-based lender to nations, said on June 10 that global economic growth will probably slow to 2.7 percent this year from 3.7 percent in 2007.

The Basel-based Bank of International Settlements, a bank for central banks, said in June the economy may be headed for a slump so severe that it brings a drop in general price levels in the U.S. and U.K. Deflation may soon become the biggest risk to the world economy, Albert Edwards, the London-based global strategist at Societe Generale SA who predicted the Asian currency crisis a decade ago, said in an interview last month.

As recently as 2003 the Fed cut its target rate for overnight loans between banks to a 45-year low of 1 percent because it was concerned about disinflation. Japan's government has yet to declare that the economy has escaped from a bout of deflation which emerged after an asset-price bubble burst in the early 1990s.

"Inflationary pressure is abating while deflationary pressure is emerging," said Akira Takei, the general manager for international bonds at Mizuho Asset Management Co., in Tokyo, which oversees the equivalent of $37.3 billion. "I believe that the U.S. economy will go into deflation eventually. It's better to prefer conventional bonds rather than TIPS."

Paulson Says He Doesn't Plan to Add Cash to Fannie, Freddie

U.S. Treasury Secretary Henry Paulson said there are no plans to inject capital into Fannie Mae and Freddie Mac after the two mortgage companies posted combined losses of $3.12 billion last week.

"We have no plans to insert money into either of those two institutions," Paulson said in an interview with NBC's "Meet the Press" broadcast yesterday from Beijing. He added that their results were "not a surprise" and that the housing slump will last beyond this year.

Paulson last month brokered a plan to bolster the two government-sponsored enterprises that includes giving Treasury the right to buy their shares. Fannie and Freddie, which account for almost half of the $12 trillion mortgage market, reported losses three times wider than estimated, prompting some investors to predict that Paulson will be forced to act.

"Given that Fannie Mae and Freddie Mac are solely involved in housing, that's their sole business, and given the magnitude of the housing correction we've had, it's not a surprise to me to see those losses," Paulson said. Paulson, the former chairman of Goldman Sachs Group Inc., said he won't serve as Treasury secretary under the next president, regardless of who is elected in November.

"I'm going to run right up until the end," said Paulson, 62, who joined the Bush administration in July 2006, succeeding John Snow. "I will do everything I can to make for a smooth transition, to work closely with my successor here in Treasury."

Paulson said Freddie and Fannie's financial problems underscored his view that the housing crisis remains the biggest threat to the U.S. economy. The worst housing slump since the Depression won't end quickly, he said. "We have got some serious issues that we're dealing with in our economy," he said. "I believe it's going to take us well beyond the end of the year to work through all the housing problems."

Home prices in 20 U.S. metropolitan areas fell in May by 15.8 percent from a year earlier, the most on record, the S&P/Case-Shiller home-price index showed on July 29. Foreclosure filings in the second quarter jumped 121 percent from a year earlier, RealtyTrac Inc., said last month.

Acknowledging that the housing and credit crises have been "humbling," Paulson said it was important to reassure investors around the world that the U.S. is addressing its problems. "The period of turmoil that we're going through in our capital markets today is different from some of the periods we've had in the past, in that the root cause took place right in the United States of America," he said. At the same time, "long-term economic fundamentals of the United States compare very favorably".

Paulson downplayed the need for a second economic stimulus package, saying the $168 billion plan enacted in February had helped boost consumption and growth in the second quarter of the year and would continue to do so. House Speaker Nancy Pelosi, a Democrat from California, has called for a second package of about $50 billion. "Let's see how this program works in the third quarter," Paulson said.

Gross domestic product shrank in the fourth quarter of 2007, and grew at just an average 1.4 percent annual rate in the first six months of this year, aided by some $78 billion in tax rebates sent to Americans between late April and June. Shares in Fannie and Freddie have plummeted more than 80 percent this year on concern they don't have sufficient capital to withstand record foreclosures on the $5.2 trillion of mortgages they own or guarantee.

Bill Gross, manager of the world's biggest bond fund at Pacific Investment Management Co., last week said the Treasury will probably be forced to buy as much as $30 billion of preferred shares in the two. Freddie is having trouble raising $5.5 billion in capital it announced in May, and Chief Executive Officer Richard Syron said he is waiting for a more "propitious time" to raise the money. Fannie has raised $14.4 billion in fresh reserves since late last year; Freddie has raised $6 billion.

Fannie, Freddie Must Resolve Identity Crisis

Where did all the money go? Fannie MaeFNM lost $2.3 BILLION dollars in the past three months, and its cousin Freddie MacFRE lost nearly $1 billion, bringing its one-year total loss to nearly $5 billion.

Just look around your neighborhood and see the foreclosed and for-sale houses -- all worth a lot less than the mortgage money borrowed to buy them. Add it all up, in neighborhoods across America, and you have all those billions in losses. Since Fannie and Freddie are the centerpiece of our nation's housing finance industry, the losses -- and reserves for future losses -- congregate on their books.

Since they have always had a "line of credit" to the government, recently made more explicit, their problems are our problems, as it looks more likely the two mortgage giants will need an official bailout.

Just about everyone's heard of Freddie Mac and Fannie Mae -- but very few people understand what a significant role they play in financing home ownership in America. Even fewer understand how conflicted they are in their dual mission of supporting the housing market and acting as profitable businesses.

Actually, very few financial institutions can proudly point to their accomplishment of acting responsibly within their mandate when it comes to the housing loans they made. So many who should have known better opted to avoid looking at the reality of the loans they were making to people who had no down payment, no documented income, and no credit history.

At least Freddie Mac and Fannie Mae had the "excuse" that they were charged with "facilitating" home ownership across America, as well as making good business decisions. Still, in search of profits they expanded their portfolio of mortgages wildly, lowering their standards and pricing to compete in the marketplace.

Fannie and Freddie are both public companies, with public shareholders. The two organizations buy loans originated by financial institutions, package them for sale, and then use the proceeds to underwrite even more mortgages -- keeping the mortgage market "liquid." In 2006, they underwrote about 40% of all mortgages. Today, it is closer to 90%, as the private securitization market has dried up in the wake of the credit market collapse.

But, in addition to being public companies, they are also GSE's -- government sponsored enterprises. That means they have been protected since 1968 by the support of the federal government in the form of a "line of credit" through the Treasury, exemption from state and local taxes, and from some Securities and Exchange Commission oversight, even though they are public companies.

That perception that they are "protected" by the government has enabled them to borrow money in the public markets at lower rates than private corporations. It is the dual mission of these companies to act like real "businesses" and "help" Americans obtain homeownership, combined with their exemptions from SEC oversight, that has caused their problems.

How does a private company built to earn profits simultaneously serve a social good?

Here's a "mission statement" from the Freddie Mac Web site that will probably be erased when this column is published:Freddie Mac is a shareholder-owned corporation whose people are dedicated to improving the quality of life by making the American dream of decent, accessible housing a reality. We accomplish this mission by linking Main Street to Wall Street -- purchasing, securitizing and investing in home mortgages, and ultimately providing homeowners and renters with lower housing costs and better access to home financing. Since our inception, Freddie Mac has achieved more than 30 consecutive years of profitability and financed one out of every six homes in America.

That dual mission -- helping home ownership and creating shareholder profits -- worked well when the housing market was booming, obscuring unwise decisions to purchase sub-prime and Alt-A mortgages. But when the bubble burst, the earnings referred to in their mission statement were replaced by huge losses.

Even worse, both Fannie and Freddie are projecting more losses, based on current default rates and the gloomy outlook for housing prices in the future. Estimates of an 18% to 20% decline in home prices, from top to bottom, are now common. The Case-Shiller index, which reflects all loans -- including riskier jumbo loans not purchased by Freddie and Fannie, shows a decline of 25% for home prices in some major urban areas.

Clearly, housing is not likely to rebound quickly. Equally clearly, the government will have to get involved. When the president signed the housing bill on July 31, it included a provision that would allow the Treasury to buy the equity and debt (stock and bonds) of these companies as a way to keep them going, should they "run out " of capital. A week before that, the Federal Reserve gave the two companies access to borrowing at the Fed's discount window, something previously reserved for banks.

Freddie Mac's stock is trading at $5.90 a share, down more than 80% from its high of $67 earlier this year. And Fannie ended the week at $9.05, down from a high of more than $70 in the past 12 months. Both have slashed their dividend to five cents a share. They would have eliminated the dividend entirely, but many of their shareholders are institutions that are required to hold only dividend-paying stocks.

Both companies acknowledge the need to raise more capital -- at least $5 billion each -- but who would buy their stock, with such a gloomy outlook and the uncertainty about their future mission? It looks like the Treasury, using our tax dollars, will be the buyer of last resort to save them. But save these GSE's -- for what purpose in the future?

That is the key to the problem: defining their role, either as profit-making companies, or government do-good agencies supported by taxpayers. If you expect a company to act responsibly to its shareholders, then the management must be focused on that goal. If there are dual goals, and they conflict, how can you please multiple constituencies? When they conflict, what can you expect?

Some in Congress are urging them to keep growing, just to keep the economy going, to restart the housing market, and restore the American dream of home ownership. You can understand why the politicians find this attractive in an election year. But to "rescue" housing, they'd have to once again guarantee loans to people who are truly a credit risk.

Instead, the chastened companies have belatedly tightened up on lending standards, which means higher rates and less availability of mortgages, in order to do the right thing by their shareholders. That's not pleasing the politicians. Does it make sense to restart the housing market under the same system, with expanded guarantees against risk? Do we want to create that fiction again? I think not.

All signs indicate that euro's joyride is at an end

Feet firmly planted on the Maginot Line last Thursday, Jean-Claude Trichet reaffirmed the European Central Bank's settled conviction that “the fundamentals of the euro area are sound and the euro area does not suffer from major imbalances”.

He admitted “downside risks” to growth, conceding that financial market turbulence might affect the real economy “more than currently anticipated”. However, he insisted that there should not be too much read into the past month's torrent of appalling eurozone economic data, breezily characterising them as a “technical correction” after strong first-quarter growth and advising sceptics to “look through the volatility in quarter-on-quarter growth rates and monthly indicators”.

When the ECB raised interest rates a month ago, he added for good measure, they had “already priced in” a dip in growth in the second and third quarters, and all information available since then confirmed the wisdom of that decision.

At 4.1 per cent, inflation was the enemy to beat, and it would be beaten, in a world of higher food, commodity and energy prices, only by “a change in the behaviour of companies and households”. Just take the medicine, children - though the word “recession” never crossed his lips.

The quiet on the Western Front ended within 24 hours, in a trading blitzkrieg that dumped the euro for dollars. No doubt Mr Trichet would counsel against reading too much into volatile exchange movements, but it is my guess that Friday's striking about-turn - which gave the dollar its best day against important currencies since July 2002 and the euro its worst against the dollar for four years - was not a blip, but the start of a trend.

That is because the ECB's see-no-evil assertion of “sound fundamentals” had the unintended effect of belatedly concentrating attention on just how unsound the eurozone's prospects - and Britain's - now look. Analysts have been so fixated by America's travails that they barely noticed how rapidly business activity and economic sentiment were collapsing across the Atlantic.

The signs were there for all to read that Europe is heading into a recession from which it will struggle to recover, while America may have got away with a relatively minor economic contraction from which it may rebound sooner than expected. Take, for an overall picture of activity in the “real economy”, last month's chart from the Institute for Supply Management in the US and compare them with eurozone purchasing managers' index.

On both sides of the Atlantic, business is difficult, beset by higher costs, uncertain demand, inflation worries and fear of further nasty surprises in financial markets. But in the US, the manufacturing PMI has held remarkably steady through the turbulence, with only short dips below the 50 per cent equilibrium level it is registering. The sector is adding jobs, and, at 54 per cent, export orders are healthy.

More remarkably, the non-manufacturing business index, which includes rental and real estate, came in at 49.5 per cent and, after two months of contracting, the backlog of orders index rebounded to 52 per cent. Not plain sailing, but not bad for an economy that, badly shaken as it has been by the credit crunch, just chalked up its 81st month of consecutive growth.

Last month's eurozone composite PMI, the weighted average of manufacturing and services output, was grimmer by far: at 47.8 per cent, it was the lowest since November 2001. Confidence indicators are falling faster than at any time since the shock caused by the attacks of September 11 in that year, dropping from 94.8 in June to 89.5 in July.

Retail sales in June fell by 0.6 per cent, and by more than double that in Germany, which accounts for no less than 28 per cent of the eurozone retail market, underlining the fact that the slowdown includes domestic spending as well as foreign demand. Misery on the housing front, which is by no means confined to the profligate Anglo-Saxons, is part of the story.

Housing bubbles have burst in the Irish Republic, Greece, Portugal and, most spectacularly, Spain. With an overhang of 700,000 unsold homes, exposure to Spanish mortgages may be even more unattractive than being saddled with US sub-prime paper.

Business activity has dropped for seven straight months in Spain, as it has in Italy - which confirmed last week that its economy shrank in the second quarter by 0.3 per cent. So have Spanish tax revenues, and, despite fiscal stimulus measures equivalent to 1.5 per cent of GDP, retail sales are dropping like a stone and unemployment is back to double digits.

But the pain in Spain would, it was argued, stay mainly in the Spanish plain. Even when the place was humming, it accounted for only 11.8 per cent of eurozone GDP. That illusion will end on Thursday, when statistics are likely to confirm that not only are Spain, Denmark, Sweden, Italy and Ireland in recessionary territory, with France in the doldrums, but Germany, the eurozone's keystone, is expected to record a fall in GDP over the last quarter of between 0.8 per cent and 1 per cent.

That alone would be enough to drag the eurozone average down by 0.2 per cent - and harden sentiment against the euro. Germany's slide was unexpected and has been precipitous. Early this year its economy was running so strongly against the tide that ministers boasted how much they loved the strong euro.

No longer. Factory orders have fallen for seven months in a row, from within as well as outside the eurozone, to 8.4 per cent below the levels a year ago. Consumer and business confidence have plummeted. Most ominously, inflation is 3.3 per cent - lower than the eurozone average but high enough to spook Germans, ever mindful of 1920s hyperinflation.

Yet German unions are demanding inflation-beating autumn pay settlements. That increases the risk of a wage-price spiral spreading through countries such as Spain, Italy and France, where nominal wages traditionally reflect consumer prices.

The ECB is between a rock and a hard place. If it defends the Maginot Line of price stability, deep and lasting recession is on the cards, yet Mr Trichet insisted last week that it could do no other. He fears that if it wavers, the ECB will be seen to have failed its first serious test. Either way, the euro's joyride is over.

Auction-Rate Costs May Rival Spitzer Settlements

Wall Street's costs to end federal and state investigations of the auction-rate bond market's collapse may wind up exceeding the sanctions from abuses of mutual funds and analyst research in the past decade.

UBS AG and Citigroup Inc. agreed last week to buy about $26 billion of auction-rate bonds from clients and pay $250 million in fines after regulators said the firms marketed the securities as safe alternatives to money-market investments. Merrill Lynch & Co. announced a plan to purchase $10 billion. Investigations of other firms that sold the debt continue, New York Attorney General Andrew Cuomo said Aug. 8.

Banks may have to write down the debt they buy from customers by $4 billion, Bank of America Corp. analyst Jeffrey Rosenberg said in a report last week. The probe of mutual-fund abuses from 2003 yielded more than $5 billion in penalties and agreements to reduce fees, while Cuomo's predecessor, Eliot Spitzer, and regulators including the U.S. Securities and Exchange Commission won $1.4 billion from 10 firms accused of using tainted research to win investment-banking deals.

"These are developments of gigantic, historic proportions," James Cox, a securities law professor at Duke University in Durham, North Carolina, said of the auction-rate agreements. "Never have we witnessed defendants, who created a product that isn't inherently illegal, being required to buy back such a large market."

The auction-rate settlements come six months after the $330 billion market seized up when investors fled all but the safest government bonds. Dealers, saddled with growing losses on debt tied to subprime mortgages, stopped buying securities that bondholders didn't want.

UBS, based in Zurich, and New York-based Citigroup and Merrill may purchase securities that have already lost as much as 30 percent of their value, according to prices on online platforms run by New York-based Restricted Stock Partners.

Bonds sold by local governments, hospitals and colleges trade at 92 to 98 cents on the dollar, according to Barry Silbert, chief executive officer of Restricted Stock. Auction- rate preferred shares issued by mutual funds are at about 85 to 92 cents, he said. Debt backed by student loans is valued at 70 to 85 cents.

UBS, Citigroup and Merrill were among the largest underwriters of auction-rate debt, according to Thomson Reuters. The other biggest banks in the market include New York-based Morgan Stanley, Goldman Sachs Group Inc., JPMorgan Chase & Co., and Lehman Brothers Holdings Inc., Royal Bank of Canada in Toronto, and Wachovia Corp. and Bank of America, both in Charlotte, North Carolina.

Morgan Stanley agreed last week to buy $1.5 million in auction-rate securities from two municipalities in Massachusetts to settle claims made by Attorney General Martha Coakley that the bank improperly marketed the investments.

Coakley, who reached a similar accord in May with UBS, probed auction-rate sales separately from Massachusetts Secretary of State William Galvin, who filed complaints against UBS and Merrill and is still investigating Bank of America. Cuomo and other state attorneys general are continuing to examine the market. "We're looking at the entire industry," Cuomo said at the Aug. 8 press conference to announce the settlement with UBS.

Auction-rate debt allowed municipalities, student loan companies and mutual funds to raise long-term money with short- term yields because interest rates were set every seven, 28 or 35 days through dealer-run auctions. When the market collapsed, investors were left with securities they couldn't sell and issuers got hit with penalty rates as high as 20 percent.

To escape high rates and unfreeze securities, borrowers moved to refinance the debt, shrinking the market to about $205 billion, according to data compiled by Bloomberg News and Thomas J. Herzfeld Advisors Inc. in Miami. State and local government borrowers refinanced or plan to replace $97.8 billion, closed-end funds announced redemptions of $23.8 billion, and student-loan providers removed about $3 billion from the market, the data show.

Almost all of the student-loan and preferred securities have been frozen since February, while more than half of the municipal auction-rate bonds remain locked up, according to data compiled by Bloomberg News. Securities firms may avoid additional fines if they use "best efforts" to help their clients get out of the securities, the SEC said last week when the settlements were announced.

Banks will need to find ways to dispose of the auction-rate securities to recoup their money. The strategy used by mutual funds may provide a partial solution. Boston-based Eaton Vance Corp., Chicago's Nuveen Investments Inc., and BlackRock Inc. in New York developed new preferred shares that carry a "put" option, which guarantees that an investor can sell back their securities when needed.

Money raised from the sale of the new securities will be used to retire the auction-rate preferred shares. Nuveen completed the first sale of the new shares last week, raising $500 million to help redeem auction-rate preferred securities issued by four tax-exempt funds. Banks may reverse their writedowns by pushing for more deals to refinance the auction-rate securities.

"If the banks themselves are taking them back onto their balance sheets, they're not going to be slow to offload that liability," said James Colby, senior municipal strategist at money-management firm Van Eck Associates in New York. "Sooner rather than later, the issuers that stand behind" the debt "are going to be encouraged by the banks to find a way to close the books on these products," he said.

Banks braced for more bond mis-selling action

Flushed with the success of securing $40 billion of settlements from Merrill Lynch, UBS and Citigroup, US state regulators are expected to turn up the heat on banks accused of mis-selling auction rate securities (ARS).

Regulators from several states have demanded documents from Wachovia, the American mortgage lender, which has said that it is cooperating with their inquiries. The move comes as the US Federal Reserve has stepped up pressure on Wall Street banks to ensure they have sufficient liquid funds to withstand another Bear Stearns-style shock by stress-testing their balance sheets.

On Friday, brokers at Credit Suisse, the investment bank, were accused in a civil lawsuit, filed in New York, of misleading investors about the nature of auction rate securities. STMicroelectronics, the plaintiff, is seeking $415 million (£216 million) in damages. It is also understood that federal prosecutors in New York are preparing a criminal case against two former Credit Suisse brokers. The bank did not return calls yesterday.

The state of Texas is also pursuing settlements from banks that it argues mis-sold such bonds. They are now untradeable and effectively worthless in the market. Auction rate securities are similar to ordinary bonds except that the interest rate is set at an auction held every week, month or 35 days. If there are no bidders, the entire market for the bonds freezes. Regulators have accused banks such as UBS, Merrill Lynch and Citigroup of playing down the risk of such a seizure in the market.

Denise Voigt Crawford, the Texas state securities commissioner, is leading a 12-strong team investigating a dozen Wall Street banks. She expected that some would “settle very soon, perhaps in the next couple of weeks”. On Thursday, Citigroup and Merrill Lynch agreed to spend $17.3 billion buying back such securities from about 70,000 clients. On Friday, UBS agreed to pay $22 billion on reacquiring ARS assets and paying fines.

Royal Bank of Scotland and HSBC were also significant providers of ARS assets. RBS did not return calls about whether it was being investigated by US regulators for ARS mis-selling. At the end of June, HSBC offered to buy back ARS assets that its clients had been unable to sell since the market froze in February.

It has not disclosed how much these are worth or what the take-up has been. The New York attorney-general’s office, the Massachusetts Securities Division, the Securities and Exchange Commission and the state of Texas are among those that have led the way in forcing the banks to reimburse clients and, in some cases, to pay fines for misleading investors.

Chinese market hits 20-month low

The threat of inflation and the possibility of a post-Olympic hangover sent China's benchmark stock exchange to a 20-month low today, making Shanghai the world's worst performing index this year.

The Shanghai composite index fell 135.65 points, or 5.2pc, to 2,470.07. The market has lost almost 60pc since last October, beating Vietnam into second place as the worst performing market. Small investors became jittery after the market fell on Friday ahead of the Olympics Games opening ceremony. Many small investors believed that the Chinese government would prop up the market to "save face" while the Games were on.

Their disillusion crystallised into a selling spree today. More than 80pc of investors polled by the Stock and Fund Information Service said they felt the market would fall further after the Olympics and that they wanted to sell out before the games ended. "The government has spent all the money on the games instead of putting money into the market," complained one anonymous blogger.

Goldman Sachs put out a research note predicting a gloomy post-Olympic period for the Chinese economy, which triggered further unease. Tourism and Real Estate were too of the biggest falling sectors, but there were losses across the board, with only a handful of companies posting a rise. Airlines and oil companies were also badly hit.

More seasoned experts blamed the falls on a rise in the producer price index (PPI), a key indicator of future inflation. The Chinese government said the PPI, which measures the price that manufacturers are getting for their products, rose by 10pc in July compared with last year, its highest rate of increase for 12 years.

Analysts blamed high energy and raw material costs for the rises, which could have a direct impact on consumer price inflation. The threat of inflation has also forced the government to raise interest rates, to raise the bank's reserve requirements and to tighten controls on foreign investment into China, all of which have choked the market of cash.

"There has been no increase in capital coming into the market and large IPOs have sucked up a lot of money," said Li Feng, an analyst at Galaxy Securities, one of China's largest state-owned brokerages. He added that investors were also concerned that the market will be increasingly unstable after the Olympics, and that concerns over the US economy were also upsetting Chinese exporters. "This is not irrational panic," he said.

Zhang Fan, the head of research at Tubon Securities, another Chinese broker, said that individual investors were upset that the government has not "sent messages" to calm the market, and that the only way to stop the Shanghai index from falling further was an injection of fresh capital.

This credit crisis is like the plague and nobody is safe yet

A year since the credit crunch burst upon an unsuspecting world, the big questions remain unanswered. Where are we now? Is it nearly over? And has understanding finally caught up with reality?

The central banks' measures to return the money markets to normality by injecting massive amounts of liquidity have been at least partially successful. The spread of three-month interbank interest rates over the official policy rate - a useful indication of the willingness of banks to lend to each other - has narrowed from a peak of 1.2 percentage points to 0.8 percentage points now.

Before the credit crunch struck, however, this spread was regularly in the region of 0.2 percentage points. So although the worst may now be behind us, things are far from normal. Moreover, even if the liquidity crisis may be past its worst, the housing crisis has only just begun.

At the start of the credit crunch, house prices in the US had already fallen by 4pc. But over the past year they have fallen more rapidly, taking the total drop from the peak seen in 2006 to 16pc. My guess is that they still have 15pc to 20pc to fall.

In the UK, incredibly, one year ago house prices were rising at the rate of 10pc per annum. One year on, the housing market is in free-fall, with prices sliding at their fastest rate on record. Indeed, they are already about 10pc below last autumn's peak. I reckon that they may have another 25pc or so to go.

The eurozone has not escaped either. On some measures, house prices in Germany are now 8pc below the level seen before the credit crunch struck. And in the past year, house prices in Ireland have gone from rising at an annual rate of 6pc to falling at an annual rate of 8.5pc. In Ireland also, house prices may have another 20pc to fall.

If you hear someone telling you that what has gone wrong is merely excess lending in US sub-prime, or mistakenly slow counter-actions by the central banks, both now thankfully corrected, buy them a cool, refreshing drink - and pour it over them. The current ills are the natural and inevitable result of the mammoth bubble in the housing market here and abroad.

Admittedly, the extent of over-valuation of houses, and hence the extent of subsequent price falls, does not bear comparison with the mega-bubbles of the past - in dotcom shares, black tulips or South Sea stock. And at the end of this process houses, unlike dotcom shares or black tulips, will still be worth a lot.

What makes this episode so special is not the size of the excessive price rise but rather the importance of the asset class caught up in the bubble. Property is simply the most important asset class there is. So with prices still falling sharply, things look far from over.

Understandably, the events of the past year have had a marked impact on how well the main economies are expected to perform. Before the credit crunch struck, the consensus forecast for UK GDP growth this year was 2.2pc. It is now 1.5pc.

But still the forecasting community don't get it. They downgrade their forecasts ever so carefully, inch by inch, with an ever-watchful gaze at the activities of their peers. Once we have been swamped, they will tell us that the boat is about to sink.

In recent weeks, it has become clear that economic growth in the world's largest economies has all but ground to a halt. In the UK, a retrenchment in spending on the high street and the weakness of the industrial sector suggest that the economy barely grew at all in July.

In the US, the latest data imply that the boost to spending from the large tax rebates is fading, suggesting that the economy may contract later this year, just as it did at the end of last year. Leaked reports indicating that German GDP fell by 1pc in Q2 suggest that the eurozone economy is dangerously close to a recession. Meanwhile, Japanese GDP is likely to have fallen in Q2. And the rest of Asia also looks likely to experience something of a slowdown.

Of course, there are businesses and even individual countries that are not yet in dire straits. But a recession is like the plague: it moves from one place to another. The Black Death did not strike uniformly across the whole of Europe at exactly the same time.

While it was raging in Milan, across the Alps, people in Geneva thought they were safe. Within a few months, though, they had succumbed. By the time that Geneva was gripped, in Milan things were past their worst. People in Paris still hoped they would escape. But once Geneva was recovering, Paris began to succumb. And London followed ineluctably soon afterwards.

UK Housing Bubble: Apocalypse Now?

Who will save the great British House-Price Bubble? I'd been calling the top for so long – as long-time Daily Reckoning UK readers will recall with a groan – that the crisis now upon us almost missed me by.

But "in the market for established homes, more transactions [are] falling through," reports the latest Summary of Business Conditions from the Bank of England, "with some estate agents reporting a cancellation rate of up to 40%."

Put another way, some parts of the UK – where national transaction volumes have already dropped 43% from their average of the last three-and-a-half decades – are seeing four-in-ten sales grind to halt after the deal is agreed.

"That was partly due to the unwillingness of many sellers to accept a lower offer," says the Bank's July report. Meaning that would-be buyers are under-cutting their initial bid, leaving vendors to either take it or leave it. But vendors remain in denial, meantime, about the true market-price of their homes in this fast-sinking market.

Central London has already seen prices lose 10% from last autumn. Nationwide, average sale prices have fallen 8%. But compare the average "asking price" tracked by Rightmove – the No.1 estate-agency website – with the actual "completion prices" recorded by the official Land Registry, and the gap between hope and reality continues to widen, rather than shrink. It reached almost £59,000 in June, a 24% discount off vendor intentions.

How come? Contrary to popular belief – egged on by central government, the media (not least Channel Four), and claims that the UK "needs" an extra three or maybe Five Million Homes by 2020 to meet demand – house prices don't always go up. Not with the average home costing a record 6.5 times average income by mid-2007.

And then, of course, came the credit crunch. Now, on the other side of the trade from would-be vendors, many potential buyers simply cannot raise a mortgage loan, let alone match the seller's over-inflated dreams of yesteryear's gains.

Anecdote here in London has that what US realtors would call "jumbo" mortgages now require the buyer to settle a minimum 25% of the sale price with a cash deposit. Lenders will then advance a maximum half-million pounds. That effectively caps home prices in the capital at the apocalyptic level of £666,000...some $1.3 million.

Yes, that's more than twice the price of London's average semi-detached home (a quaint English expression meaning "a house with only one shared wall". American readers enjoying the average 2,250 square feet of US living space should consider that British homes are barely one-third that size. The most common alternative to "semi-detached" is a sardine-tin "terrace" with neighbors squashed right up against you on both sides.)

But the greatest lie of them all during this decade's historic bubble in prices was that the "trickle down" from high-end home buyers – numbering the Russian mafia, Euro-trash bankers and City traders fat on year-end bonuses – would keep the whole game running at any price for ever.

Fact is, in contrast, that the excesses higher up the housing ladder merely encouraged more modest subjects to beggar themselves trying to keep up. All told – adding personal loans and credit-card debt to outstanding mortgages – UK citizens now owe the banks some £1.44 trillion...roughly $2.8 trillion and well over 12 months of gross domestic product (GDP).

That's more than twice the outstanding debt owed in July 2001. The economy has grown a mere 24% since then. So at the top of the curve, with new debt growing by 14% year-on-year, every extra Pound borrowed resulted in just 10 pence growth in the economy.

Never before in history has any other nation even come close. At least the Tokyo real estate bubble ending in 1989 came against strong personal savings rates and a massive surplus in Japan's balance-of-payments. Whereas now, and here...?

"The UK housing event is probably second only to the Japanese 1990 land bubble in the Real Estate Bubble Hall of Fame," writes Jeremy Grantham, co-founder of the GMO investment group in the late '70s. It now runs $126 billion in assets from Boston.

"While the US is a newcomer to housing bubbles," he goes on in his latest client letter, "the Brits are old pros. It's practically their national past time. "1973 and 1989 were the peaks of two handsome, fairly symmetrical housing bubbles in the UK. [Now] house prices could easily decline 50% from the peak, and at that lower level they would still be higher than they were in 1997 as a multiple of income. It will make our troubles look like a toothache to their hip replacement.

What's more, "unfortunately for global financial well being," notes Grantham, "the UK is not Iceland, but a major player in the global banking business, so the scale of the write-downs will produce yet another wave of destabilization."

The Predators’ Ball

Roy Barnes is a self-described "small-town" lawyer with a mane of silver hair and an Andy Griffith drawl. But like Griffith's Ben Matlock, the TV character he resembles, Barnes is the furthest thing from a rube.

He comes from a family of bankers, and back in the '90s Barnes saw, far before many in Washington, what was happening as deregulation took lending further away from the local banks and gave it to mortgage brokers and Wall Street. So when Barnes was elected governor of Georgia in 1998, he decided to push through the toughest antipredatory lending law in the country.

The 2002 law made everyone up the line, including investment banks on distant Wall Street and rating agencies like Standard & Poor's, legally liable if the loans they sold, securitized or rated were deemed unfair. "There has to be accountability," Barnes told NEWSWEEK. "In the end you have to be able to say, do I really want to make this loan? Because I may have to eat it."

"A victory for Georgia consumers," the Atlanta Journal-Constitution called the new law, which was also hailed by AARP and the NAACP. It was when Roy Barnes started talking about accountability that the Feds began marching into Georgia.

Barnes found himself besieged by lobbyists from major banks and national regulators—as well as Fannie Mae and Freddie Mac, the government-sponsored mortgage issuers whose mandate is to help people obtain affordable homes at fair prices; today, Fannie and Freddie are so financially fragile that the government has agreed to bail them out if necessary.

The major mortgage issuers hinted that they would turn Georgia into a financial pariah if the state made them liable. They let Barnes know in no uncertain terms that he was something of a "country bumpkin" when it came to banking, says his legislative aide, Chris Carpenter.

As Barnes recalls, "They would say—and Fannie Mae and Freddie Mac were part of it—'This is a complex global market. If you start interfering with the free flow of money, then Georgia will become an island that has no credit'. I kept telling them, 'You're in for a crash here'."

Ultimately, the Georgia Legislature, under Barnes's successor, gutted his law in early 2003 after a dramatic eleventh-hour vote in which a Republican senator warned that Freddie Mac was about to cut off most of its business with the state. "It broke my heart," Barnes says. (Fannie and Freddie declined to comment specifically on any efforts against Georgia's liability law, but in general they say they have "always supported efforts to fight predatory lending," says Fannie spokesman Brian Faith.)

The saga of Roy Barnes's failed effort to protect Georgia from the subprime disaster is a reminder that states' rights can still be a good idea. It was state and local officials who saw the oncoming flood of failed loans first—not least because defaults and foreclosures were destroying their neighborhoods years before Wall Street or Washington noticed.

But what happened in Georgia is also a warning about what lies ahead—because the kind of federal lobbying Barnes faced six years ago is still being directed against state legislation today. Critics say new federal legislation and rules fall short, and that Washington's regulators continue to try to pre-empt states from regulating national banks and thrifts. "In the face of this horrible mess, we still don't have firm, clear regulations to protect consumers, like prohibiting loans the borrower can't repay, or gouging on price," says Margot Saunders of the National Consumer Law Center in Washington.

Nowhere is the sense of state impotence greater than California, which became ground zero for subprime defaults. Last May, David Jones, chair of the California Assembly's Judiciary Committee, tried to resurrect Barnes's idea of liability in California. The result "was major jihad by the lending industry," which killed the bill, says Kevin Baker, the committee's chief counsel. New York state was somewhat more successful—it signed a bill into law this month—but "Freddie Mac was up in Albany working hard to gut the bill's language this past spring," says New York consumer advocate Sarah Ludwig.

Spokesmen for Fannie and Freddie say they've sought to work with states, not override them, and they have often backed consumer-friendly new rules, such as one banning unnecessary credit insurance. Late last month President George W. Bush signed a law that created a new regulator for Fannie and Freddie called the Federal Housing Finance Agency.

But that law also offered Fannie and Freddie multibillion-dollar bailouts at taxpayer expense, with no demand for internal reform, critics say. Former Treasury secretary Larry Summers argues that we're missing a "once in a generation opportunity" to reform Fannie and Freddie, which wield enormous lobbying power in Washington and on Wall Street. Summers, a Harvard economist, says the subprime crisis could end up costing taxpayers much more than the 1980s savings and loan bailouts, which left Americans with a $300 billion bill.

Spokesmen and lobbyists for Fannie, Freddie and the banks say many of the problems that caused the current mess are being addressed. "The new law empowers our regulator to crack down on us in many ways," says Freddie spokesman Doug Duvall. At the Federal Reserve, chairman Ben Bernanke announced a new "Regulation Z," which created some common-sense rules, such as forbidding loans without sufficient documentation to show if a person has the ability to repay.

As for now former governor Barnes, he may have turned out to be mostly right in his analysis of the subprime problem, but he says he's staying out of politics. Instead, as a real-life Ben Matlock, he will fight for consumers in the courts. "My law's a toothless tiger now," Barnes says. "We have one of the highest rates of foreclosure in the country." And the states still seem to be fighting a losing battle.

Credit crisis one year on: How much longer will it last?

There hasn't been much to laugh about in the hallowed halls of the Bank of England recently but last week some junior members were joking about a new economic phenomenon: the Wimbledon Worrier. Suitably cryptic for the bright sparks in the bank, the moniker refers to one man: Spencer Dale.

Dale, who lives with his wife and two children in Wimbledon, south London, is the newest member of the Bank's Monetary Policy Committee. His is a baptism of fire. He is the man chiefly responsible for producing this week's hotly anticipated Inflation Report, the official view of the economy that appears every quarter.

"The tension over this report is amazing," said one Bank insider. "It's not just the usual view on the health of the economy - everyone expects to be told whether the credit crunch is over or not. The politicians desperately want it to be positive but opinions are incredibly divided, at the Bank and elsewhere."

Having worked at the Bank since graduating from the University of Warwick in 1989, Dale is a proper lifer. He has spent two decades carefully climbing the ladder, honing the credentials that have propelled him onto the MPC at the tender age of 41.

He is known as a favourite of Mervyn King, the Bank's Governor, and also impressed Ben Bernanke, the Fed boss, on a recent secondment advising the Board of the Federal Reserve.

Yet after his first MPC meeting Dale was said to be "nervous" about discussing the divisions over economic policy. Insiders say the pressure is now much worse. Friday marked the anniversary of the beginning of the so-called credit crunch, the date last year when the apparently inexhaustible supply of debt dried up.

The 12 months since have been rammed with ignominious records: the first run on a British bank for a century (Northern Rock), the collapse of one of America's biggest banks (Bear Stearns), the biggest share price fluctuations in history and the largest write-offs that Western financial institutions have ever seen.

Debate has raged about the causes of the sudden crisis, its origins, its development - and now, crucially, its longevity. Now all eyes are on this week's report from the Bank.

Last year, just a few days after the sudden crunch began, the Governor used the Inflation Report to predict correctly that, far from being a short, sharp shock, markets would be shaken by a "more disruptive movement" and that the "tremors in financial markets" would augur more turmoil to come. Britain was warned that the economy was heading for its worst year since 1992.

A year later, opinions are still divided as to whether the crisis is past its worst or just warming up. Last week's MPC meeting was said to be the most divided in its 11 year history.

On Thursday, John Varley, the chief executive of Barclays, announced a 33 per cent fall in first half profits and in the same breath said the crisis was turning. He said risks in the banking system were now "significantly alleviated" and that "confidence in the system is returning".

Yet even the same day the carnage in the markets continued unabated. Halifax said house prices had fallen by 11 per cent in the year to July; Hammerson, the FTSE100 property company, said £407m had been wiped off its portfolio, and Fortress, the US private equity firm, posted a $55m loss.

The bleak news ended another week in which companies in every sector reported tumbling performance and blamed the credit crisis - from ITV to Cains, the Liverpool brewer that went into administration. Little wonder that Dale and the rest of the MPC are feeling the heat, while Britain looks to them to say whether this is the bottom or merely the top of another drop.

Their decision will be based on a review of a torrid 12 months. Can we now understand what happened last summer? And what the world of global finance has since learned? Let's start with the symptoms of crisis: high fever, disorientation, convulsions, loss of vision, numbness, and, in the worst cases, paralysis.

The earliest clues were in California and a sudden outbreak of West Nile virus. This time last year the Governor, Arnold Schwarzenegger, declared a state of emergency in three of the state's counties. One theory: when thousands of people were forced out of their homes because they could no longer afford the mortgage, they couldn't be bothered to empty their swimming pools. In the Californian sun, mosquitoes flourished. The virus arrived. People died.

"This is not just about banks overstretching themselves with exotic products or even about people losing money. It has a wider effect on society which in some ways could not have been predicted," said one financier. On this side of the Atlantic, one man noticed the symptoms quicker than others: Adam Applegarth, the man then in charge of Northern Rock, the aggressive mortgage lender. "Life changed on August 9," he said. "That's when the markets just froze."

As Peter Spencer of the influential Ernst & Young Item club put it, the arrival of the credit crunch "was like a seizure. We have had stock market Black Mondays, but we have not really seen anything like the suddenness of this before."

We've seen it all before - only the numbers are new

'Who Governs Britain?" was Edward Heath's slogan for the 1974 general election. After a cold winter when rising oil prices and rampant inflation had begun to bite, together with the two-day week, the answer came back from the electorate: not you. Harold Wilson, the Labour leader, was back in Downing Street as the prime minister of a minority government.

The symptoms of today's credit crisis are similar to those of 1974 - just multiply the numbers by 100.

In 1974 the country was just starting the deepest recession there had been since 1929. The International Monetary Fund (IMF) was breathing all over Denis Healey, the chancellor, with chilling authority. There was no doubt who would be calling the tune.

A credit crunch was gathering momentum at the end of 1973 and a year later was at its most vituperative. It lasted for nearly three years. Taxation under Labour remained punitively damaging. Pay freezes exacerbated the situation. People conveniently forget that income tax at the higher level was 83 per cent in 1973 and was not reduced until 1986 to 40 per cent.

I recall lying in bed in my flat in Islington on a cold January morning in 1974 during a brief period when there was electricity, listening to the irascible late John Timpson on Radio 4 exhorting Willie Whitelaw, the then employment secretary, to get his well-covered backside round to the offices of the National Union of Mine Workers. The government was arguing with the miners over an increase of 1 per cent in their wages.

The Tory chancellor prior to the election had been Anthony Barber - the worst in living memory. Inflation had been rampant, finally hitting more than 20 per cent by 1972. Draconian measures to fight this were introduced, including the Pay Board. It was largely unsuccessful.

Oil prices were exorbitant. There was a wage freeze, and interest rates at the beginning of 1974 stood at 12.75 per cent. A decade had passed since Harold Macmillan proclaimed "you've never had it so good". House ownership was becoming fundamental and credit was so tight that any loan for mortgage purposes above £30,000 was unobtainable.

Then, enter stage left: the mavericks from the smaller banking fraternity who did a splendid job of topping up the borrowers with their requirements. The secondary banking crisis hovered over the Old Lady of Threadneedle Street like a storm cloud. With the secondary banks now struggling to raise loans and deposits, the lifeboat sailed out of the Bank's portals.

The likes of Barclays initially supported the HP giant Mercantile Credit, before buying it in 1975. Barclays had also originally owned United Dominions Trust before selling it rather deftly to Prudential. However, aggressive small and aspiring banks such as London and County, Sterling Industrial Securities, Burston & Texas Commerce Bank and many others went to the wall. Dawnay Day struggled and that smart operator Jack Dellal managed to sell his Dalton Barton operation to Keyser Ullmann.

It was a desperate situation and it took fully three years before the financial system recovered its poise. Stockmarket machinations at that time are also worthy of note. In 1974 the FT 30, which had been in existence since 1935 and remained as such until 1984, when it was replaced by the FTSE 100, was on its knees. Imperial Tobacco, BP and Rolls-Royce are the only three stocks that made the journey from the FT 30 to the FTSE 100.

Banking stocks, which were not admitted to the FTSE 100 until 1984, such as National Westminster, Lloyds Bank and Midland, all fell below their respective nominal value of £1, with Lloyds and National Westminster plumbing the depths of 88p. We looked at each other across the dealing table and asked: "Is anarchy about to strike?"

There was an unequivocal cry of "No", and everyone grabbed the phone to their brokers and bought about £250-worth of each bank - a good deal of money in those days. These proved to be bold and rewarding trades. More than 30 years later it's the same issues - it's just the numbers are different.

America's decline will not be easily reversed

Having grown up in an America where the opportunities seemed endless, I am dismayed at how optimism seems to have diminished among our younger people. To understand how we got into this position, it might be useful to go back to 1933.